While the tech and the precious metals sector have to date recovered sharply from the first leg of the 2020 market plunge, other more economically reflective sectors like financials, energy and real estate investment trusts are not feeling the same optimism and remain mired in a bear market. See Blackstone to shutter real estate income fund for a taste of what’s unfolding. As the Trump admin works daily to prop up the stock market as key to its re-election bid in November, a financial pandemic continues to undercut the real economy and national income.

Dick Bove spent decades as a US bank analyst and was traditionally very bullish on the sector. His new position as a strategist evidently affords him a wider scope to acknowledge downside risks and his comments on BNN this week offer some big picture insight on US banks and the economy. Here is a direct video link.

An important caveat I would add: while JP Morgan is widely considered ‘best of class’ in investment banks and Bove praises CEO Jamie Dimon, the bank’s share price remains 40% below its February high, and the giveback and write off part of this credit cycle is only just started. A similar story is playing out for Canada’s ‘best in class’ banks.

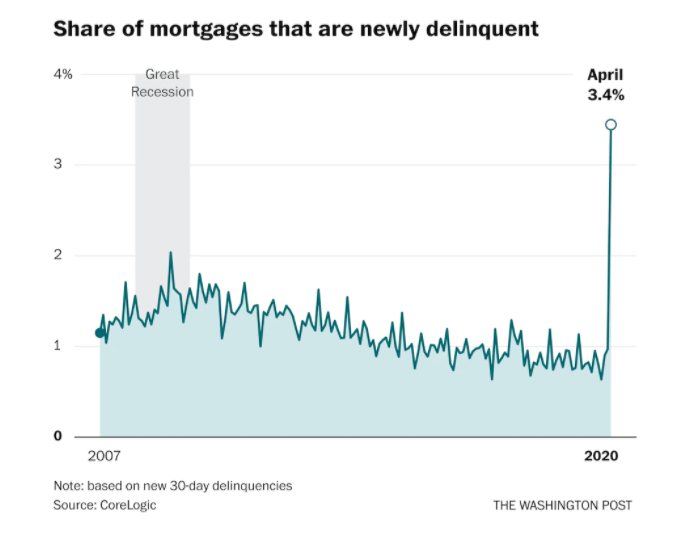

One problem area is the share of mortgages newly delinquent. The chart beside  shows the US trend to the end of April and compared with the 2008 recession.

shows the US trend to the end of April and compared with the 2008 recession.

Even excluding approved mortgage loan deferrals for qualified borrowers, a US Census Bureau survey shows that as of June 30, about 8.4 million households had missed a mortgage payment in the past month and that was up from the end of April. The Mortgage Bankers Association reports 4.1 million households were in forbearance as of July 5. Millions more who didn’t have a loan backed by the federal government weren’t eligible for the forbearance program and so some loans are going right into delinquency with more likely to follow when permitted deferral periods end. See An indicator that presaged the housing crisis is flashing red again.

Similar trends are evident in Canadian household loans, with deferral programs delaying and increasing the likelihood of insolvency filings for many households. Canadian insolvency trustee Doug Hoyes explains in Insolvency Predictions post-COVID-19:

Mortgage and payment deferrals will add to consumer credit balances post COVID-19. The deferrals are beneficial to help individuals manage cash flow and help lenders manage delinquency rates but the end result is larger balances for longer.

With less ability to pay, many individuals will make partial payments on credit card debt and other obligations, resulting in growing rather than declining credit balances. Delinquencies will increase. While some credit card companies are offering to lower interest rates, interest will still accumulate on ever higher balances.

Worse, some consumers will manage the crisis by taking on more debt. What is worrying is that much of the borrowing will be in the form of high-interest subprime debt, including payday loans and high-interest financing loans. Heavily indebted consumers were already relying on these types of loans to make ends meet before the crisis, and they are increasingly likely to do so now. Alternative lenders will see higher delinquencies and losses in the short run but may offset this financially with massive loan growth.

…Payments through the government economic response programs like CERB will offset some of the demand for more credit and default rates. It is too soon to predict exactly how high insolvencies will rise, how quickly and for how long. However, we do know that Canadians will experience fallout from the heavy burden of debt they carried into this crisis and that the tail will be long.

Companies have also piled on debt during the pandemic, with global firms selling a record $2.1 trillion of bonds to investors this year and nearly half coming from U.S. issuers (Bloomberg data). With many highly indebted coming into the crisis, adding more debt now is imprudent for borrowers, lenders and investors and compounds insolvency prospects. See: Father of the z-score predicts a surge in ‘mega’ bankruptcies.