The latest weekly survey by Nanos Research finds that 44% of Canadian respondents expect home prices to rise over the next six months, and just 27% said they could drop–this is reportedly one of the most optimistic readings on this question in the last 7 years. At the same time, the share of Canadians who expect the economy will strengthen over the next six months dropped to 19%, the lowest since June. Disconnect anyone?

Before we bank on housing ‘optimism’, it’s important to appreciate that positive sentiment readings rise and fall in lockstep with the price.

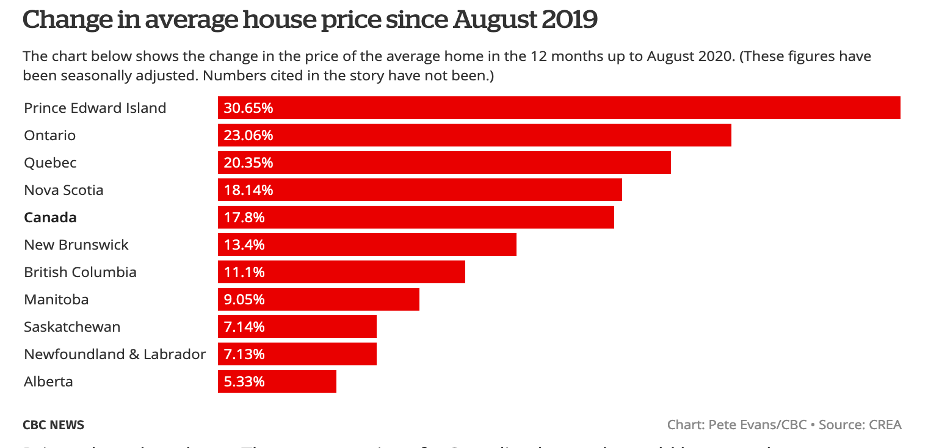

As shown on left, the average Canadian home price sold in August for $586,000 –up 18% year over year.

As shown on left, the average Canadian home price sold in August for $586,000 –up 18% year over year.

In Ontario, Quebec and PEI prices leapt over 20%. In the Greater Toronto Area the average home price sold for over 900K, and was up 25%, year over year, in areas like Barrie, where I live. Relators are reporting that city dwellers are moving out of condos and many are looking for less urban areas with more green space between neighbours.

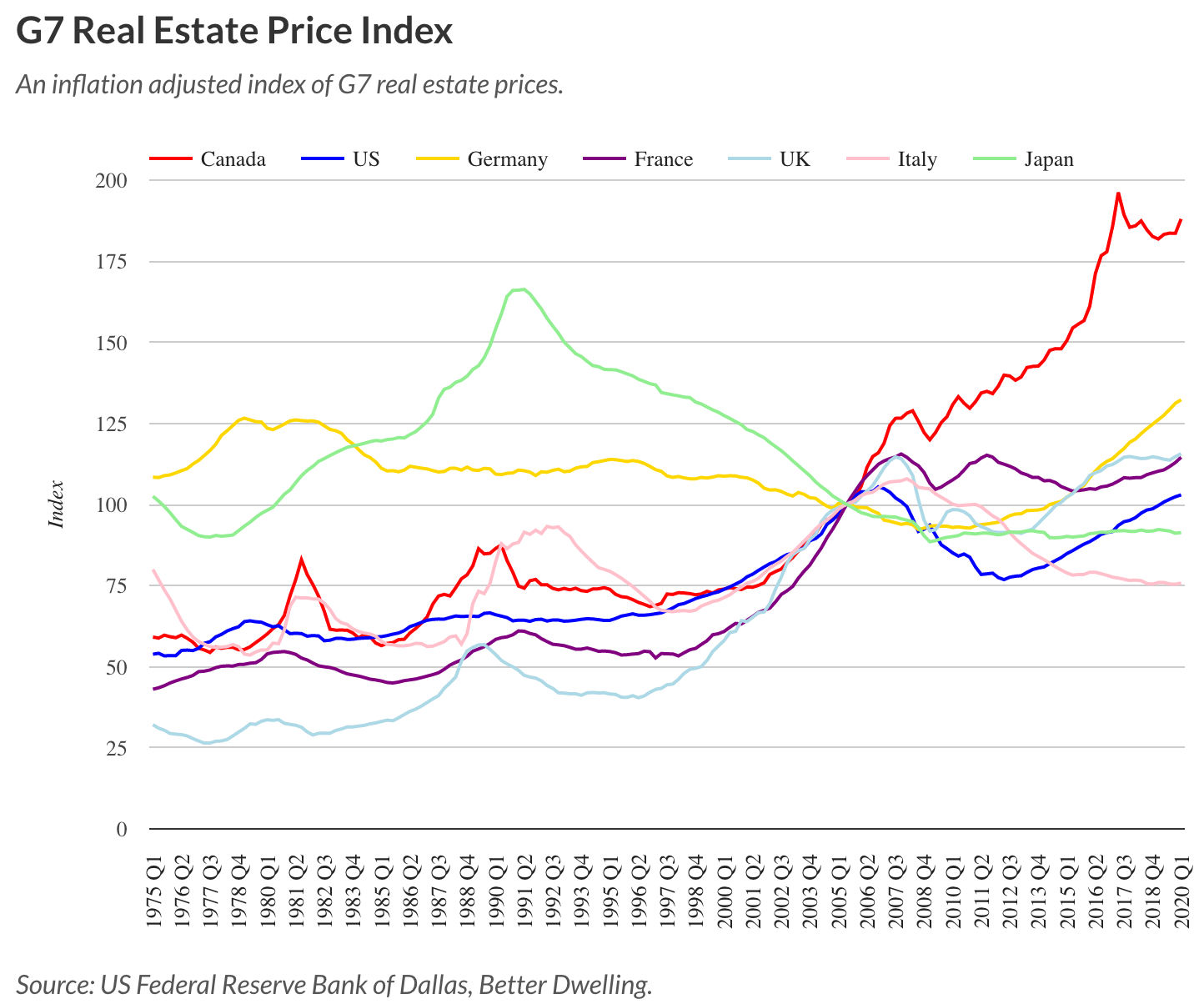

Lest we forget, this latest jubilance comes as Canadian real estate prices had already increased 88% since 2005–about triple the pa ce of any G7 country (red line below since 1975). The next closest is Germany (in yellow), with a gain of 32.3% over the same period.

ce of any G7 country (red line below since 1975). The next closest is Germany (in yellow), with a gain of 32.3% over the same period.

Canadian household incomes, meanwhile, have risen about half the pace of home prices, gaining 45% from $60,600 in 2005 to $87,930 in 2018, according to the latest data from Stats Canada.

Nationally, this renders median Canadian home prices about 6.7 times the median household income and a crushing 8 to 10 times in the most populous areas like the Greater Toronto and Vancouver Areas.

Math note: the long-standing ‘affordable’ ratio on home prices is 3 to 4 times household income. This is the time-tested level at which people have a reasonable chance of paying for their house while still affording essentials like food, utilities, taxes, maintenance and other needs like education, retirement and rainy day savings.

I recall myself and my husband buying an Ottawa townhouse as our first home in 1991 for 97K. This was about 2x our then 50k joint annual income as two young professionals with no kids. With student loans and one car payment, the budget was still painfully tight.

Unreasonable home prices are a major reason that Canadian households owed $1.82 for each dollar of income at the end of 2019, with some of the younger homeowners carrying mortgages balances over 450% of their household income (2016 Bank of Canada analysis).

This is not at all surprising. Even if one is buying just the median-priced Canadian home today at $586k with a full 20% or 117k downpayment, this leaves a mortgage of 468K– 532% of the median household income! Again, established norms of ‘affordability’ have traditionally recommended taking on mortgage balances of not more than 200 to 250% of a household’s gross income.

As I discussed in Canada’s Housing Bubble most ominous in the G7, historical precedents for this kind of extreme pricing and debt loads are daunting for Canada. Lesser extremes in other countries, and our own in the 1980s and 90s, have been followed by a 25%+ price plunge and 10 to 15 years of growing back losses. And of course, plenty of painful foreclosures, evictions and bankruptcies.

Yes, owning one’s home is a great goal and can be a cornerstone of financial stability, but only if it is stable. This requires that it be bought and maintained with a portion of one’s income and capital that still affords enough resources to cover other critical needs and goals.

Affordable housing, whether we buy or rent, should leave three-quarters of our income for other needs and unforeseen developments. If we cannot find this where we are looking, we should seek alternate arrangements for cost-sharing or migrate to new areas that are affordable to live.

Once we do buy a home, the goal should be to pay it off as quickly as possible and, no, low-mortgage rates do not change the priority of getting debt-free as a goal.

We should reject ‘have our cake and eat it too’ thinking. Despite what salespeople often like to tell us, we don’t need to get our home equity ‘working for us.’ Home equity is to provide a home, and that should be its sole and important job. Very rarely will home equity lines of credit (HELOC) or reverse mortgages be a sound financial idea.

If we have too much of our net worth in our home, or it takes too much of our income to maintain it, then the right answer is to downsize to a less expensive shelter to free up cash.

Today, most people do not know these basics and, too often, they rely on salespeople for recommendations making all age groups vulnerable to bad advice. Spreading this word is a start in the right direction.