The Bank of Canada (BOC) held its policy rate at 1.75% yesterday caught between the rock of slow growth–falling exports, weak business investment, slowing job creation, souring loans, less confidence and lower consumption–and the hard place of precariously indebted Canadian households with little to no savings.

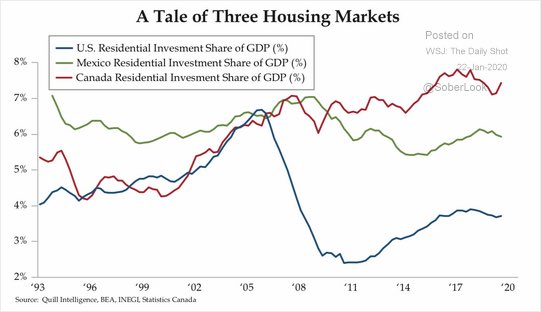

The BOC noted that residential investment was a strong point in 2019, even as it moderated in the fourth quarter. While residential investment (new construction, expenditures on maintenance, home improvement, equipment purchased for use in residential structures, and brokerage commissions) papered over systemic weakness in the Canadian economy for the past decade, the reality is that its weight in GDP needs to mean revert from an unstable 7% today to perhaps 3% in the future, and stay there for a period of years, not months.

The US saw a similar contraction in this metric between 2006 and 2012 (blue line below, chart hat tip: Danielle DiMartino Booth). Mexico is in green.

Predictably, gorging on debt to drive up the cost of housing has led to a lost decade in Canadian productivity gains and GDP per capita growth.

At the same time, Canada’s tapped out consumers desperately need to rebuild the old fashioned way, by working down debt (through repayment and insolvency filings) and building up liquid savings. This will take a few years not weeks! The Bank of Canada governors know this, so they’re hoping for a rebound in business investment–not more share buybacks–actual business investment in new plants, equipment and services, that will yield jobs, taxes and financial buffer as the economy transitions through the dual shocks of housing bubble withdrawal and fossil fuel sector reduction. They would like to see exports surge too, but that’s everyone’s hope today, and spending is slowing all over.

The BOC now estimates Canadian growth at .3% in the fourth quarter of 2019, 1.3% in Q1 2020 and 1.6% overall for the year, but they say they’ll be watching closely to see if the recent slowdown is more persistent than forecast. We expect the BOC to do some symbolic but largely impotent rate cut rates in 2020 and the loonie to weaken.

This ‘fix’ has no magic bullet. Canada needs brave business ideas and sober, long-term investment working with policy support from governments. But as with rock bottom interest rates, starting from today’s rock bottom corporate tax rates, further cuts there aren’t feasible either.

This will take patience, innovation and ‘give’ from various stakeholders in order to ‘get’ a more prosperous and stable future. We’re out of ‘easy’ money choices anyway–might as well get serious.