Those hoping that the market plunge between February and March was enough to launch the next secular expansion in stock prices overlook a mountain of historical evidence. For some illuminating charts and commentary on this topic, read the latest from Lance Roberts, The “roaring 20s”–the fundamental problem of the bullish view. Here is just one important takeaway:

Let’s also not forget the singular most important fact.

Our history’s previous secular bull markets grew from extreme under-valuations, washed-out financial markets, and extremely negative sentiment.

Such was not the case over the last decade as the Federal Reserve and Government have pumped more than $36 Trillion into the economy to keep it “afloat.”

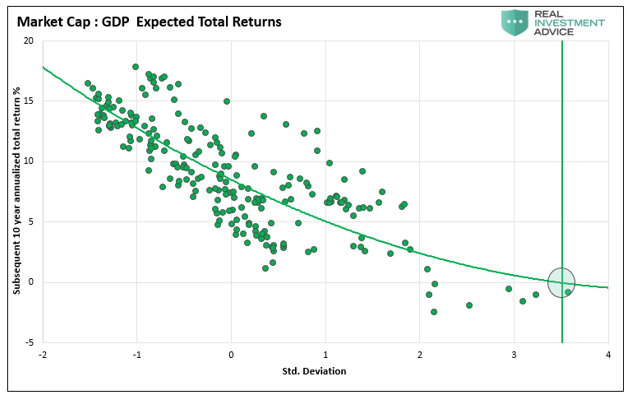

As I have explained many times, extreme asset prices are no free lunch and have historically been cured by a collapse in said asset prices or a long period of stagnant prices that works to restore attractive investment metrics once more. Given that today’s stock market capitalizations (price x shares) as a ratio of economic growth (GDP) (charted below) are the most extreme ever recorded–nearing 4 standard deviations from the mean (far right green circle below), this suggests the correction period yet to come will also be extreme.

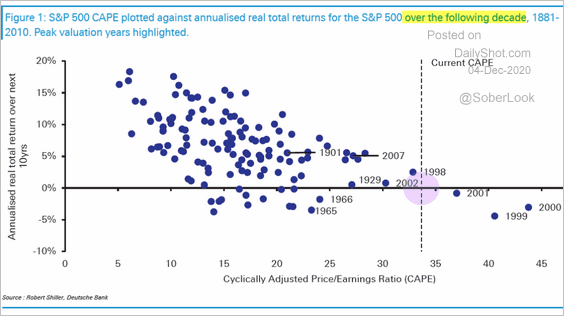

A decade of zero to negative real total returns (including dividends and before fees) is also suggested by the present S&P 500 price divided by an average of corporate earnings for the last ten years, adjusted for inflation (CAPE). The pink circle below plots the present reading above 35 and all other years since 1881 (bottom axis) and the annualized returns over the decade that followed each point (left axis). The only three worse readings were in 1999, 2000 and 2001–and sure enough, predictably, the decade following each did deliver negative real returns. Go figure; the price paid does matter!

A decade of zero to negative real total returns (including dividends and before fees) is also suggested by the present S&P 500 price divided by an average of corporate earnings for the last ten years, adjusted for inflation (CAPE). The pink circle below plots the present reading above 35 and all other years since 1881 (bottom axis) and the annualized returns over the decade that followed each point (left axis). The only three worse readings were in 1999, 2000 and 2001–and sure enough, predictably, the decade following each did deliver negative real returns. Go figure; the price paid does matter!

Nil to negative total returns for present holders for the next decade is a best-case scenario presuming they are able to hold throughout and not need or want to sell or withdraw any income or pay any investment fees. Any of these actions during the correcting period will make returns more negative.

Nil to negative total returns for present holders for the next decade is a best-case scenario presuming they are able to hold throughout and not need or want to sell or withdraw any income or pay any investment fees. Any of these actions during the correcting period will make returns more negative.

Low yields are one thing, but try inputting a decade of nil to negative compound growth into financial projections and see what happens to hopes, plans and dreams. Most financial plans today are set up to fail miserably. Failing financially is miserable indeed, especially later in life when there is less time to go back to work and make back losses.

To avoid the math of loss and chart a more stable course, one needs to take proactive steps ahead of the herd. Thinking people can do it.