As always, Lacy Hunt offers a worthwhile macro update in this interview.

Lacy Hunt Ph.D. Returns to talk about dis-inflation, the velocity of money and what happens when the supply chain gets restored. Lacy Hunt is a world-famous economist and Executive Vice President of Hoisington Investment Management Company. He spoke with Vance Crowe about what his economic models suggest is going to happen as the country and world comes out of COVID. Here is a direct video link.

As Lacy notes that US home prices have overshot relative to income gains in the past year, consider the chart below which shows the change in US home prices relative to disposable income (1975 through 2020 on the left) compared with Canada (on the right). Surreal it is.

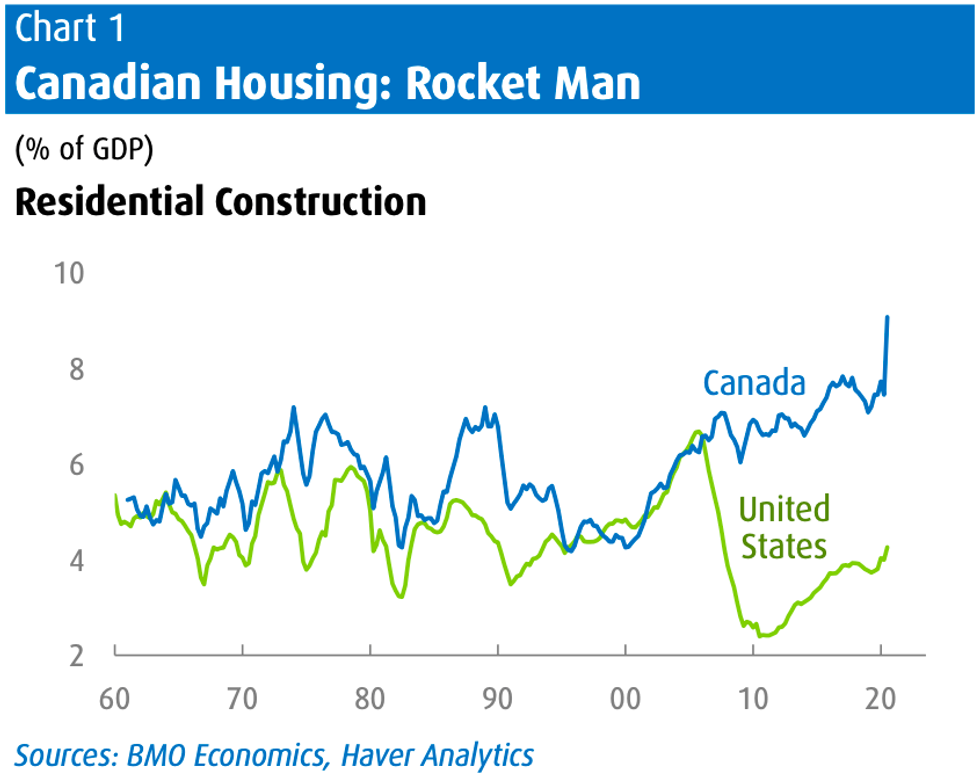

Further, as Lacy explains that the US residential sector is today a relatively small 3 percent of US GDP, consider the chart below which shows that Canadian residential investment made up a record 9% of GDP in 2020. This is 30% more than the US economy’s absurd dependence on residential investment at their last housing bubble peak in 2006, just before prices crashed and took 14 years to recover. Canadian real estate has now beat this dubious distinction.

Adding insult to the injury of this mania was the near quadrupling of lumber prices between October 2020 and May 7th, adding some $48,000 to the cost of a newly constructed 2400 square foot home. Since then, lumber prices have done an abrupt u-turn, down more 20% in the last three weeks, but still a whopping 56% above the previous cycle high in 2018. More downside work to do here. Timber! indeed.

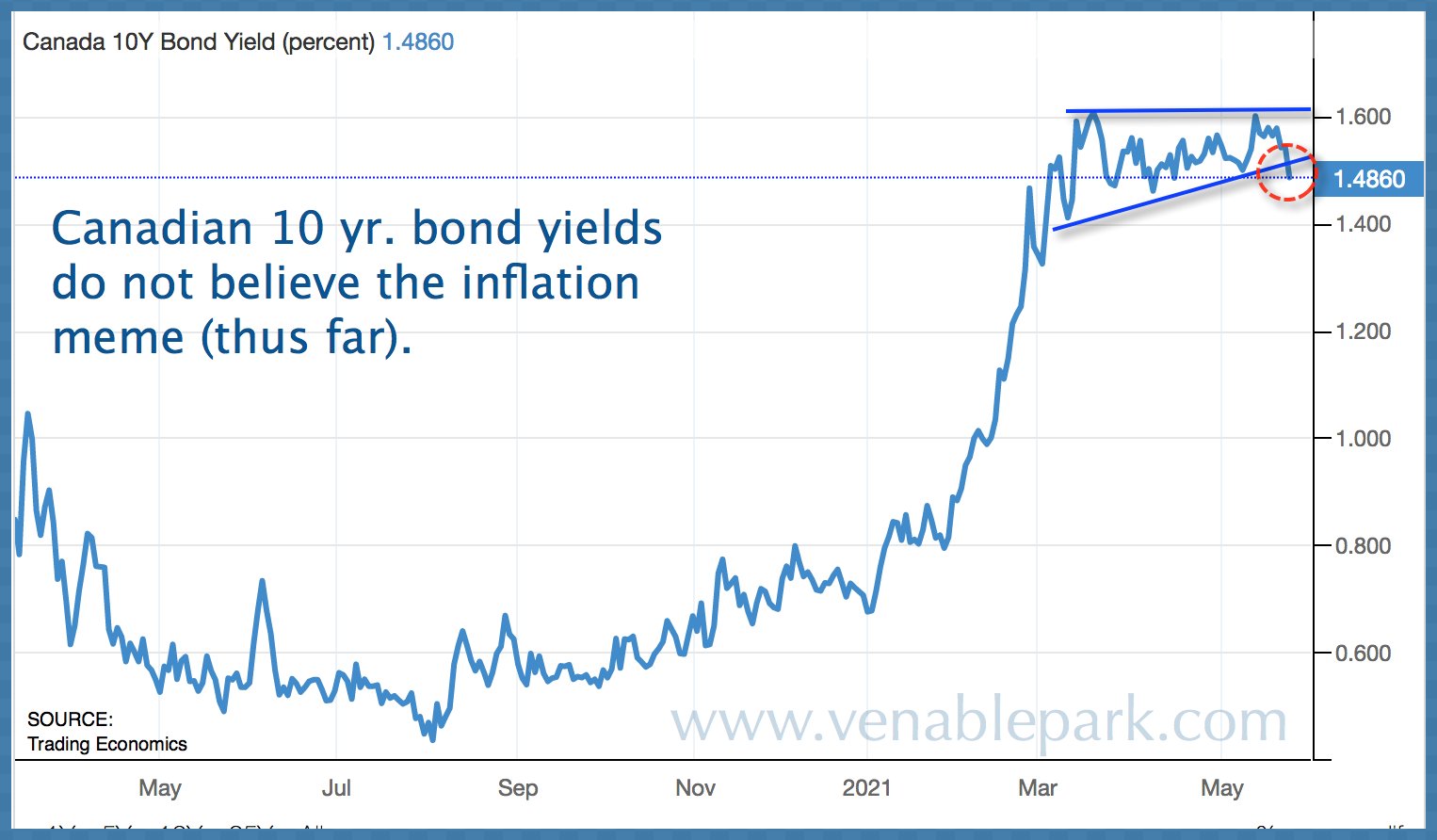

From current heights, the deflationary forces of falling asset prices are likely to overwhelm all the inflationary efforts of central banks. Treasury prices seem to agree. As shown in the chart below from my partner Cory Venable, after leaping along with the inflation narrative from last summer to March, 10-year Treasury yields have begun to move lower again (rising Treasury prices).