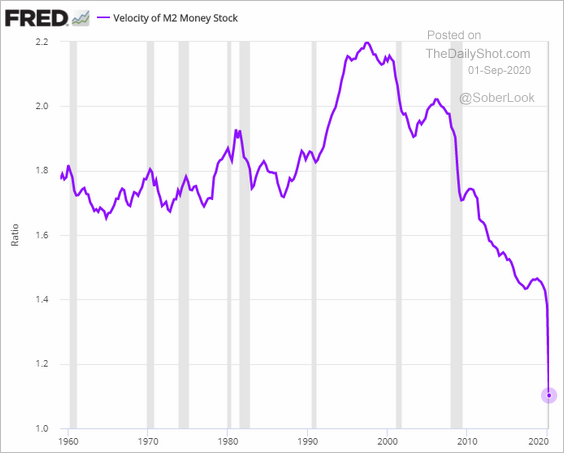

As we covered in our client letter for August on Monday, central banks can pump money into financial intermediaries and buy some securities to increase  cash in the system but they cannot force lending nor productive investment through the economy. This is why M2 Money Supply (movement and multiplier effect of capital through the economy) shown on the left since 1958 (courtesy of SoberLook) has continued to collapse.

cash in the system but they cannot force lending nor productive investment through the economy. This is why M2 Money Supply (movement and multiplier effect of capital through the economy) shown on the left since 1958 (courtesy of SoberLook) has continued to collapse.

As a result, asset bubbles and non-productive capital mount like alligator jaws waiting to slam down on prices and participants once more. Gary Shilling’s month-end letter for July (subscription) “Underfunded Entitlements” covers the math of the current financial pandemic in detail. He touched on some of the details, including M2, in his recent BNN interview below.

Gary Shilling, president of A. Gary Shilling and Company joins BNN Bloomberg to discuss his bearish outlook on the market and why he anticipates the recession to continue though out 2021. Here is a direct video link.