The recent pause in bankruptcies has been enabled by cheap loans made available to companies with less than stellar balance sheets and questionable business plans.

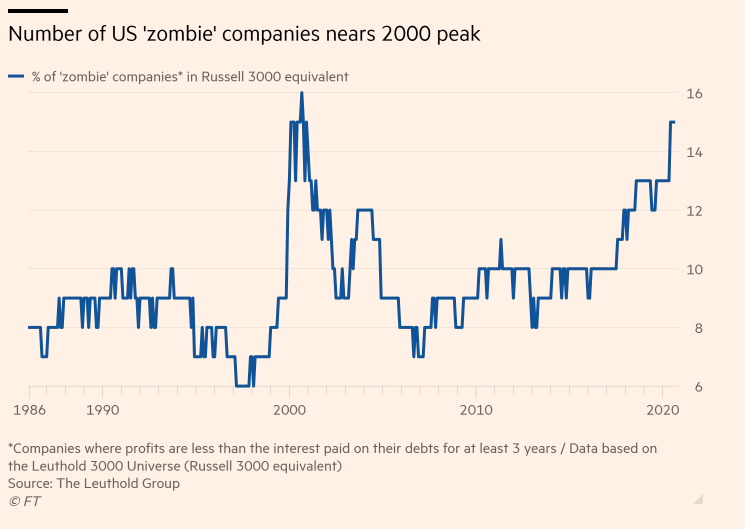

Zombie companies have feasted on price-indiscriminate yield-seekers with a ravenous appetite to pay top dollar for credit that is not  money sound. The debt owed by Russell 3000 companies where profits have been insufficient to cover the interest paid on debts for at least three years, reached 15% recently–the highest since the 2000 bubble top as shown here in this chart from the Financial Times and The Leuthold Group.

money sound. The debt owed by Russell 3000 companies where profits have been insufficient to cover the interest paid on debts for at least three years, reached 15% recently–the highest since the 2000 bubble top as shown here in this chart from the Financial Times and The Leuthold Group.

As consumers and corporate revenues continue to retrench, cans will no longer be kickable, and bankruptcies have some catching up to do.

At that point, as in 2001 and 2009 (red ovals below), a good deal of paper will be worthless, but the corporate bonds still paying will have dropped in value enough to put the ‘high’ back in ‘high yield’–double and triple the yields presently on offer.

My partner Cory Venable’s chart of the effective yield of US CCC credit since 1995, offers insight on the income banquet coming for those few who can buy when present holders are liquidating in panic. At that point steeply discounted offers will be ripe for the taking.