A few recent charts, courtesy of DailyShot.com, offer clarity on where we are in the present financial cycle.

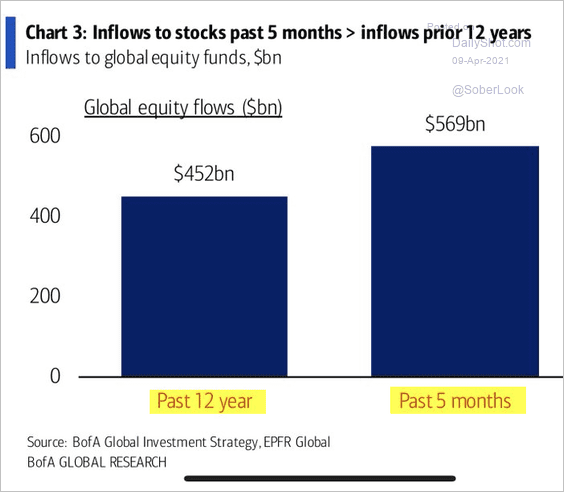

According to data from BofA, central bank and government injections (backed by taxpayers) encouraged more than half a trillion dollars to flood into global equity funds over the past 5 months–exceeding the total inflows recorded over the previous 12 years.

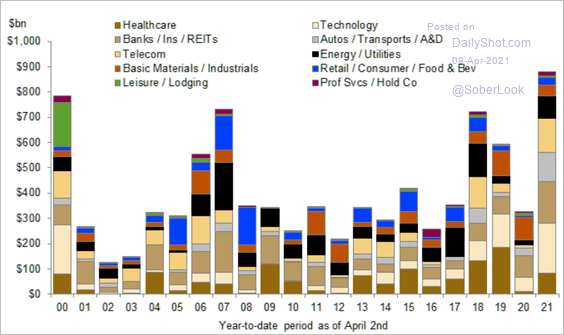

The rising liquidity and risk appetite enabled corporate mergers and acquisitions (shown below by sector since 2000) to reach a new all-time high in the first quarter of 2021, surpassing the prior peaks in 2000 and 2007.

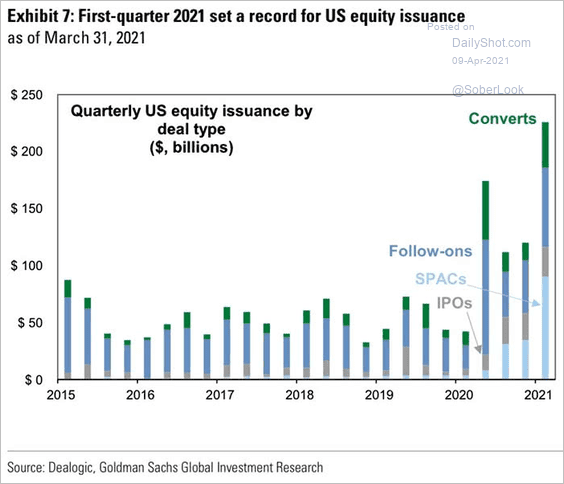

It also allowed companies and their investment bank underwriters to sell a record amount of new equity issues to the public in the first quarter of 2021.

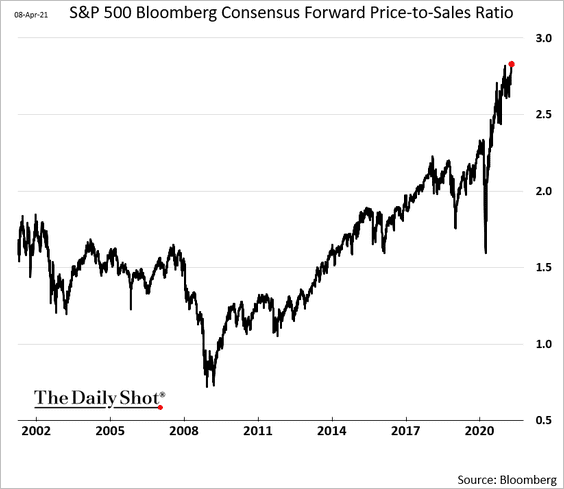

At the highest price to forecast-sales ratios in at least 20 years…

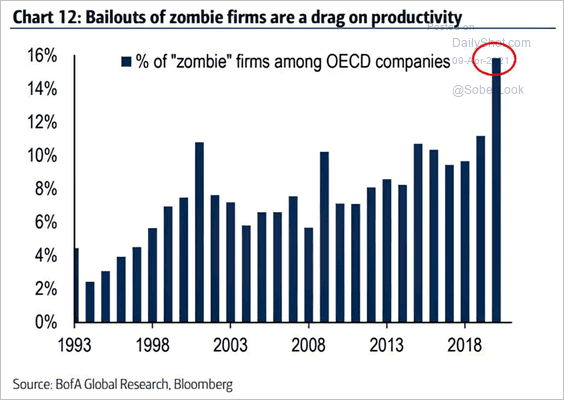

And allow zombie companies –those not making enough money to pay the interest on the debt they’ve already accumulated–across the OECD, to borrow even more.

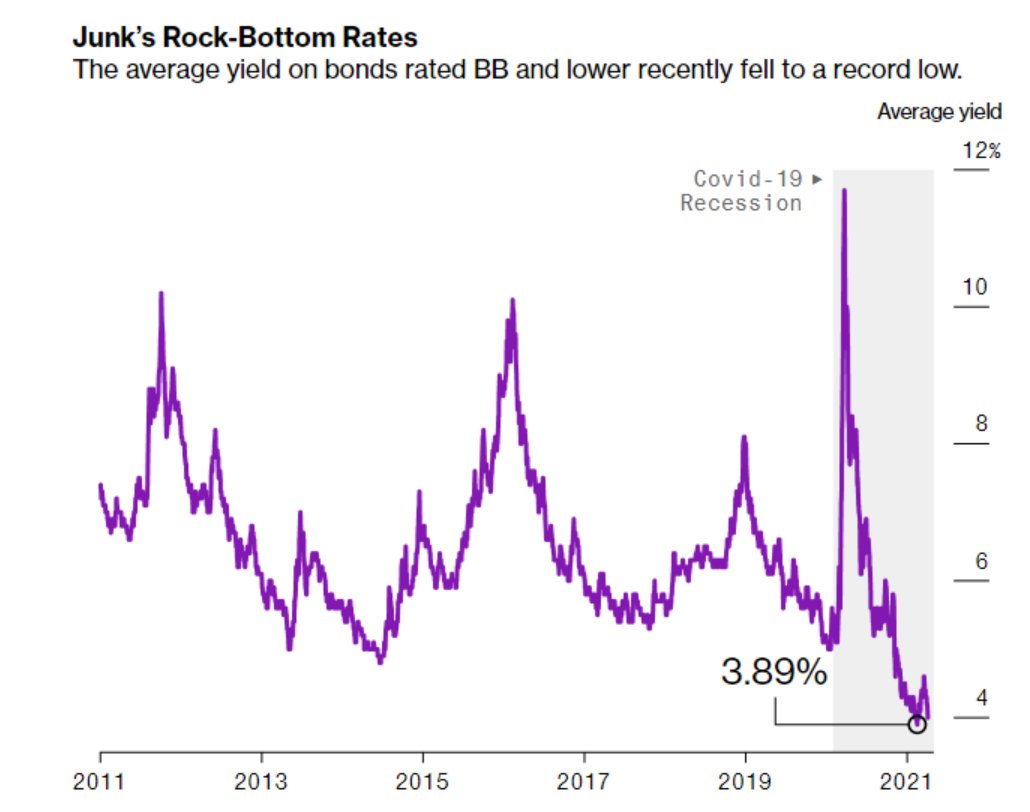

While paying lenders the lowest interest compensation ever–less than 4%.

Whatever buyers may think they’re doing here, it’s certainly not ‘investing’.

Whatever buyers may think they’re doing here, it’s certainly not ‘investing’.