Even when we don’t owe a mortgage, personal use real estate is negative-carry–we spend money to maintain it rather than it paying us.

As an investment, on the other hand, real estate is supposed to generate enough cash flow to carry itself. If it doesn’t, owners are out of pocket to keep it afloat. This is the definition of speculation– where you own the asset because you hope it will go up in price enough over your holding period to pay back carrying costs and then some. It’s a risky business for individuals because rental income and our income from other sources can fall, making negative carry harder or impossible to maintain.

When a lot of people are holding negative-carry, it magnifies downside for the property market and the economy as a whole.

A recent client poll by the investment-research firm Veritas found that only half of would-be real estate investors in Canada (mostly polled in the GTA and Vancouver), were earning net positive rental income. Of the other half, 18% said they were breaking even and a third said they were losing money. See: Canadian Real Estate Investors are losing money, pose risk to system: Veritas.

This means at least a third are pure speculation, with holders hoping prices will rise enough to compensate for carrying losses. It also represents the potential for significant forced-selling should employment weaken and/or prices stagnate/decline over the next couple of years.

Importantly, this financial strain can spread even if interest rates don’t rise but move lower. According to Statscan, the Canadian household debt-service ratio reached an all-time high in September, rising over the last 9 months even as interest rates have declined.

A new survey from insolvency firm MNP finds that forty-seven percent of Canadian respondents said they don’t expect to be able to cover basic living expenses over the next year without taking on more debt. See Canadians ‘drowning in debt’, even as 47% struggle to cover costs: MNP.

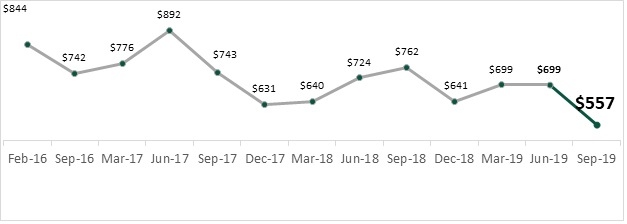

Forty-eight percent reported having less than $200 remaining at the end of the month after living expenses and debt payments. As shown below, on average, respondents said they had $557 left after paying their monthly bills and obligations, 20% less than the $699 they had leftover in June.