A decade-long expansion in financial markets driven by relentless central bank largesse and corporations ploughing in cash to bid up their own shares has come at a heavy cost. Not only have extreme valuations and slowing growth wrought anemic and negative-yielding assets all over the world but equities, corporate debt and real estate in many areas, are now set up for the likelihood of negative returns for the next decade, maybe longer. At the same time, participants have become increasingly risk-drunk, aggressively banking on hopelessly flawed presumptions.

Trying to maximize returns in treacherous market conditions, the masses are once more set up for financial failure, with dwindling upside, massive downside, and little ability to absorb negative or even modest returns going forward.

While modern portfolio theory presumes negatively correlated assets (that perform best at different points in each market cycle), it is typical for people to eschew or dump lesser performers and double down on those that have gained most–thereby managing to concentrate capital risk and magnify eventual losses.

With North American stock and corporate debt markets the most over-valued and unattractive since 1929 today, those wanting or mandated to be constantly allocated to corporate security markets have been citing better prospects in Europe where stock markets have also leapt double digits since last December.

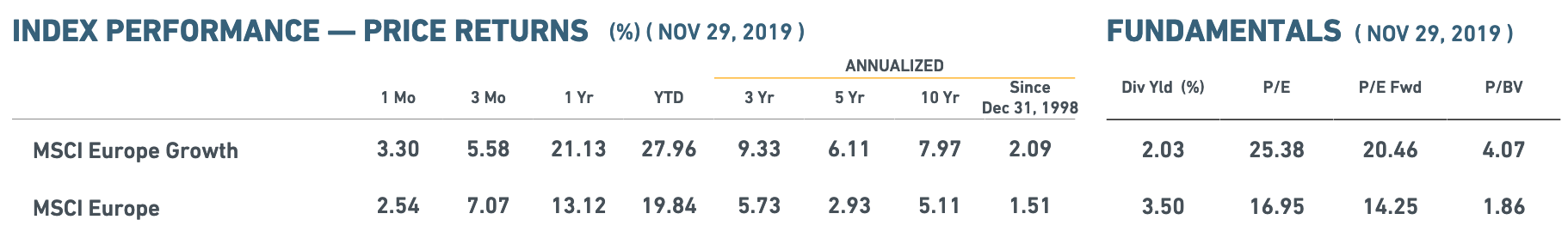

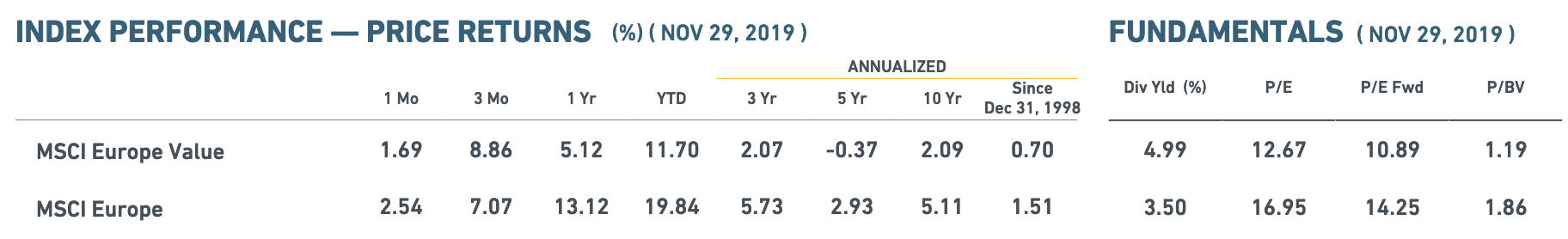

The MSCI Europe Index rebounded 19.84% to the end of November 2019, compared with so-called ‘value’ stocks in the MSCI Europe Value Index up 11.70% over the same period behind the MSCI Europe Growth Index which leapt an awesome 27.96%. The dramatic ‘outperformance’ of growth over value picks and managers has inspired many to dump value and buy ‘growth’ this cycle. Who wouldn’t right? Well, those that value capital, for one!

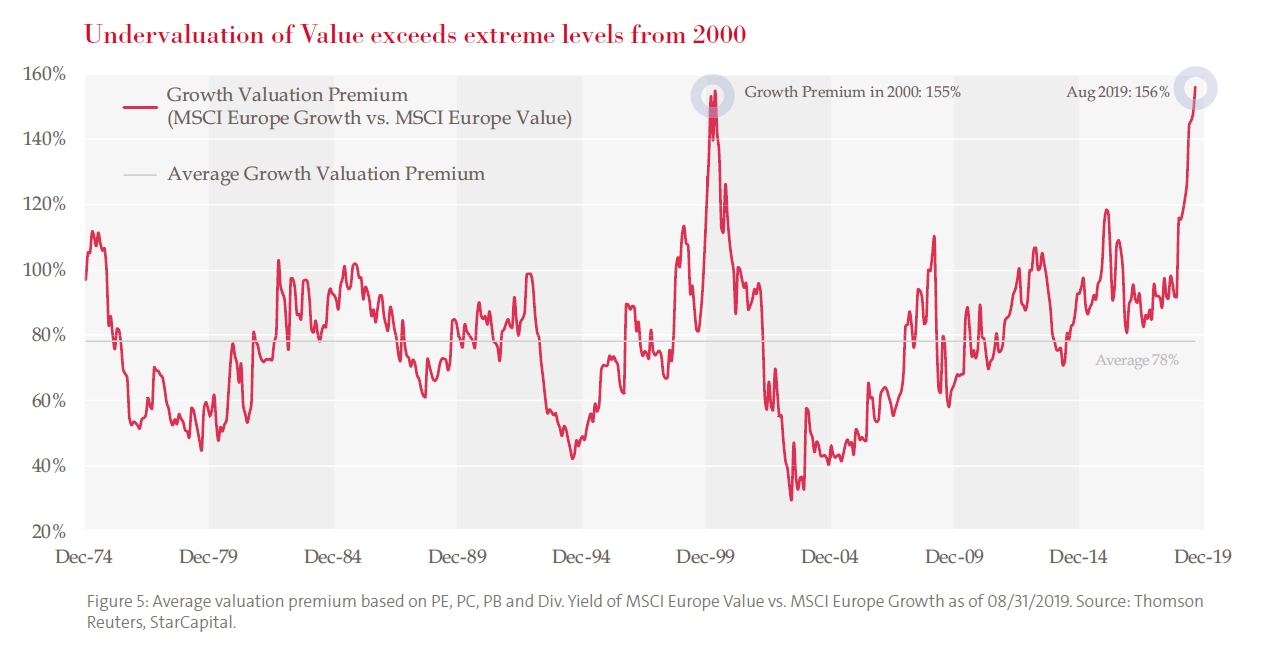

As shown below since 1974, European growth stocks are now the most over-priced relative to ‘value’ in the last 45 years.

But that’s not half of the story. The last time European stocks were this over-valued was coming into 1999, and since then ‘growth’ has clocked an average return of 2.09% a year (before any fees) while ‘value’ has averaged .70% per year, as shown below from the MSCI website. Growth and value stocks together, the MSCI Europe Index has averaged 1.51% annually over the last 21 years, BEFORE ANY FEES and ASSUMING ZERO CAPITAL or INCOME WITHDRAWALS were taken out over the ENTIRE holding period!!

And while it is true that value stocks today are yielding twice as much as growth, and trading at half the price-to-past earnings, price-to-forward earnings, and price-to-book value (see ‘Fundamentals’ on far right above), they are unlikely to lose less in the next bear market, and may even lose a bit more! Why? Because levered, speculative capital has flowed into all asset classes over the past decade, similar to what happened in the 2005-08 period (this cycle arguably even more so), and the coming liquidity crunch is likely to squeeze stocks and corporate debt of all stripes all at once, just as it did in 2000 and in 2008 and 2018 as shown in the MSCI tables below–‘growth’ on left and ‘value’ on right.

This is not to pick on Europe, of course. Similar trends and numbers have played out in stock markets all over the world the past 21 years because monetary policies and fund flows have followed each other in one increasingly desperate wave.

This is not to pick on Europe, of course. Similar trends and numbers have played out in stock markets all over the world the past 21 years because monetary policies and fund flows have followed each other in one increasingly desperate wave.

The bottom line is this: returns have been dismal and capital risks extreme because price-indiscriminate funds have ‘bid’ global stock markets into an epic era of mass hysteria. This is what launched stocks into a secular bear market in 1999. It is why they have dramatically underperformed safe deposits and treasuries since, and it is why they are likely to do so over the next many years hence.

The only value here is the extraordinary opportunity coming for those who can stick to a capital risk-minimizing discipline today and then buy true value assets at a steep discount in the next global bear market. The ‘performance’ race is far from over yet.

Happy holidays.