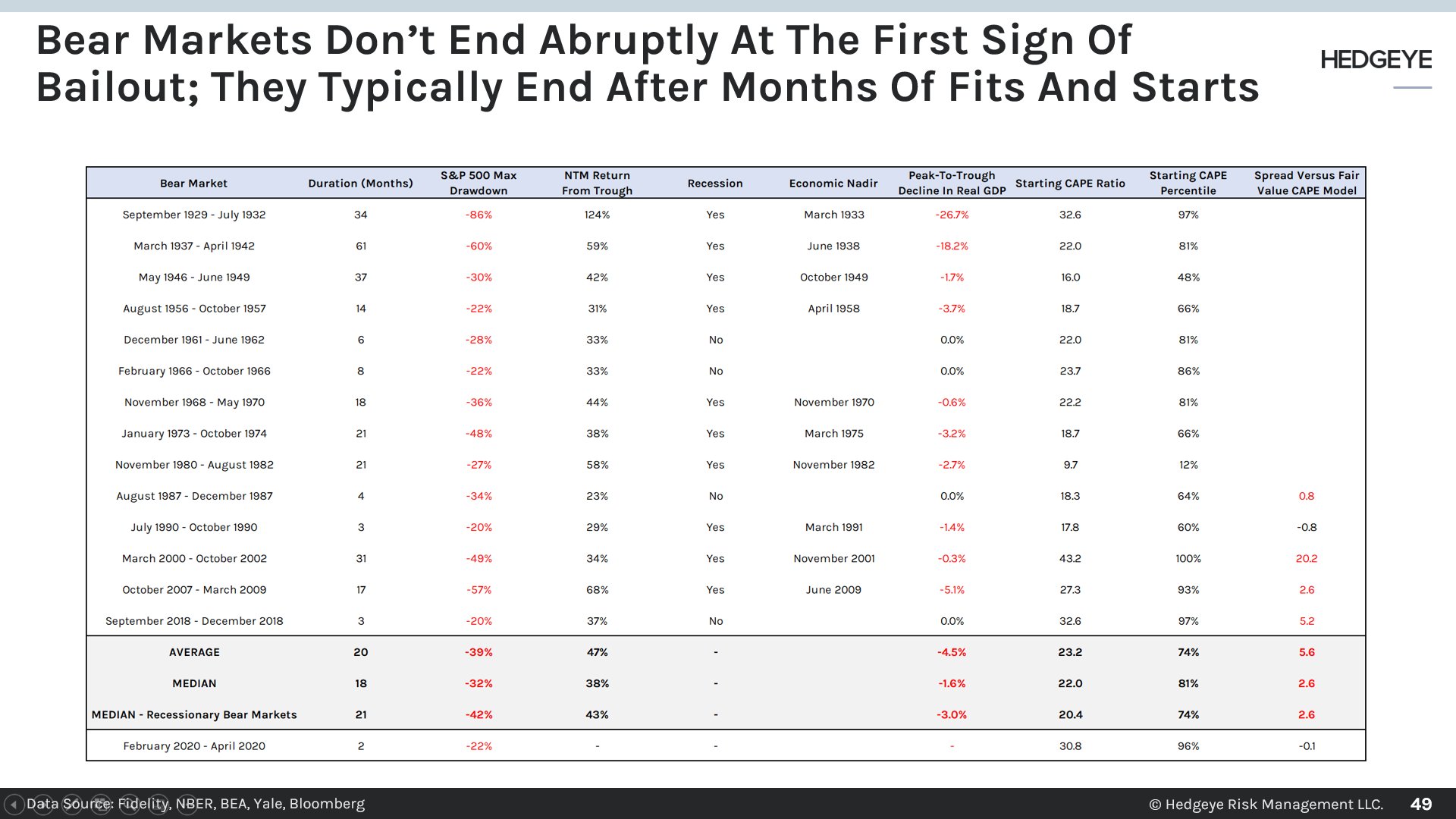

As shown below, the 23% rebound in equity prices since March 23 has returned the S&P 500 to a short-list of the least attractive valuations in history at 19x forward earnings estimates, and equal to the market top on February 19. Canadian equity valuations have followed along for the ride. In short, from present levels, investment prospectives remain among the bleakest in a century.

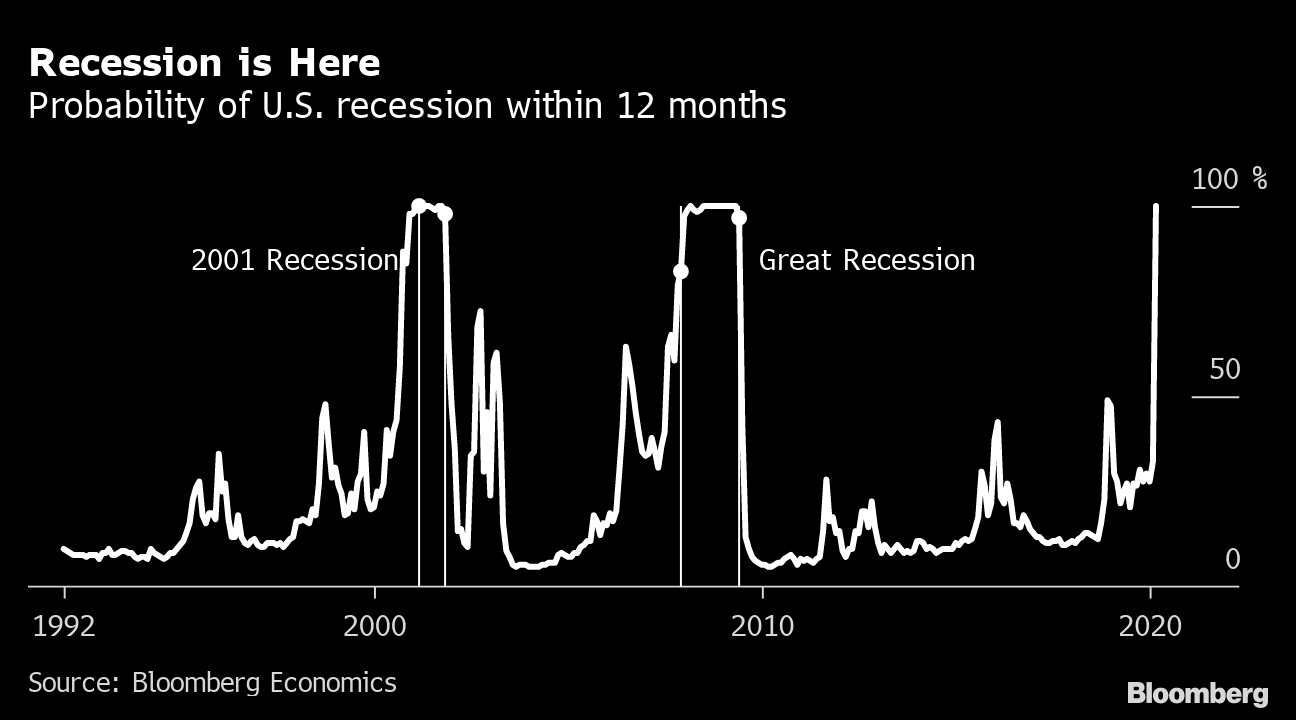

This is especially true since we are entering the deepest global recession since the 1930s with record job losses, business failures, loan defaults and lost earnings all in the mix. The chart below shows the 100% probability of a U.S. recession now underway in 2020, as in 2001 and 2008.

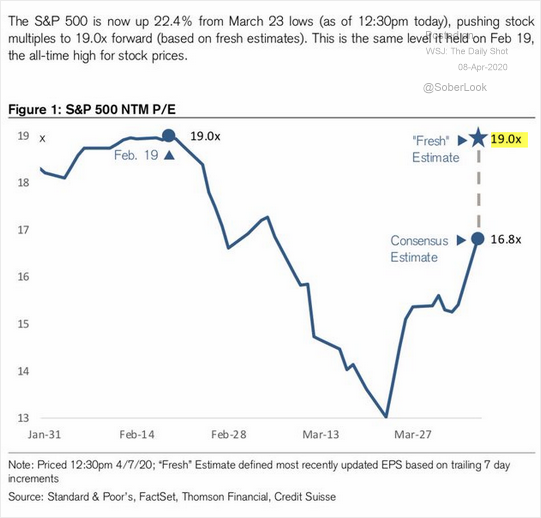

Recessions do not clear quickly, no matter how aggressive policy interventions may be. As shown in the table below from Hedgeye, recessions historically come with median bear markets of -42% over 18 months.

Recessions do not clear quickly, no matter how aggressive policy interventions may be. As shown in the table below from Hedgeye, recessions historically come with median bear markets of -42% over 18 months.

The three previous times when we headed into a recession with stock market valuations (CAPE) in the 90th+ percentile, as in February 2020, the drawdowns have been 49 to 86% over 21 to 34 months, followed by years trying to grow back losses. Financial decisions and capital allocations should be managed within this context.