Gary Shilling, president of A. Gary Shilling & Company, explains why he thinks we’re close to a global recession and investors should start to short the S&P 500. Here is a direct video link.

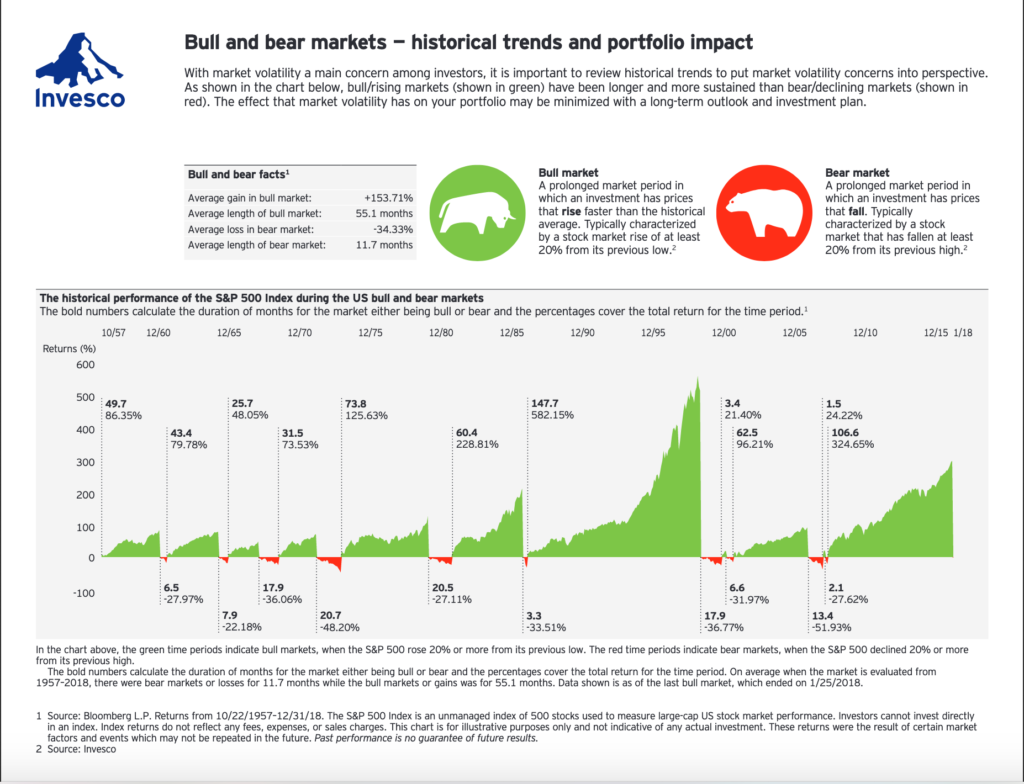

Good economic overview in this segment. Take away re cycle tops: “when it’s obvious, it’s over.” On the if this market cycle ‘is average’ guesstimate, a few points are noteworthy. First, the S&P 500’s expansion over the past decade has lasted and gained twice as much as the average cycle since 1956, as you can see in Invesco’s graphic here.

The average bear market during this 62-year period has been -34% not -20%.

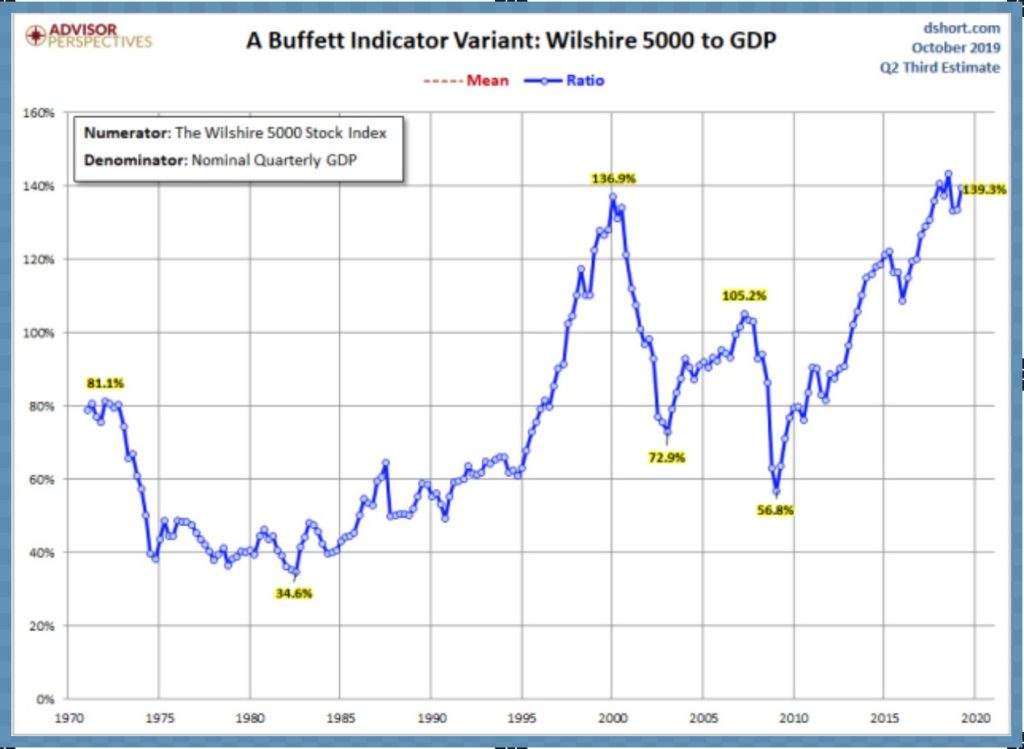

Secondly, over the last 20 years, stock prices (2000, 2007 and 2018) have reached the most extreme valuation highs in history. Below is just one reliable measure in the so-called ‘Buffett’ indicator (shown since 1970) of stock prices divided by nominal US GDP. At 139%, the present ratio is even marginally higher than the 2000 tech-wreck bubble top.

As a result of extreme valuation tops, the ‘average’ market decline in the last two bear markets has not been -34%, but more than 50%. For these reasons (and many more), it is likely that the next bear market will be significantly more than ‘average’.