Pump-and-dump schemes have been suckering in the gullible for centuries. Past major loss cycles have resulted in stiffer regulation and prosecution of perpetrators. Following last week’s congressional hearing, the Securities and Exchange Commission is preparing a report about the trading frenzy around GameStop’s shares, with a view to informing potential regulatory action. We shall see; so far billionaires behind high-frequency trading have been highly successful in keeping regulation at bay, hiring aggressive legal representation, negotiating cost-of-business fines, and bringing former regulators onto their payroll at the end of their terms. Regulation notwithstanding though, individuals will always be vulnerable to the lure of hustlers and gambling.

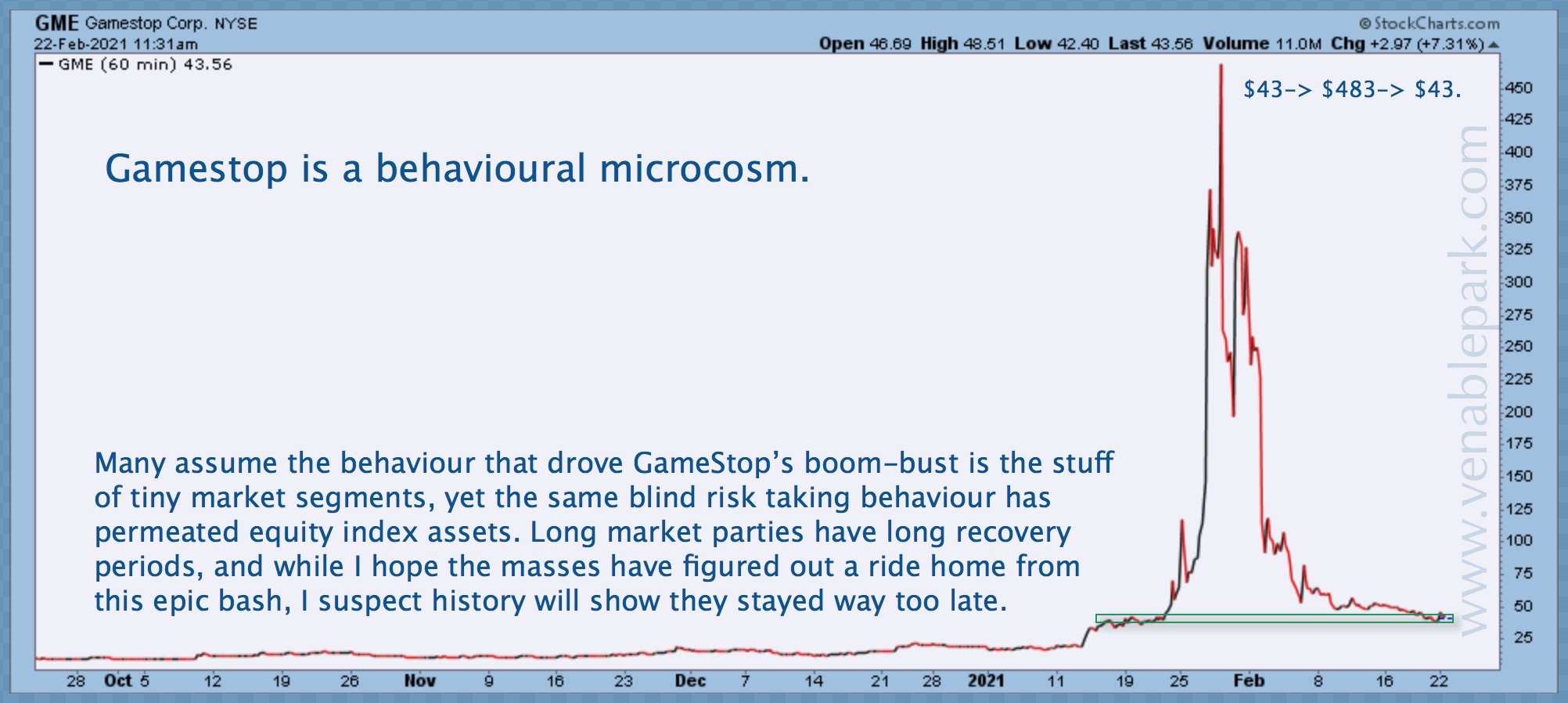

The abrupt GameStop price moves are shown in my partner Cory Venable’s chart below–from $43 to $483 and back again within a couple of weeks. GameStop is a high-profile example, but it’s also a symbol of larger financial trends and behaviours today–a tale as old as markets.

See A Stock-Trading dupe is born every minute:

For a pump and dump to work, you need a certain type of investor—specifically, the type P.T. Barnum said is born every minute (on platforms like Reddit and Robinhood, more like every nanosecond). To be nice, let’s call them dupes. “Greater fools” works too.

It takes fortitude and self-control to save ourselves from the constant threat of financial suicide under the guise of ‘investing’. The present frenzy will go down in history as one of the greatest financial bubbles ever, how we fare from peak to trough will be felt for years to come. Capital preserved matters most in the end.