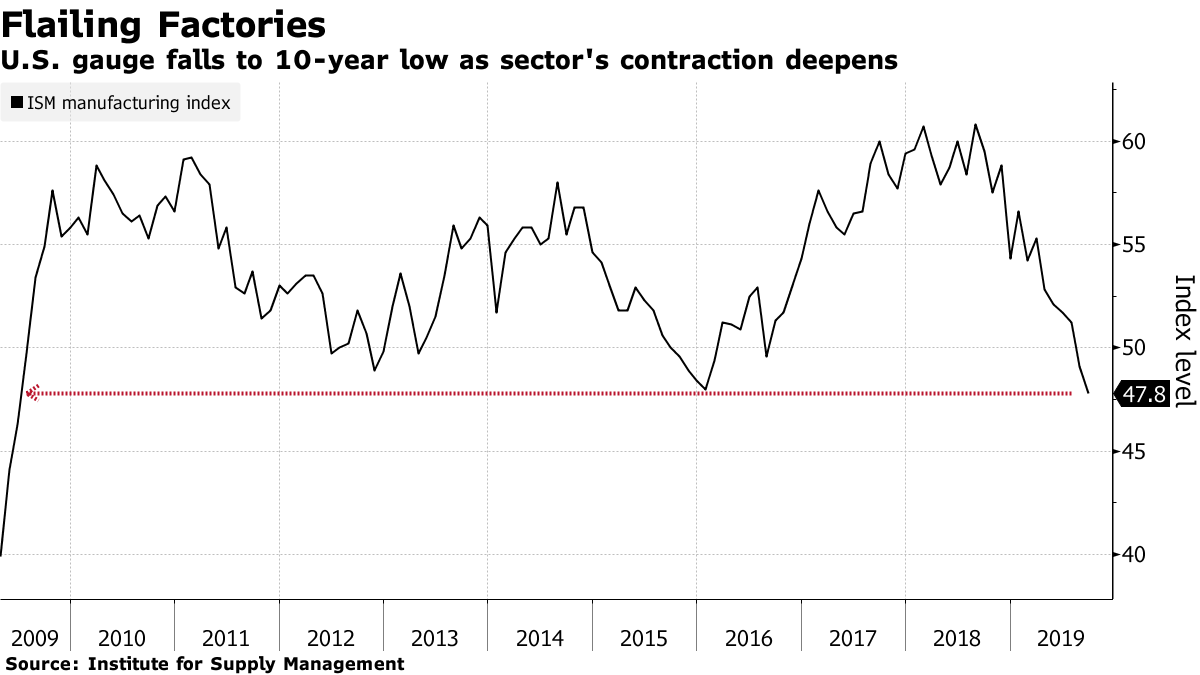

This morning we have further confirmation of the global downturn spreading with the US ISM manufacturing index contracting to 47.8 in September (50.1 was the consensus expectation); the second month in a row that the reading was under 50 (49.1 in August). This was the ste epest contraction in this reading since the last recession in June 2009.

epest contraction in this reading since the last recession in June 2009.

The US joins China’s factory sector, which also contracted for a fifth month in September and the euro area where German factories experienced their worst month since the depths of the financial crisis. See: US factory gauge hits 10-year low as employment wobbles.

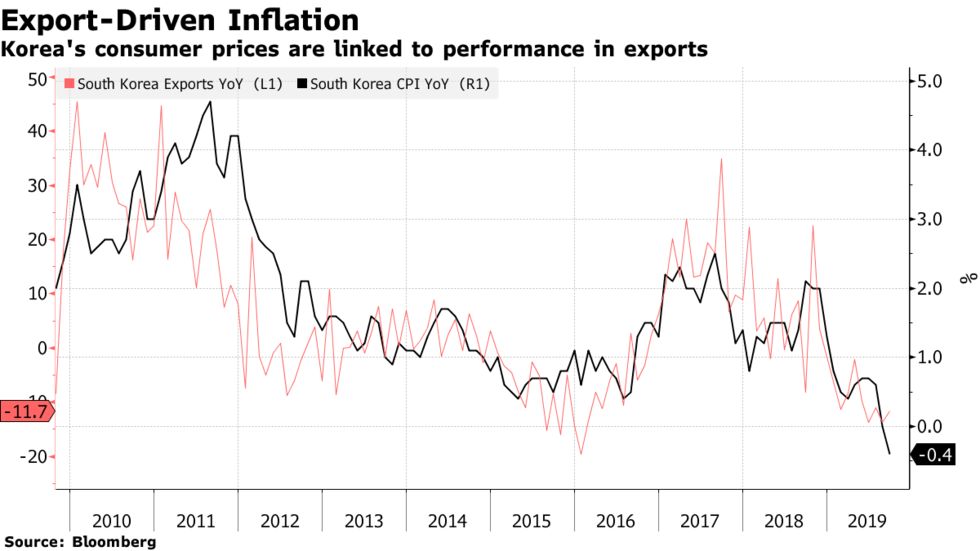

At the same time, another major global bellwether South Korean exports, registered a tenth month of double-digit contraction in September (-11.7%, shown in red beside) on a 32% drop in semiconductor shipments and a 22% drop in exports to China. Consumer prices shocked consensus inflation expectations (in black) with a negative 0.4% read, see: South Korea’s falling prices flash red-light for global growth.

major global bellwether South Korean exports, registered a tenth month of double-digit contraction in September (-11.7%, shown in red beside) on a 32% drop in semiconductor shipments and a 22% drop in exports to China. Consumer prices shocked consensus inflation expectations (in black) with a negative 0.4% read, see: South Korea’s falling prices flash red-light for global growth.

As debt-fueled demand and inflation have run out of momentum, lower prices are a necessary part of the process needed to clean out massive over-capacity in most goods and many services. Lower prices also, however, will continue to hurt corporate profits and gross domestic product in most countries and should push lofty corporate stock and debt markets significantly lower as this story unfolds.

Australia cut interest rates this morning for the third time this year. (Paging Bank of Canada?) Other central banks will keep doing likewise, but global demand is not bouncing back and disinflation is intensifying.

Price deflation is how I expected this wildly inflated cycle to unfold, but the majority of policymakers and financial forecasters are being caught off guard. Central banks and their add-more-consumer-debt playbook are out of old ideas here. As observed by analyst Peter Boockvar this morning:

“I always thought it was going to be a bout of higher inflation that was going to end the central bank monetary madness, but maybe it’s just the realization that you need a functioning banking system in order to have a growing economy.”

Fortunately, there are a lot of new plans to revitalize the world economy that require tons of productive investment and will be highly stimulative to growth and jobs. See Europe’s $13 trillion climate plan might be about to get serious for just one of many examples now being considered. These new initiatives will be paid for by diverting subsidies and tax breaks which have flowed disproportionately to large corporations in the last decade.

No stakeholder can have economic cycles all their way. This one is now at a secular turning point. Those who have benefited most to date will be hit most in the give-back phase.