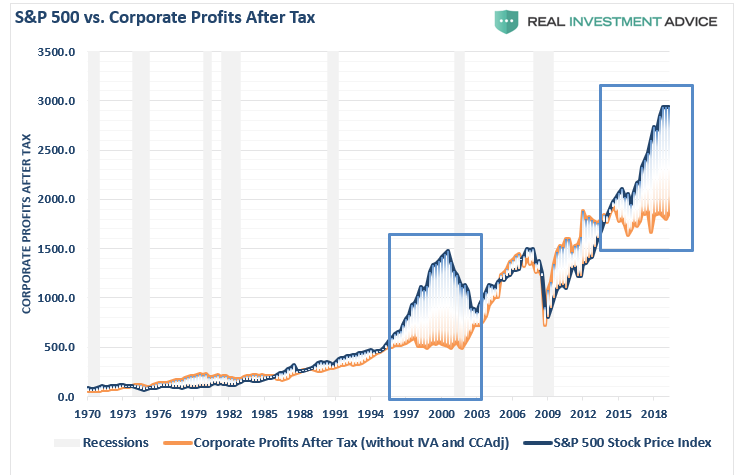

As explained well by Lance Roberts in Corporate Profits Are Worse Than You Think, the S&P 500 stock index price (in blue) has now overshot corporate profits (orange) by the most since the late 1920s and the 2000 bubble top.

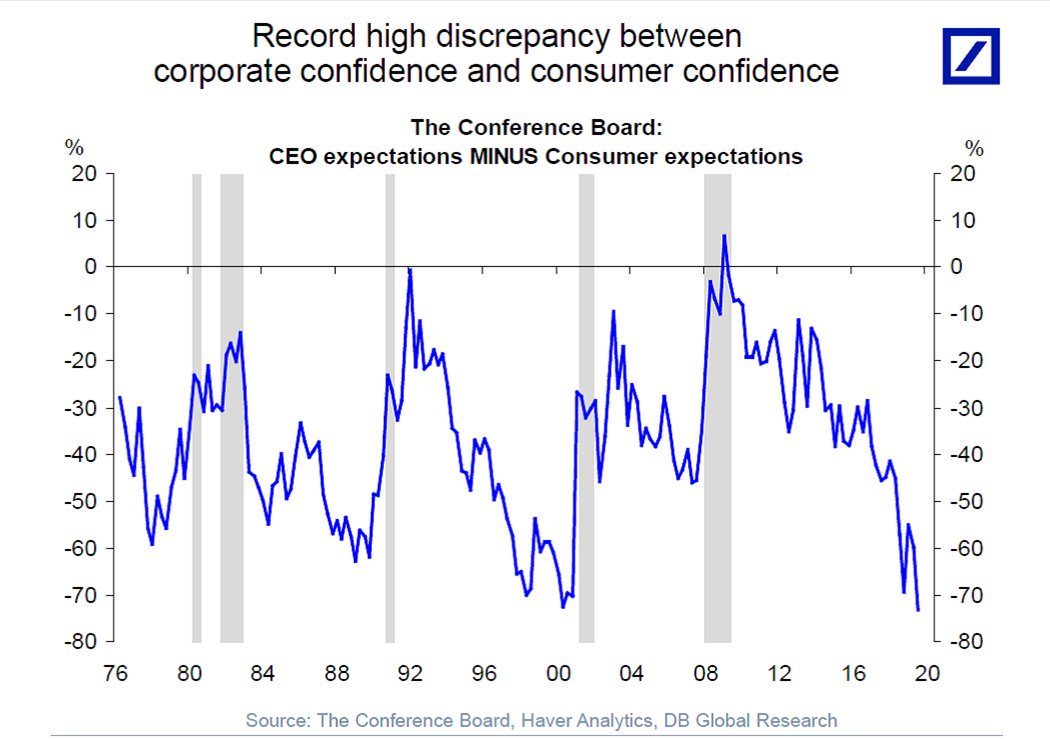

In typical late-cycle fashion, consumer confidence is high while corporate leaders are worried about falling revenues and focused on cost-cutting. As shown below, the sentiment spread between CEO and consumer expectations is the widest today since the tech wreck top in 2000.

Part of the issue here is that realistic corporate executives know they have had one hell of a liquidity-driven-run over the past several years, and extremely favourable financial conditions never continue forever.

They are also fully aware that corporate profits (orange line in the first chart above) have only remained inflated thus far thanks to record share buybacks and other accounting tricks they have used for near-term ‘beats’ at the expense of longer-term strength and returns. More than anyone else, they know how the sausage has been made!! That’s why executives have been selling their own shares into the flow of corporate buybacks in record numbers.

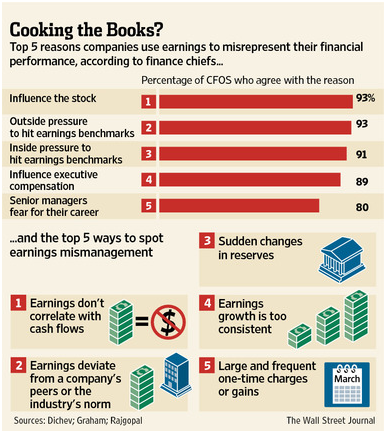

As the Wall Street Journal reported, when surveyed, 93% of CFOs (head sausage makers) said that companies  use reported earnings to overstate their financial performance in order to influence the stock price higher (as shown in the graphic on left).

use reported earnings to overstate their financial performance in order to influence the stock price higher (as shown in the graphic on left).

Would-be investors who believe or argue that share prices are rising because they or their asset managers are savvy and picking ‘good companies’ with ‘solid earnings’ are deluded and missing the plot here.

This cycle will go down in history as one of the most capital destructive episodes of all time. And there were a ton of warning signs.