“After ’99, many tech and growth companies lost 50% to 100%. We’re thinking in 2020, everything happens much faster. So, if it took 12 months for the end to begin, now it’s going to take six months.” Here is a direct video link.

Another familiar accelerant of price correction cycles: margin debt has exploded again.

Something to watch out for in 2021:

Margin Debt soared 50% in the past 8 months. In the past 30+ years, such investor euphoria happened exactly twice:

March 2000

June 2007

Now pic.twitter.com/BreCjy7khl— Troy Bombardia (@bullmarketsco) December 28, 2020

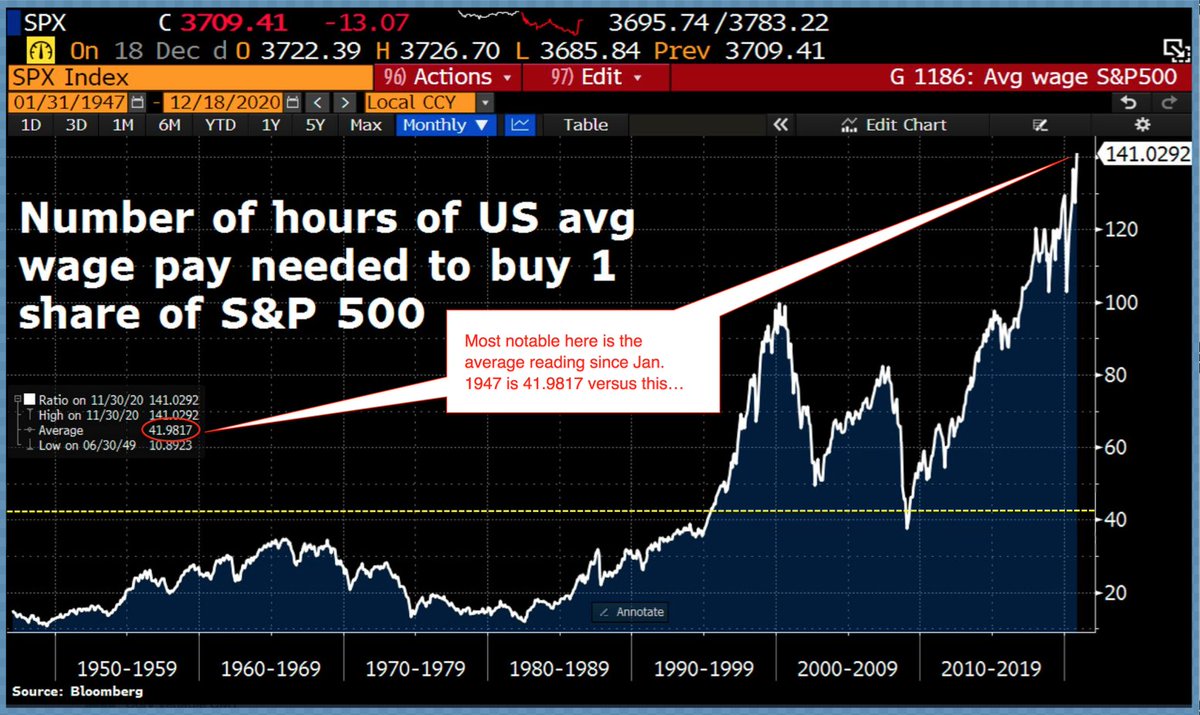

Further confirming the stocks-wildly-disconnected-from-economic-reality thesis, it now requires 141 hours of work for the average worker in the US to purchase one share of the S&P 500, This compares with a prior extreme of 100 hours in 2000, and the long-term average of just under 42 hours per share since 1947, as shown here courtesy of my partner Cory Venable and Bloomberg.