When it comes to rising profits and asset prices, financial leverage (credit) often looks genius on the way up, then reckless and financially suicidal as trends reverse. Highly levered companies, households and investors have less ability to ride out income reductions and falling prices before a cash crunch threatens their ability to meet payments and operating costs. This spawns a predictable cycle of defaults, forced asset liquidation, bad debt write-downs and insolvency.

Financing multi-million-dollar planes and equipment, the airline industry is a classic example of how leverage surprises on the upside and down.

In the decade between 2009 and 2019, cheap credit allowed air travel to double globally and airlines and related services expanded their fleets and leverage along for the ride. This dramatic expansion was always a financial crisis looking for a catalyst. Well before COVID-19, rising solvency risks and finance costs were lining up with incoming carbon pricing and necessary air pollution mitigation to increase the full-cost accounting of air travel–squeeze profits, raise fares and reduce user volume. The 2020 coronavirus is serving as a brutal accelerant of these trends. Watch Coronavirus is having a bigger impact on global airlines than 9/11, analysts say.

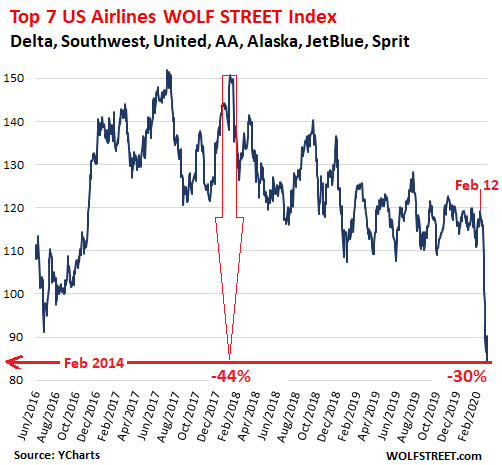

As summarized by Wolf Ritcher last week, this goes far beyond Asian and UK airlines; the seven largest US carriers lost 30% of their equity market value in the past month as flights are cancelled, and new bookings stalled.

The International Air Transport Association (IATA) now estimates a best-case ‘limited spread’ scenario where 11% of passenger revenues are lost in 2020 and a more likely ‘extensive spread’ scenario where 19% are lost (not counting the decline in cargo fees as shipments drop too.)

The International Air Transport Association (IATA) now estimates a best-case ‘limited spread’ scenario where 11% of passenger revenues are lost in 2020 and a more likely ‘extensive spread’ scenario where 19% are lost (not counting the decline in cargo fees as shipments drop too.)

The ‘extensive-spread’ scenario nearly quadruples the IATA’s prior loss estimate on February 20–just two weeks earlier.

This all bears on who is willing and able to lend to highly levered sectors–and at what interest rates–as debts come up for refinancing in 2020.

Across all sectors, a record 50% of so-called ‘investment grade’ corporate debt came into the new year just one grade above the ‘junk’ status that would make it uninvestable by many institutions and pensions. As cash flows suddenly evaporate, the spectre of credit downgrades is rising dramatically. No doubt, as in the subprime fiasco in 2008, many are now lobbying company-funded credit agencies to delay necessary reassessments.

This will not be contained in the airline sector and demands on governments to bail out struggling industries, workers, and investors are certain to grow.

Global sales in the overbuilt, highly leveraged internal combustion engine auto sector were already declining over the past couple of years. Last week, Goldman Sachs downgraded its forecast for 2020 global auto sales to a decline of 3.5% from -0.3% previously estimated. This is a similar drop to the ‘shock’ experienced by the sector during the 2008-2009 crisis, which tipped many in the space into bankruptcy. See, Coronavirus piles more pressure on the struggling car industry.

With so many entities poorly managed coming into this shock, however, it’s unreasonable to think all can, or should, be rescued.