Danielle was a guest with Jim Goddard on Talk Digital Network, talking about recent developments in the world economy and markets. You can listen to an audio clip of the segment here.

Pandemic and sudden income loss have made people more aware of their vulnerability. Even as interest rates have fallen again since March, loan demand is weak and cash savings in bank accounts have risen sharply. These are financial-health-restoring-trends in the right direction for individuals; not so much for banks and other lenders. See Deposit interest rates are taking a pandemic nosedive:

The average rate on savings accounts at U.S. banks stands at 0.08%, down from 0.1% in early spring, according to Bankrate.com, a personal-finance website.

But for many people, money stashed in a savings account represents an important protection against potential financial hardship. Easy access to that money outweighs the fact that they are being paid peanuts in interest.

Andrew Frisbie, executive vice president for consumer pricing at Novantas, said the pandemic had made many customers more interested in saving money for an emergency.

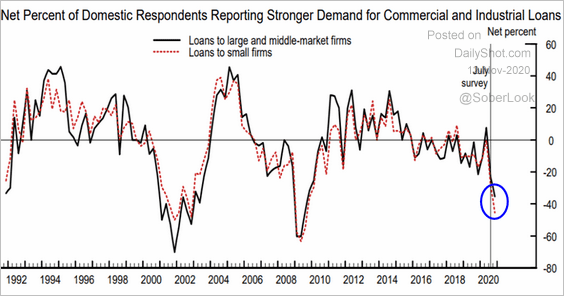

At the same time, demand for commercial and industrial loans is also weak, as shown below, courtesy of DailyShot.com, for small, medium and large firms. When debt levels are already high and revenues/income/demand weak, more debt is not ‘stimulative’.