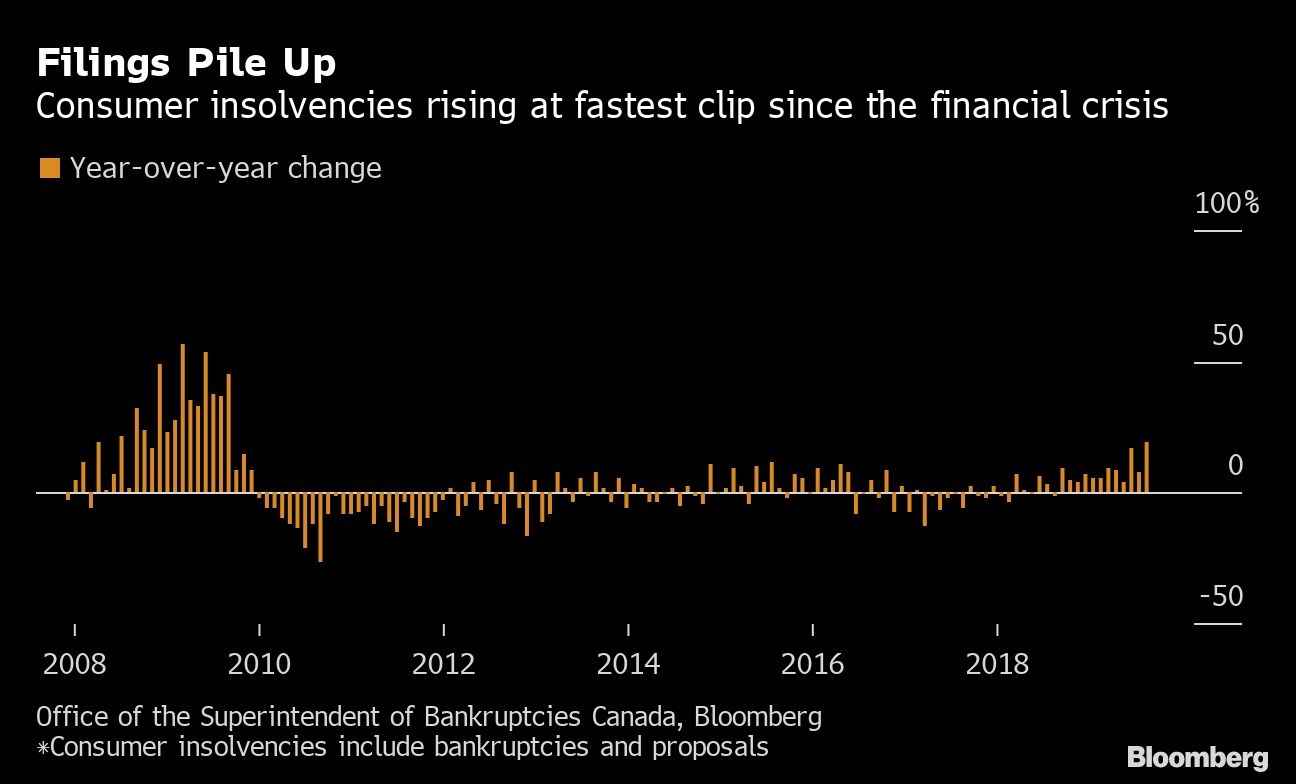

Insolvencies are accelerating at a pace that’s been associated with periods of distress: the start of the 2008-09 financial crisis, immediately before the 1990-92 recession, and during the period of pronounced economic weakness in 1995-96 that was tied to the Mexican peso crisis. Here is a direct video link.

The below chart shows the recent rise in national insolvency filings compared with the past 11 years. Noteworthy is the fact that consumers are today hitting the wall even though unemployment and interest rates remain near record lows; a tick up in either will magnify default trends.

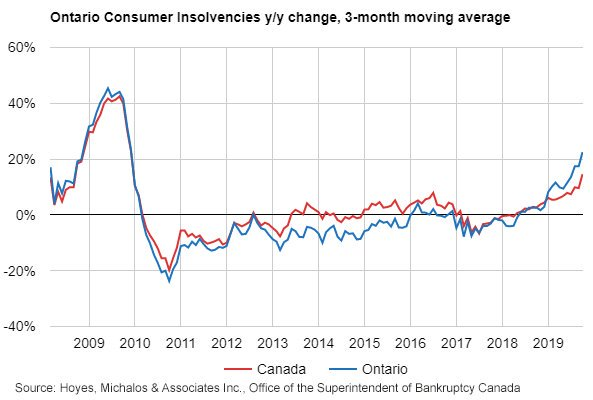

And filings are certainly not just rising in Alberta, Ontarians with our unaffordable housing and record household debt are leading national insolvency filings, as shown below. Insolvency trustee Doug Hoye explains as follows:

The pace of growth is rapidly accelerating, an indication that the consumer debt bubble is beginning to implode. Ontario has posted double-digit growth in 7 of the last 9 months and the 3-month moving average pace has now accelerated to 22.5%, while the 3-month growth rate for Canadian insolvencies increased to 14.6%. The majority of consumer insolvencies in Ontario continue to be filed by non-homeowners as seen by the relatively flat trend in our Homeowner’s Bankruptcy Index. Non-homeowners with high consumer debt are increasingly unable to sustain their monthly debt payments yet do not have the equity capacity of homeowners to refinance.