Danielle was a guest with Jim Goddard on Talk Digital Network talking about recent developments in the world economy and markets. You can listen to an audio clip of the segment here.

On the topic of property tax deferrals, I would like to clarify that it is participating provinces who enable the deferral by forwarding the taxes to municipalities and waiting to collect on an eventual property transfer or refinancing. BC offers the widest deferral program of the provinces, you can compare terms here. These programs were offered on the erroneous presumption of perpetually rising property prices. If Canada is entering an overdue period of years where property prices are not rising, tax deferral programs are likely to be up for review.

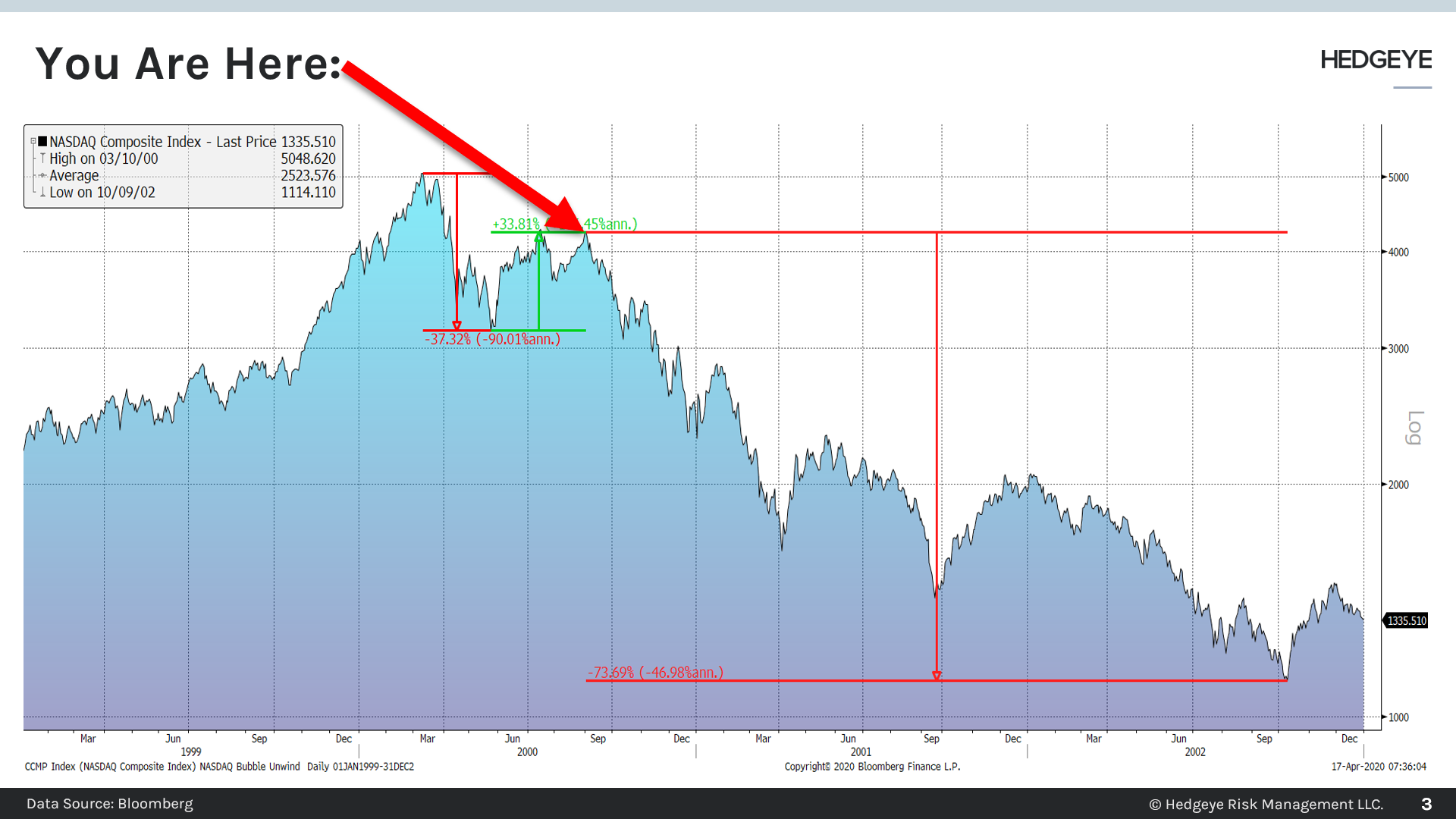

As to the question of whether or not it is too late to lower risk exposure and increase cash for capital protection and future buying opportunities, the Hedgeye chart below of the NASDAQ price behaviour during its March 2000 to December 2002 bear market, offers perspective. Unless you’re a day trader (and most of them fail), rebounds within bear markets should be used as another opportunity to sell and correct risk allocations that came into the downcycle long and wrong. It’s not too late to get defensive.