Someone recently asked me how I stay rational and focused amid manic markets and people. It’s pretty simple, really: I know that crazy is as crazy does. Growing up, I witnessed alcoholism and destructive behaviors in close family members. I know the critical importance of self-control and maintaining mental health. For more than thirty years, as a lawyer and a financial analyst, I’ve been working to help manage risk for clients, our extended family and many close friends. The saying goes that a fool and his money are soon parted, but I have seen first hand that intelligent, hard-working people are susceptible to bad advice and ill-considered decisions too.

Human life is full of risk, every day, in every way. Sober thinking and personal discipline are how tortoises prevail against hares over time. The art is not to get taken off course by races we never meant to run; and to remember that gamblers most often lose, even if they win for a while.

There is always a whole lot of crazy to be found. We can’t control other people; we can only control ourselves. Peace comes from defining what we are about and being content with the choices this informs. It’s always been thus. As Rudyard Kipling’s 1909 poem If begins:

If you can keep your head when all about you

Are losing theirs and blaming it on you,

If you can trust yourself when all men doubt you,

But make allowance for their doubting too;

If you can wait and not be tired by waiting,

Or being lied about, don’t deal in lies,

Or being hated, don’t give way to hating…

Jesse’s Felder’s latest piece offers an insightful big picture of present financial conditions. This too shall pass and then the opposite will be on offer. See One for the Age’s, Part Tres. Here’s a taste:

All told, it appears the current stock market mania has infected everyone from teenagers playing hooky from their zoom classes to day trade options to major institutions trying to piggy back on those trades to analysts tripping over themselves to try to justify the highest valuations in history.

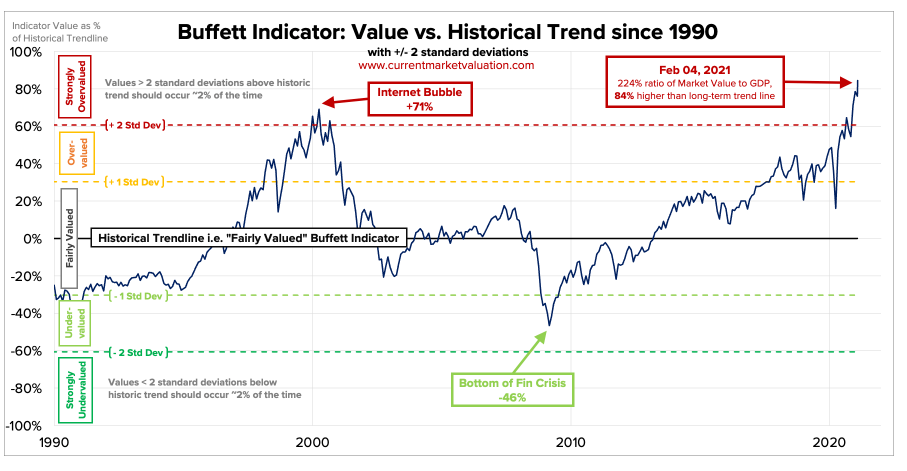

This updated chart of the “Buffett Indicator” showing stock prices at 224% of GDP, 84% and 2 standard deviations above the long-term trend of the last 30 years, is a beauty. We will be using charts like this one to teach people in the future about what not to do.