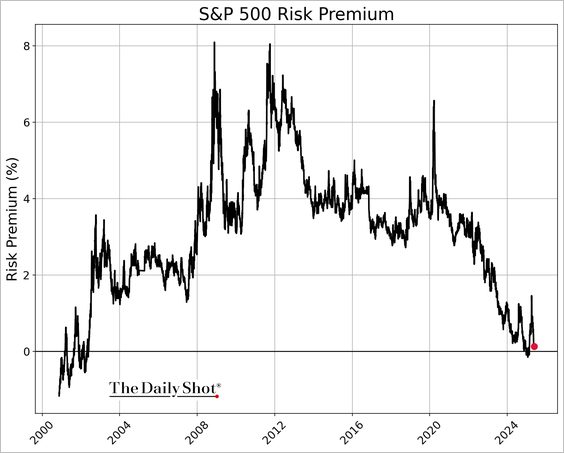

Market pricing is driven by irrational impulses when math and risk-assessment have no place in the allocation decisions being made. The present financial climate is a textbook episode where sober thinking is decried as out of step and worse.

With the masses wielding record amounts of government-backed-debt while eschewing traditional risk-checks like home inspections and historically-prudent price-to-income ratios, mania is rampant.

For some COVID-friendly-entertainment yesterday morning, we played ‘guess the price’ driving in a radius around where we live north of Toronto.

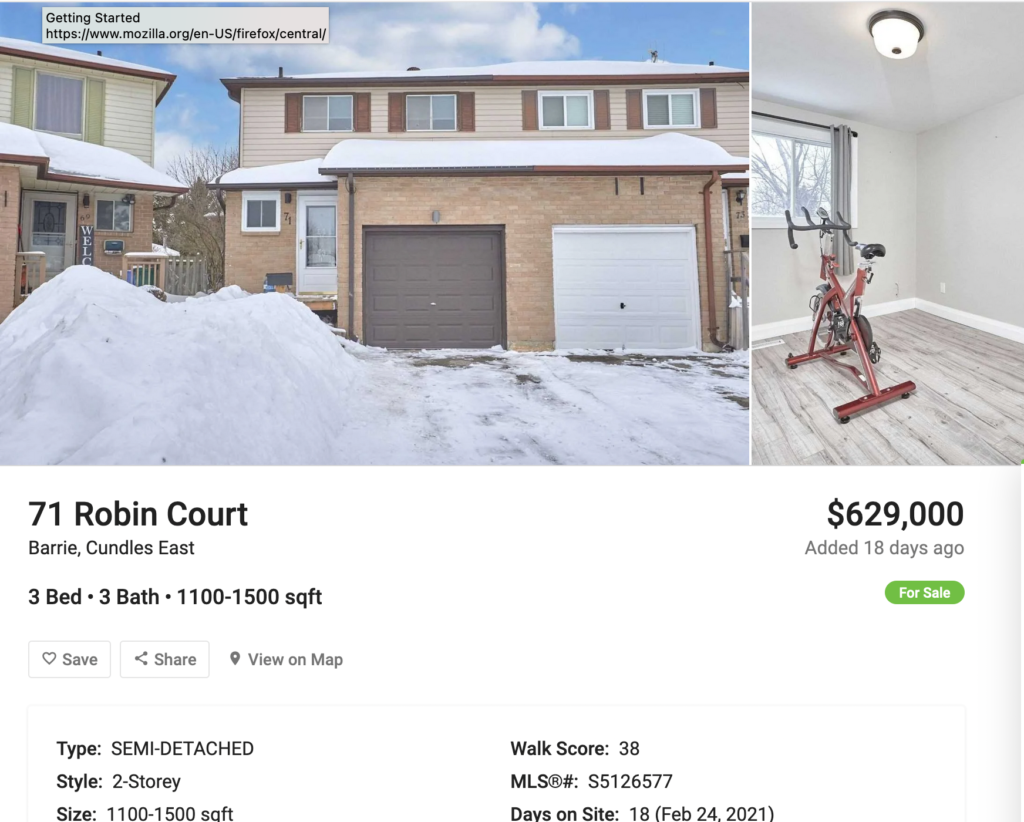

For a base-line glimpse: in Barrie, thirty-year-old entry-level townhomes are on offer for $629k. The property shown on the left last sold in August 2016 for 260K–some 140% below the current ask. Maybe they’re pushing their luck with this price. A neighbouring property sold yesterday for 585K, up 113% from its last sale at $274k in May 2016.

For a base-line glimpse: in Barrie, thirty-year-old entry-level townhomes are on offer for $629k. The property shown on the left last sold in August 2016 for 260K–some 140% below the current ask. Maybe they’re pushing their luck with this price. A neighbouring property sold yesterday for 585K, up 113% from its last sale at $274k in May 2016.

Not to pick on townhomes. Detached subdivision houses in the 700k to 1m range are run-of-the-mill. Twenty minutes into the countryside in any direction, sales in the 1 to 2m range are typical, often within days of listing.

According to the CREA, the national average home price in February was a record $678,091, up 25 percent from a year earlier. CREA forecasts the average price to rise a further 16.5 percent to just over $665,000 in 2021 and $679,341 in 2022–no pull-backs in sight.

In the meantime, the average annual salary for full-time employees has risen 4% since January 2019 to just over $54,630 in 2020.

The average detached home sale in the 905 area code immediately surrounding Toronto jumped 28% year over year in February to $1.3-million.

In these conditions, a $450,000 down payment and household income of 200% of the national median are no assurance of winning the abode lottery. See: A well-qualified millennial home-seeker throws up his hands after losing multiple bidding wars.

Fear of missing out (FOMO) during upcycles tends to overwhelm any fear of capital losses (FOCL). But amid conventional nonsense, math is always worth reviewing.

On a property priced at 1.3m, even someone wielding a historically huge 450K downpayment needs to sign on for an 850K mortgage that will typically take several decades to repay even if presuming perpetually low-interest rates. Moreover, if home prices can rise 28% in a year, they can certainly fall that much as well. A 28% decline from 1.3m would return that home price to 936K and evaporate all but 86K of the initial 450k cash downpayment. It commonly took 10 to 15 years for prices to revisit prior peaks after past realty correction cycles. That’s a long time waiting to grow back principle, even for those who can manage to wait.

Waiting to buy assets at rational prices while building cash savings is always a wise course. Today, more than usual, the fortitude to do so is likely to define individual financial prospects for many years to come.