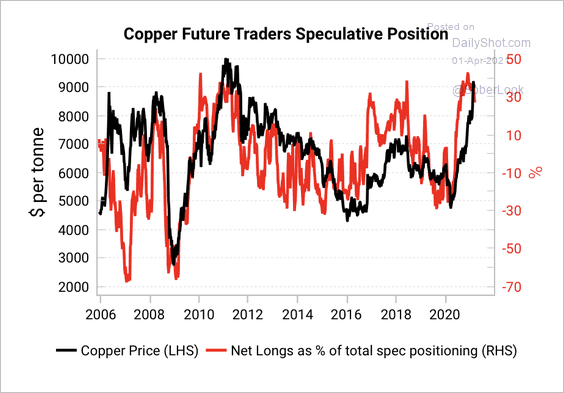

As we explained in our month-end client letter yesterday, net speculative longs in commodities closed March at an all-time high. That’s a whole lot of highly levered speculators betting that commodity prices will keep rising. Maybe, but never indefinitely. The quadrillion dollar question, of course, is where’s the top.

Making up 31% of the London Metals Exchange Index (LME), copper prices rose 108% from March 25, 2020, to $4.335/lb on February 24, 2021. This is very close to the price peak in the 2008/2011 commodity cycle. Since February, copper prices have retraced about 8%.

As shown here courtesy of the DailyShot, extrapolating the uptrend, speculators started April, the most net long copper since the cycle peak in 2011. A lot of inflation expectations are baked into this picture.

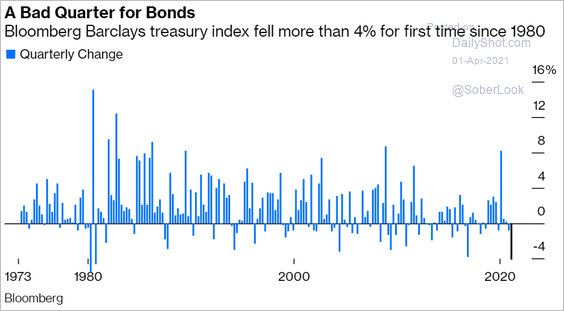

Those inflation expectations caused government bond prices to sell off just over 4% in the first quarter of 2021–the biggest decline since 1980, as shown below—this is what stock Permabulls like to call bond ‘carnage.’

Those inflation expectations caused government bond prices to sell off just over 4% in the first quarter of 2021–the biggest decline since 1980, as shown below—this is what stock Permabulls like to call bond ‘carnage.’

With the junkiest bonds now priced like cash-good deposits collecting record-low yields under 4%, speculative fever is in full bloom, and the safest treasury bonds may indeed retrace further in the weeks ahead. But here’s the thing: each move lower in 5 to 30-year treasury prices inversely increases the borrowing costs for debtors who owe more today than at any other time in world history.

With the junkiest bonds now priced like cash-good deposits collecting record-low yields under 4%, speculative fever is in full bloom, and the safest treasury bonds may indeed retrace further in the weeks ahead. But here’s the thing: each move lower in 5 to 30-year treasury prices inversely increases the borrowing costs for debtors who owe more today than at any other time in world history.

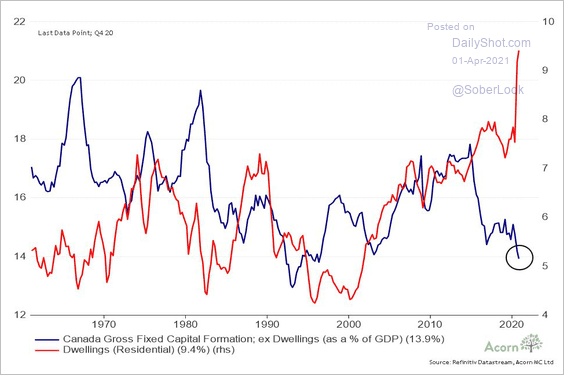

If most had borrowed that money to increase their free cash flow and thus help repay the loans, that would be one thing. But this has not been the trend. Quite the opposite, in many countries households have borrowed record debt to finance the most expensive housing in generations. While public corporations have borrowed to buyback shares, increase dividends and merge. In the process, the fixed capital investment (that can improve efficiency and productivity) has plunged to the lowest level in at least 25 years.

The chart below shows Canada’s pattern, with residential ‘investment’ in red since 1960 compared with fixed capital investment ex dwellings as a percentage of GDP in navy.

We note that these two trends have been negatively correlated and reliably mean-reverting for decades. A reversal is overdue and much needed, especially if we hope to pay down the debt now accumulated.

Historically, debt booms and speculative frenzies have been inflationary while expanding and then deflationary for years thereafter. It’s hard to see why this one should be different.

Historically, debt booms and speculative frenzies have been inflationary while expanding and then deflationary for years thereafter. It’s hard to see why this one should be different.