In our December 31 client letter, we discussed the re-steepening in the US 10-year and 3-month yield spread that has been underway since 2019, as the US Fed began cutting its policy rates once more.

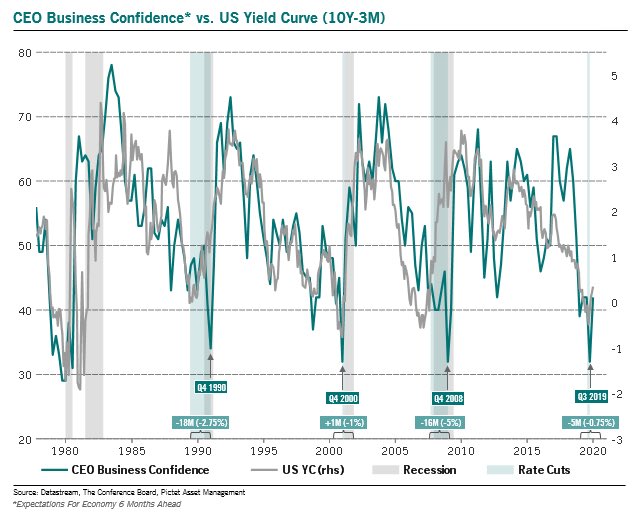

An inversion of the 10-year-3-month spread has preceded each of the last eleven US recessions, and in particular, it is the re-steepening after the inversion that marked the onset of recession by an average of 9 months. Here is my partner Cory Venable’s chart showing the re-steepening turns in 2001, 2007 and August of 2019.

We also noted that 2019 marked a record year for CEO departures at Fortune 500 companies, with corporate insiders cashing out their personal stock holdings at the highest rate since the 2008 financial crisis.

Picton Asset Management has captured these trends together on the below chart of US CEO business confidence in green since 1975, along with the US 10-year and 3-month yield spread. Here we can see cycle lows in US CEO confidence (green line) aligned with re-steepening yield spreads (grey line), and the onset of the last 5 recessions (grey bars).

With the US Fed still engaged in ongoing QE, the question is will this manage to stall an incoming recession for another year?