This morning we learned that US retail spending fell 1.3% in May (more than the -.80 expected). After a year of record spending on durable goods–items that typically last at least three years, like appliances, tools, computers, electronics, jewelry, vehicles, furnishings, and equipment–consumer spending (which drives some 2/3rds of GDP growth) looks to be coming off the boil.

Some of this is that higher prices and delayed delivery times are damping appetite; some of it is because there are only so many goods a consumer can add, upgrade, and replace before losing interest and/or spending ability. And because durable goods have multi-year utility, the recent demand frenzy has necessarily pulled forward spending from the next few years. Consumers are now more likely to focus discretionary funds on some newly reopened services and debt-repayment (also considered saving).

Signs of this are evident in recent surveys that show a plunge in consumer plans to buy vehicles, appliances and housing over the next six months.

Commodities have been sensing the shift, with the price of many key inputs like lumber (-42%), steel rebar (-18%) and copper (-9%) down sharply from recent peaks. As West Texas Crude has climbed back to the $70 area, ICE motorists are now paying about 37% more to fill up today than six months ago. Increases in oil, gas and food are officially removed from consumer price index (CPI) reports, but higher prices tend to prompt a general pullback in discretionary consumer spending; this also likely explains some of the spending retrenchment now.

Asset market participants are not positioned for a decline in consumption and inflation–quite the opposite. Despite all-time highs in most valuation metrics, there are few left betting on lower equity prices, with shorts at record lows and the put/call ratio at the lowest level since July 2000.

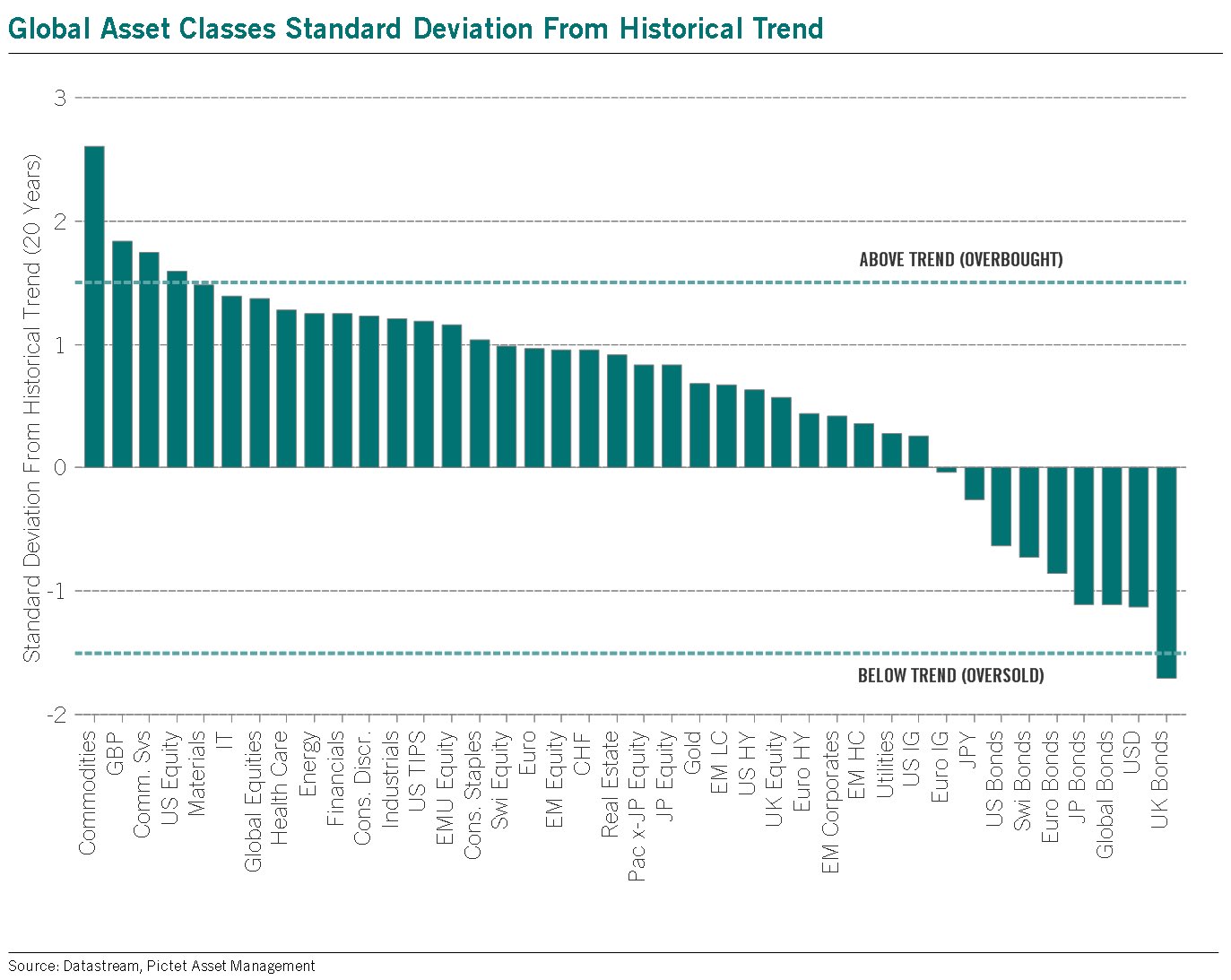

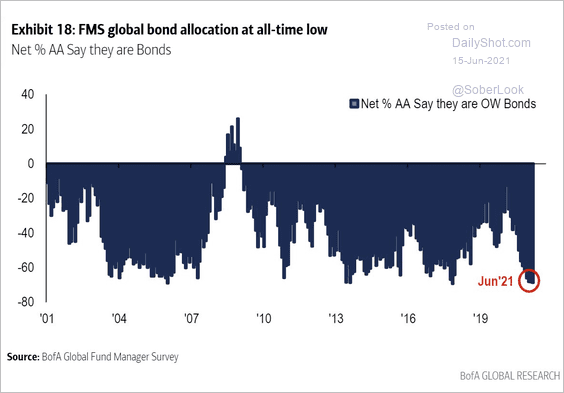

At the end of May, a confident consensus had commodities and equities (shown below, starting from far left) wildly overbought (2.5 to 1 standard deviation above 20-year trends), while bonds and the US dollar (on the far right) are historically oversold. Global fund managers have bought the inflation trade hook, line and sinker. As shown below, since 2000, courtesy of DailyShot.com, less than 25% of funds report being overweight bonds in June.

Global fund managers have bought the inflation trade hook, line and sinker. As shown below, since 2000, courtesy of DailyShot.com, less than 25% of funds report being overweight bonds in June.

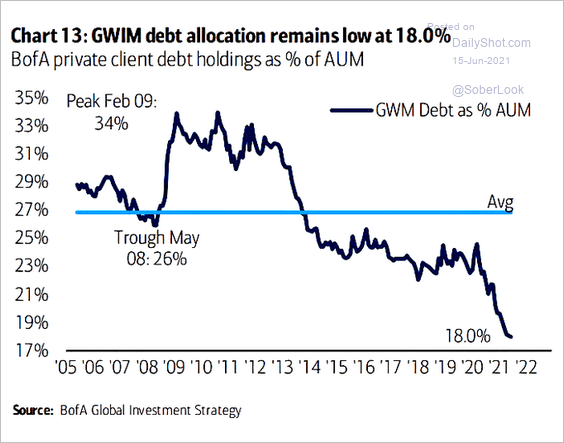

Ditto for global wealth management clients who, as shown below, have the lowest allocation to investment-grade bonds in at least 20 years.

Ditto for global wealth management clients who, as shown below, have the lowest allocation to investment-grade bonds in at least 20 years.

This is not true of the lowest grade junk debt, which, as shown below since 2000, is so overbought it yields just 3.84%–the least compensation for this capital risk on record.

This is not true of the lowest grade junk debt, which, as shown below since 2000, is so overbought it yields just 3.84%–the least compensation for this capital risk on record.

There is no question that this is the greatest speculative bubble of our lifetimes. It’s not a brave new era, but it is a dumb and reckless one. Today, all equities, corporate debt, commodities, real estate and cryptocurrencies are trading in positive correlation.

The only meaningful capital defence or diversification available is in cash, Treasuries and possibly bullion, but they’re all nil to low yielding, so few are patient and disciplined enough to have capital wait there. That means few will have the liquidity and mental strength to buy low when all the other asset bubbles burst together.