Insurers are experts at pricing costs because they have skin in the game: they are in the business of compensating property, life, and disability damage. Believe whatever you like about causes, the fact is that climate change is rapidly escalating costs on earth, and the burden of this will not continue to be absorbed by just insurance companies, governments, and poor people.

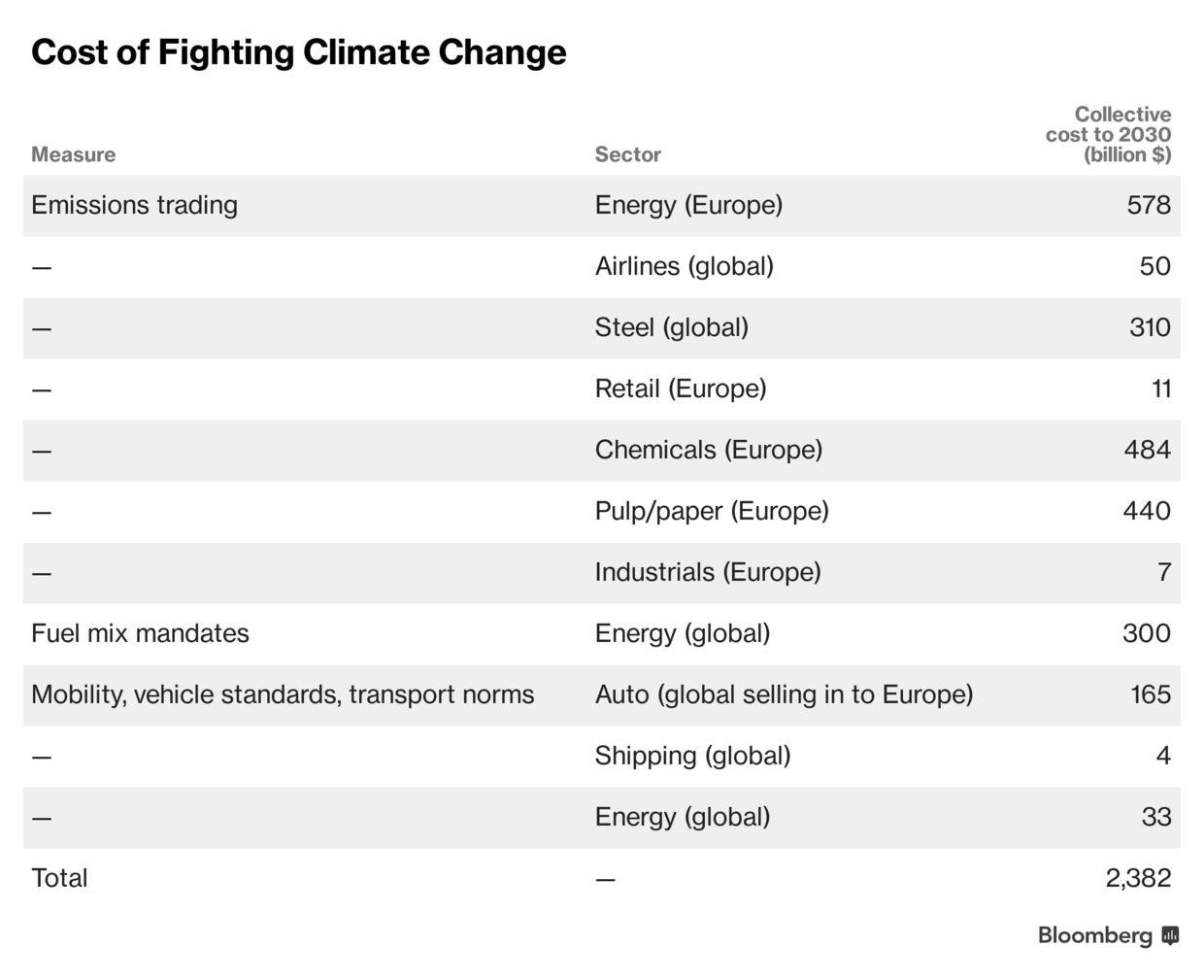

German insurance company Allianz SE estimates that addressing the costs of climate change will flow to companies worldwide in the amount of about $2.5 trillion over the next ten years, with oil and gas companies bearing about a trillion of that ($900 billion) directly. Other sectors facing escalating cost burdens are steel, chemicals, pulp and paper, and the auto sector, as shown below. But most sectors will bear significant weight in the transition to sustainable systems and products. See more here. Every way we slice it, the private sector is on the hook for much greater responsibility and full cost accounting for its activities going forward. This will increasingly demand capital investment, absorb cash flow, and squeeze profit margins. It will also necessarily incent more cost-effective business models and management choices and bring huge opportunities for those able and willing to accept reality and adapt quickly.

Every way we slice it, the private sector is on the hook for much greater responsibility and full cost accounting for its activities going forward. This will increasingly demand capital investment, absorb cash flow, and squeeze profit margins. It will also necessarily incent more cost-effective business models and management choices and bring huge opportunities for those able and willing to accept reality and adapt quickly.

At the end of the day, this challenge is about math and effective resource management. The last decade of blowing cash on old-world systems, expensive mergers, and stock buybacks, is coming into a period of harsh review. And would-be investors holding expensive corporate shares and debt on the presumption of business as usual, are due for a reality check.