How well we interpret and respond to the inflation cycle defines longer-term investment outcomes more than anything else. With the consensus now confidently in the accelerating inflation camp, alternate views are rare and worth considering. David explains dominant factors well in this segment.

- Are we really facing secular inflation?

- How the recent stimulus impacts the inflation narrative

- FED has it right – this inflation is a “transitory phenomenon”

- How to play against the popular narrative that secular inflation is imminent

- Why this inflation is transitory

- Outlook on treasury yields

Here is a direct audio link starting at 11:00 minutes on the play bar.

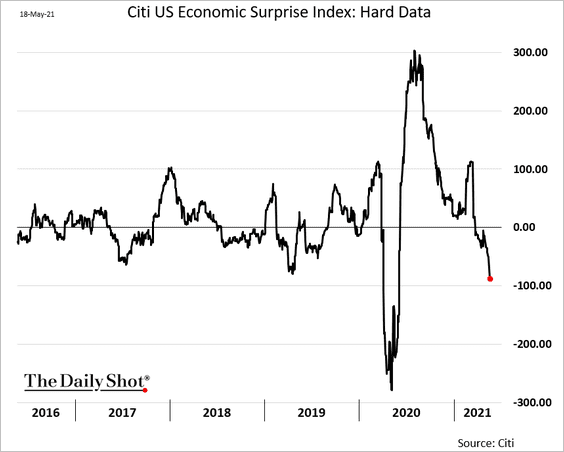

Below is the April Citi US Economic Surprise Index David mentions as being at the lowest level in 11 months.