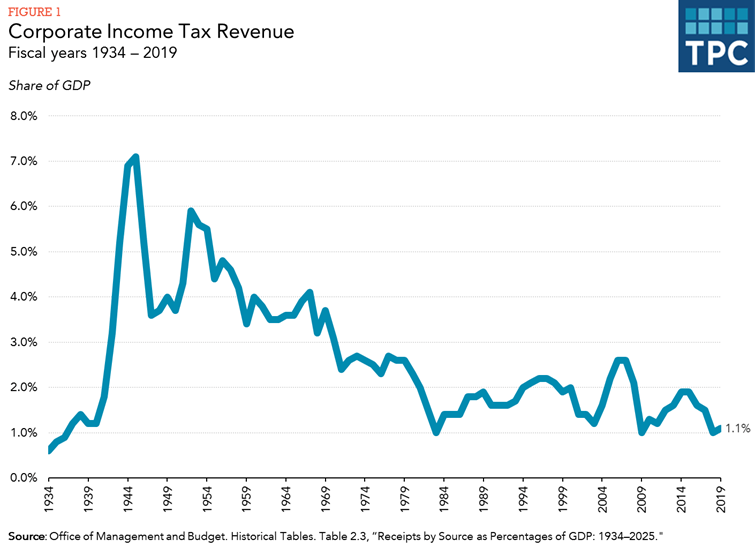

The argument that raising taxes on the ultra-wealthy will not eliminate government deficits is a red herring. The primary purpose of tax policy is not to eliminate deficits but to incentivize socially constructive behaviour and dissuade the socially destructive. Tax collection from the wealthiest individuals and corporations has fallen since WW2 worldwide, while government subsidies, bailouts and support p rograms favouring the wealthiest constituents have soared. This chart of US corporate income tax revenue as a portion of GDP since 1934 reflects a trend that has played out across all OECD countries.

rograms favouring the wealthiest constituents have soared. This chart of US corporate income tax revenue as a portion of GDP since 1934 reflects a trend that has played out across all OECD countries.

In Canada, the general corporate tax rate has fallen from 50% in 1982 to 26% in 2020, while the top marginal personal tax rate has fallen from 80% in 1972 to 60% until 1981, to 33% today.

Tax policy has been a major factor increasing wealth disparity, falling productivity, and destructive asset bubbles for at least the past thirty years, and the pandemic has accelerated the problems. If history repeats, the policy pendulum will now swing back in the opposite direction for years to come. This month, the British government got the ball rolling with the announcement of its first corporate tax rate increase since 1974–to 25 percent from 19 percent starting in April 2023– after successive Conservative governments lowered it from 28 percent over the past decade. The government also plans to freeze several personal tax allowances for four years starting in 2022 ( I suspect the freeze will end up being longer than 4 years).

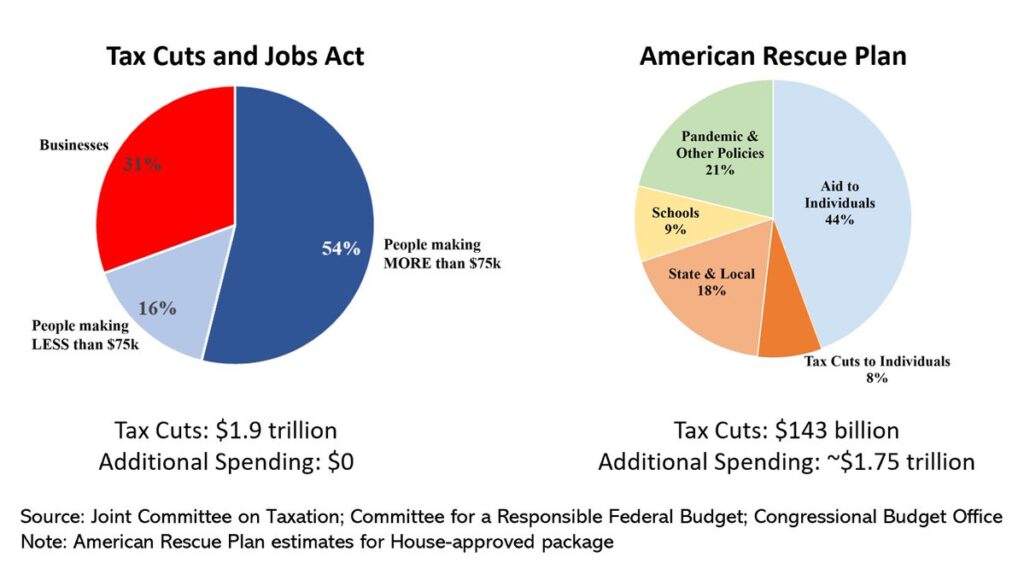

The beneficiaries of the ‘American Rescue Plan’ from the Biden administration are compared  below (on the right) with the Trump administration’s tax cuts (on the left)–both ballooned the national deficit and national debt, but different values are evident in each.

below (on the right) with the Trump administration’s tax cuts (on the left)–both ballooned the national deficit and national debt, but different values are evident in each.

Many of the world’s wealthiest individuals and corporations have increasingly used low or no tax zones, trusts and off-shore shelters to help stockpile wealth outside of the tax system and real economy even as they benefit from government-funded infrastructure and services.

The segment below is a worthwhile recap of some recent high-profile examples.

At the WEF in Davos the world’s wealthiest people meet annually to discuss philanthropic solutions for saving the world. But few want to talk about the issue of tax avoidance through philanthropy. Here is a direct video link.