From 2009 to 2019, S&P 500 companies alone poured $5.29 trillion into share buyback programs (data from S&P)–more than double the $2.59 trillion from the 10 years prior. Dividend payments to shareholders saw a similar increase, nearly doubling to $3.53 trillion from $1.89 trillion.

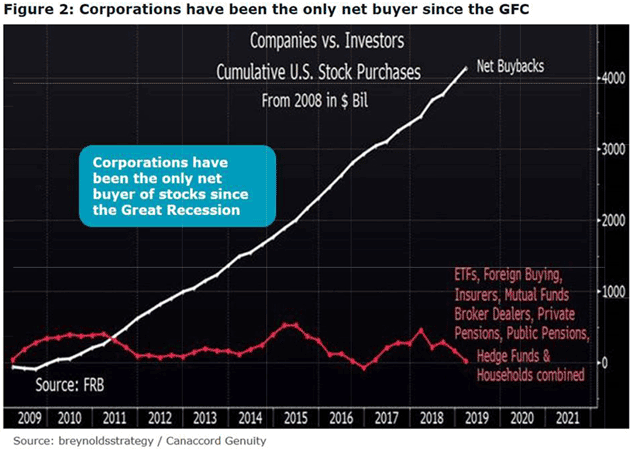

As charted below, this has made corporations the only net buyers of stocks since the 2008 recession (white line), while inflows from outside investors have stagnated (red line). Ponzi anyone?

Ponzi anyone?

Now as stock prices tumble in a bear market, the cash wasted on buyback evaporates into thin air, just as holes gap wide on income statements and loans are more expensive and difficult to find.

The timeless truth is that the public buys most at market tops and least at market bottoms. But the same is true of companies. As a cash crunch spreads and buybacks dry up in 2020, the stock market is losing buyers on both fronts, while those looking to sell leaps. See If companies aren’t buying their own stock, who is?

Not surprisingly, numerous studies have confirmed that companies that retain profits and reinvest in better products, operations and cash buffers, are more stable and productive over time.

The WSJ video report below is a good summary of the factors at work here.

The stimulus package aimed at addressing the coronavirus pandemic includes a restriction: any company that takes aid will have to swear off stock buybacks while receiving government funds. WSJ explains share buybacks and how they became targeted in the bailout. Here is a direct video link.

The video report mentions that proponents argue buybacks benefit workers by driving up the value of their pension assets too, not just executive compensation. But clearly this is a joke. If that were true, then CEO pay would not have risen to 300x average worker pay in recent years. Pension deficits would also not be soaring with companies dumping secure benefit plans in favour of gamble-and-hope contribution plans.

The time-proven best way to build a strong workforce is to invest in their health and education, pay them well, and build excellent products produced where your customers live. At the same time, strong balance sheets enable companies, employees (including executives) and the economy to survive the setbacks and cycles that recur, without bankrupting governments on endless bailout pleas.