The 50% drop in Bitcoin and other cryptocurrencies over the past month has shown, yet again, that they’re not the stable store of value that proponents wish they were. Then, overnight, we have further confirmation that they’re also not secure.

U.S. officials managed to recover most of the ransom paid to hackers that targeted Colonial Pipeline as investigators accessed the password for one of the hackers’ bitcoin wallets and seized $2.3 million.

The money was recovered by a recently launched task force in Washington created as part of the government’s response to a rise in cyberattacks. See Bitcoin slides 8% as U.S. seizes most of Colonial Pipeline ransom.

Think only the criminals can employ brilliant programmers and hackers? Very funny.

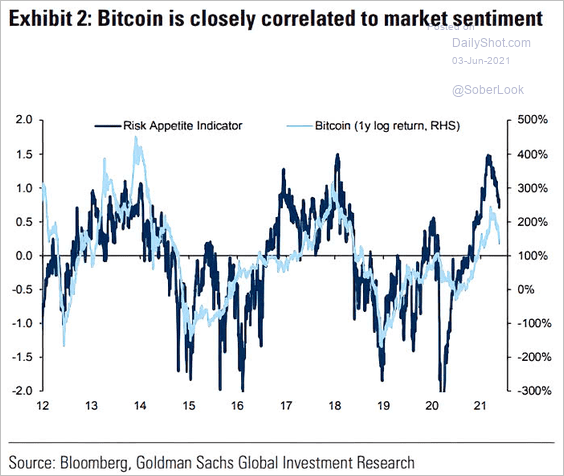

While we’re bursting bubbles here, might as well also deal with the cryptos are a ‘safe haven’ blather. As shown below since 2012, crypto-daddy Bitcoin (in light blue) has traded in positive correlation with risk appetite (dark blue), not counter to it.

It’s no surprise that in a world with record financial leverage and speculative mania that bubbling asset markets would explode up and down together. More of the latter yet to come.

It’s no surprise that in a world with record financial leverage and speculative mania that bubbling asset markets would explode up and down together. More of the latter yet to come.