Full-cost accounting, producer responsibility and segregated cleanup funds were not adequately enforced when oil and gas prices were soaring and profits booming, now with the sector in crisis, taxpayers, landowners and public health are being left to absorb the costs. Tailing ponds in the oil sands are just one of the problem areas.

Andrew Leach, associate professor at the Alberta School of Business, discusses the problem of cleaning up oil sands tailings in the province. Here is a direct video link.

Abandoned oil and gas wells are another. When wells are done producing, owners are supposed to be responsible for plugging, decommissioning them and returning the land to its original state. But some larger owners have transferred their responsibility to smaller companies with insufficient resources who then go bankrupt or shut down leaving cleanup uncompleted.

A study released last week from the California Council on Science and Technology (CCST), commissioned by the state’s oil and gas regulator, estimated some 5,540 wells in California appear to be orphans.

In Alberta, the problem looks even bigger with 3,406 abandoned wells on the property of rural landowners, 2,772 decommissioned sites in need of environmental reclamation, and another 94,000 at risk of abandonment.

While oil and gas companies are supposed to post a security deposit or ‘bond’ set aside for cleanup, the amounts collected have been chronically insufficient in most places.

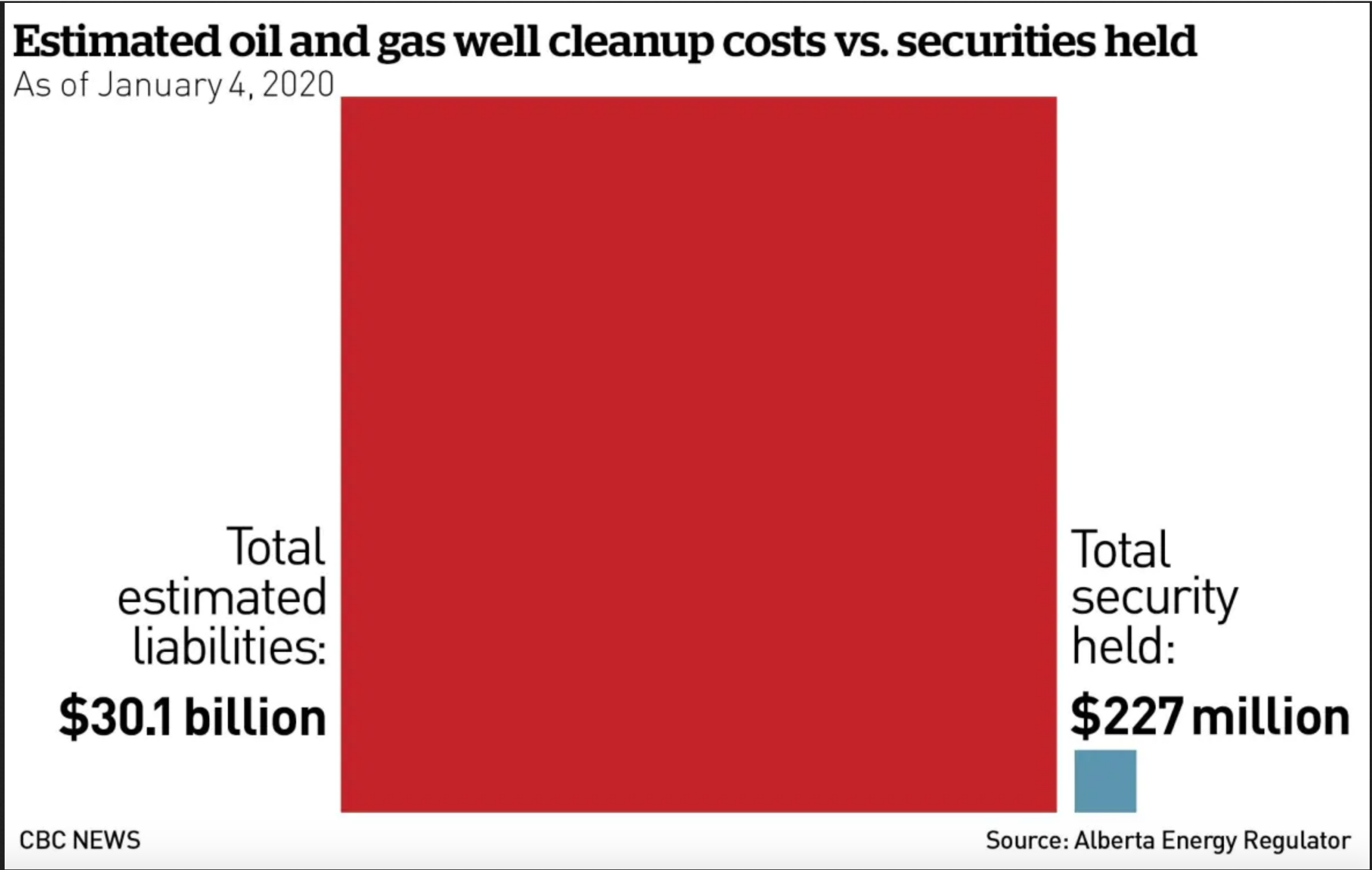

As shown below, the eventual cleanup bill for every o il and gas well in Alberta was recently estimated at $30 billion (red on left) while the Alberta Energy Regulator (AER), the agency that oversees the energy industry and its activities, holds just $227 million (blue bar) in financial security for this purpose. See: Alberta’s looming multi-billion orphan wells problem prompts auditor general probe.

il and gas well in Alberta was recently estimated at $30 billion (red on left) while the Alberta Energy Regulator (AER), the agency that oversees the energy industry and its activities, holds just $227 million (blue bar) in financial security for this purpose. See: Alberta’s looming multi-billion orphan wells problem prompts auditor general probe.

Apparently, like many of the companies themselves, AER continued to presume inflated 2008-2010 oil prices in their calculations over the last decade, which grossly overstated producer assets and meant appropriate security deposits were not collected. Now asset values are being written down and IOU’s are mounting.

The industry says using accurate pricing will force more companies into bankruptcy, and increase end-of-life obligations left on the public purse and landowners. Others point out that authorities are well aware of which companies drilled the wells and passed off their environmental responsibility and governments must intensify efforts to pursue them.

Credit rating agency Moody’s warned in 2018 that the energy transition now underway represents “significant business and credit risk for fossil fuel companies and their lenders.” Taxpayers must be added to this list.

On top of cleanup costs, last week, rural towns and municipalities in Alberta announced they are presently owed $173 million by oil and gas companies in unpaid taxes which is forcing them to cut services and raise taxes on other businesses and homeowners.

Alberta’s current energy minister is trying to blame the previous NDP government for this mismanaged mess. In truth, responsibility for years of willful blindness is on all of us.

As Shell CEO Ben van Beurden said in an interview with Time Magazine last month, when asked how the company continued expanding production knowing the environmental impact of fossil fuels:

Yeah, we knew. Everybody knew,” he said. “And somehow we all ignored it.”

Van Beurden explained that in the 1990s Shell publicly acknowledged climate science and said the world needed to act to combat the problem. But at that time, neither governments nor consumers seemed too concerned about emissions, and the demand for oil was growing like gangbusters, so the company doubled down. By 2018, Shell was the third-largest company in the world in terms of revenues.

Now, he says conditions have changed and “We have to figure out what are the right bets to take in a world that is completely changing because of society’s concerns around climate change.”

But ‘concerns around climate change’ is understating the catalyst here. The evolution away from fossil fuels and toward less polluting, more efficient energy sources and systems is about financial viability. The status quo of extracting profits for a few and leaving crippling costs for the many is simply no longer fundable.