With the US 10-year treasury yield pushing through 1.62 today, bond prices are in retreat and the yield back to where it was in early February 2020. It’s as if the pandemic never began. That is, except for all death and suffering, lost businesses, unemployment and massive debt addition that continues to unfold.

How much further yields rise matters for all markets. Higher treasury yields mean higher fixed mortgage rates, lower borrowing capacity and increasing pressure on equities and realty prices.

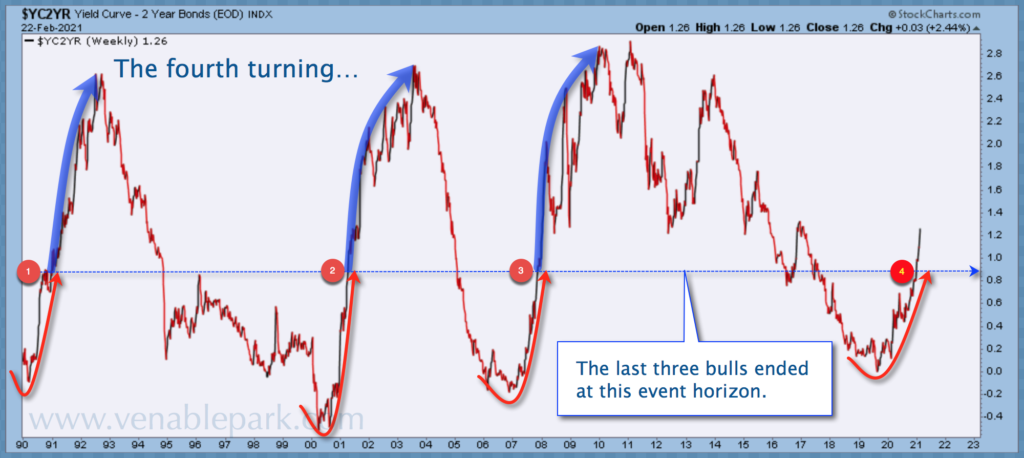

As shown in my partner Cory Venable’s chart below from February 22, the last three bear cycles for stocks (shown since 1990) began when the 10-year yield had risen far enough above 2-year yields that the spread between the two passed .8% (dotted blue line), and did not end until this spread had topped 2.4%.

Having broken above .8 in late 2020, the 10-2 spread breached a new cycle high of 1.477% today. If history is a guide here, we could see a further spread increase in the months ahead, with the 10-year potentially topping out somewhere near the 3% range. In the 2007-09 cycle, the US 10-year topped at 3.36% in April 2009 and the 2-year just over 1% while the stock market halved. With debt at historic highs at every level today, leveraged participants, assets and sectors are even less tolerant to higher rates now than in the past.

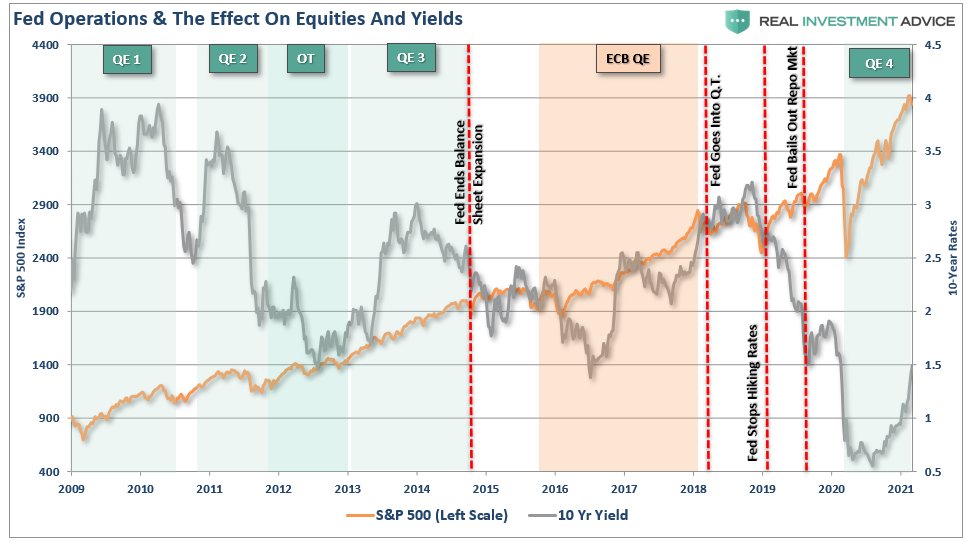

Some point to central bank bond-buying as a reason why rates will not rise further. But this flies in the face of experience during past ‘quantitative easing or QE’ interventions.

As shown below, courtesy of Lance Roberts, each time central banks have swapped their cash for bonds on bank balance sheets (QE) since 2009, increased liquidity in the financial system has moved, not into the real economy, but rather out of safe deposits and into higher-risk securities on increased risk-seeking from market participants. In the process, net selling of treasuries pushed yields higher for a time until higher yields snuffed out the risk rally once more.

The upside here is that higher yields will offer another valuable opportunity to put cash to work in the highest quality bonds in the coming weeks. This will be a place to collect income and some capital gains as other assets tank. And then, finally, we will have a valuable cyclical opportunity to move cash into high-yielding, low-priced equities once more. Well worth the wait.