Hoisington Investment Management’s always insightful Q3 2019 review, can be read here.

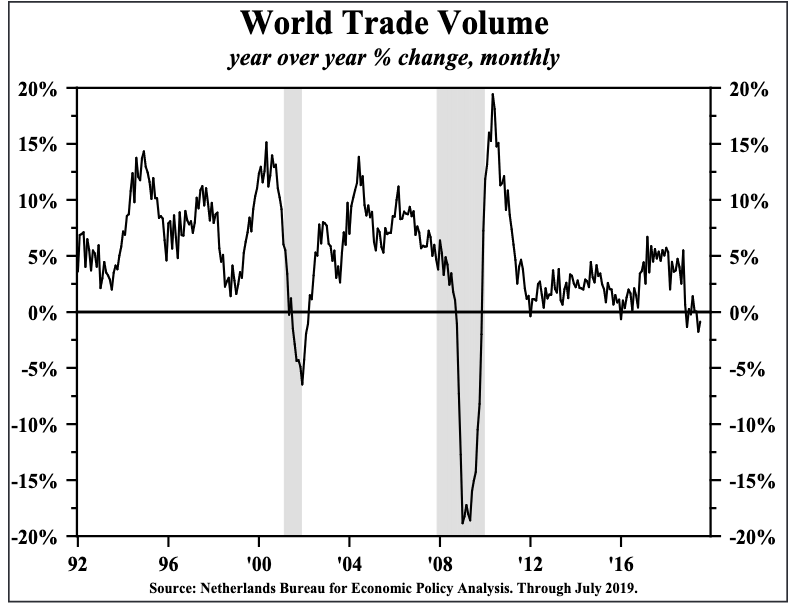

As shown below, year-over-year world trade volume fell in the third quarter by the most since the recessions of 2000 and 2008.

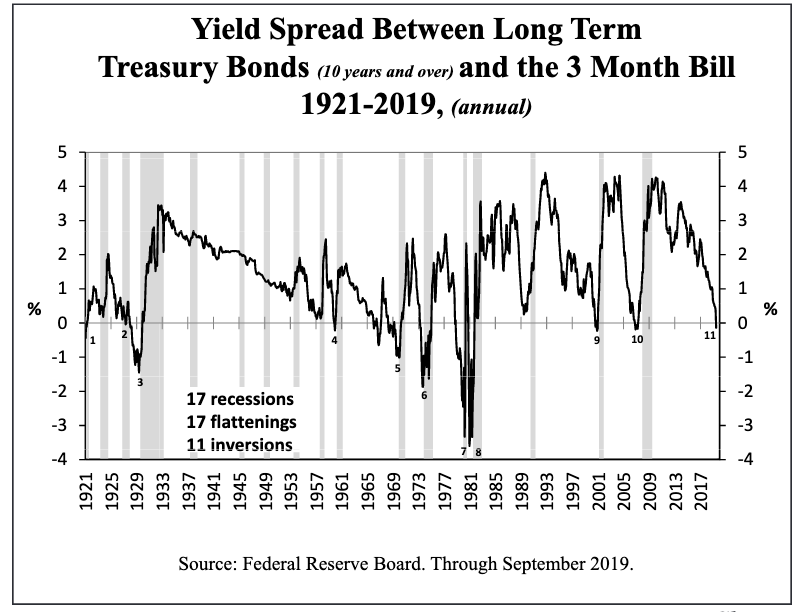

Confirming slowing growth, thirty-year Treasury bonds rose and their US yield fell to a record low at 1.90% (the previous record low was 2.09% in August 2016). The spread between the 3-month and treasury bonds 10 years and longer has been inverted now for more than 6 months. There were ten such inversions lasting four months and longer between 1921 and 2008. All of them signalled the onset of a recession as shown below.

Confirming slowing growth, thirty-year Treasury bonds rose and their US yield fell to a record low at 1.90% (the previous record low was 2.09% in August 2016). The spread between the 3-month and treasury bonds 10 years and longer has been inverted now for more than 6 months. There were ten such inversions lasting four months and longer between 1921 and 2008. All of them signalled the onset of a recession as shown below.

This time is unlikely to be different. If anything, record global indebtedness and unprecedented monetary slack have sewn the seeds for deflation and weak growth this cycle, more than average. As Dr. Lacy Hunt concludes:

This time is unlikely to be different. If anything, record global indebtedness and unprecedented monetary slack have sewn the seeds for deflation and weak growth this cycle, more than average. As Dr. Lacy Hunt concludes:

“The global over indebtedness has clearly restrained growth, and therefore has had a profound disinflationary impact on every major economic sector of the world. This fact, coupled with an overzealous U.S. Central Bank have created the conditions for an economic contraction in the U.S. and abroad. This has also created a worldwide decline in inflation and inflationary expectations. It is therefore unsurprising that record lows in long term interest rates have been established in all major economic regions. A quick and dramatic shift toward greater accommodation by the Fed could begin to shift momentum from contraction toward expansion. However, policy lags are long and slow to develop…”