Yesterday, the US Fed acknowledged that financial conditions and inflation expectations had rebounded faster than they had predicted, and they now expect to increase their presently near-nil policy rates twice in 2023–a year and a half from now. More imminent for markets–this suggests the Fed would start tapering its “not QE” bond purchases by early 2022.

As has been the pattern, the US dollar bounced sharply on the prospects of less financial liquidity, and it’s rallied further today. Record dollar-shorts are getting thumped in the process, and record commodity longs and equities riding the other end of the dollar teeter-totter are dropping sharply.

In truth, hints at this turn have been building since March 2021, when US 10-year Treasury yields topped 1.77 and the dollar index retested and held its December 2021 low around $90. Against the commodity-centric loonie, the greenback bounced off the $1.20 downside support area that has held since 2015. We included this chart from my partner Cory Venable in our client letter for May 2021–with the trading range shown in green.

We noted at the same time that lumber prices were leading the deflationary charge lower, having fallen from $1730 in April to $1,320 at the end of May. Lumber touched $904 per thousand board feet this morning -48% from the April highs so far. With production ramping higher and intentions to buy new homes in freefall, lumber prices still look garish. As a point of reference, lumber would need to retrace a further 58% just to return to where it was last June and 70% to return to the $250 range seen near the top of the 2006 US housing bubble. Timber! Indeed.

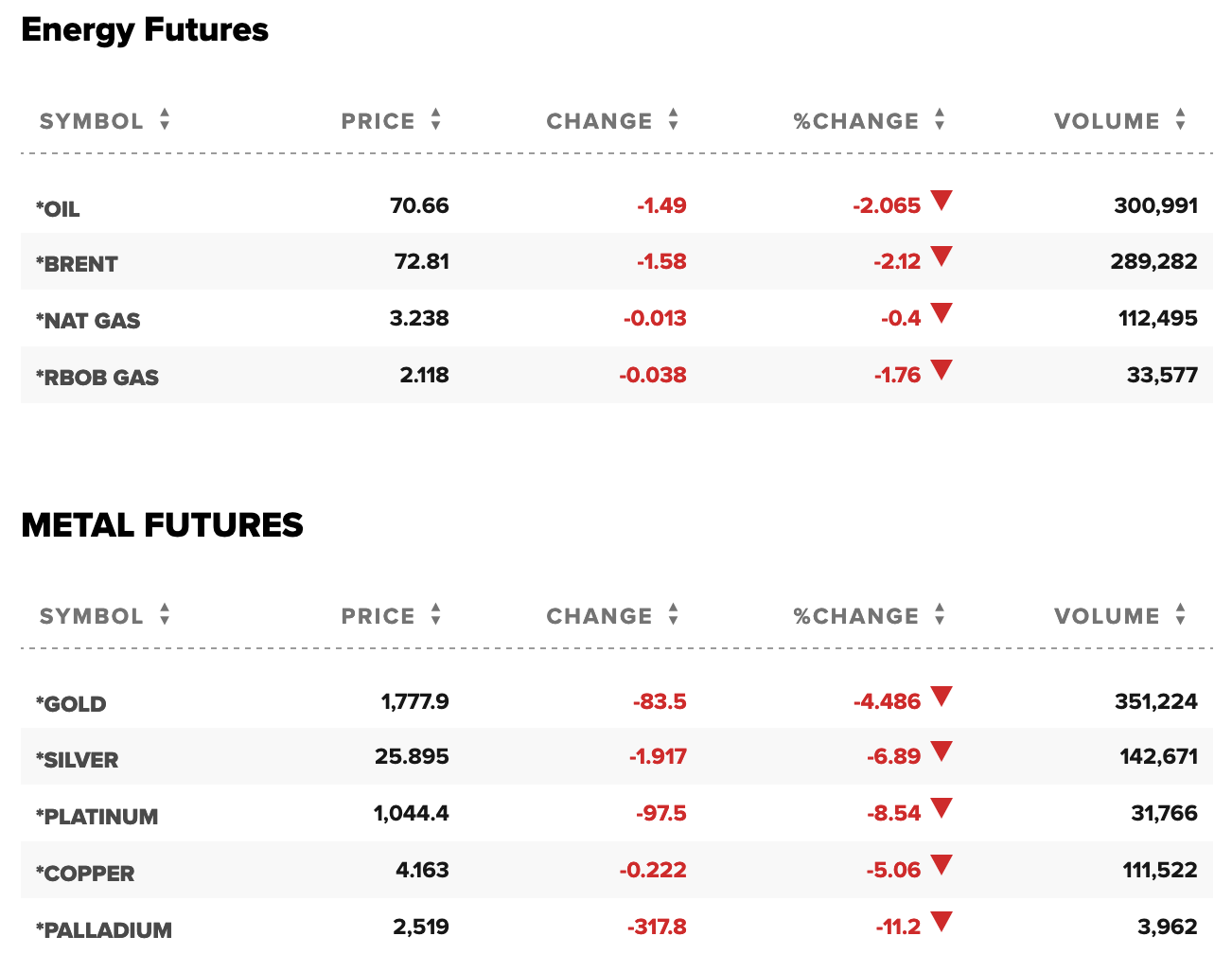

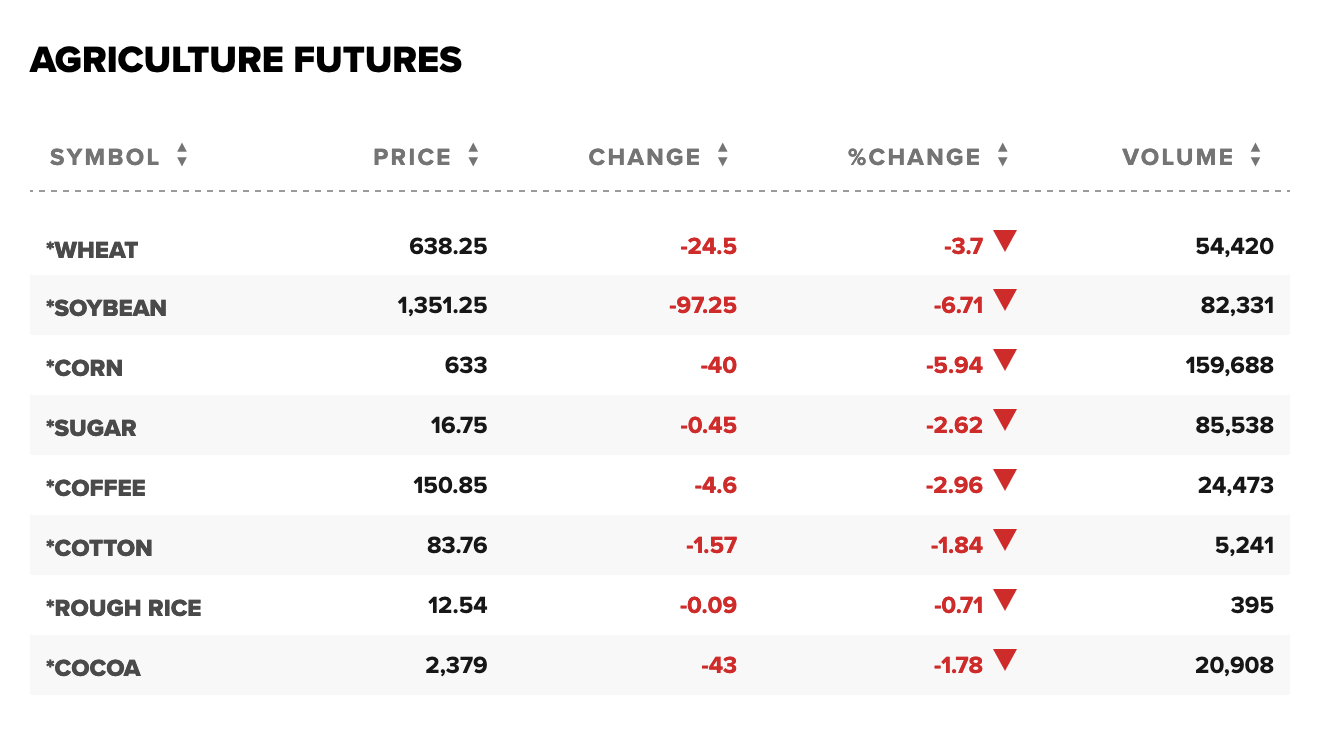

As seen in this screenshot from this afternoon, most commodities are tumbling with lumber. Oil, food, metals–precious and not, are no different. Diversity not.

After a brief dip yesterday afternoon, Treasury bonds are once again rallying with the greenback today. We have been expecting this might happen. Higher interest rates (and commodity prices) are a negative feedback loop that weighs on consumption and the initially envisioned economic growth rate. Once realized, this tends to drive capital flows back to the relative security and guaranteed income of government bonds while risk assets lose lift. Our May client letter explained with the below chart of the US 10-year Treasury yield. A yield retreat to the sub 1% range has been our base case as risk markets work through their next nervous breakdown.

Realists never forget that there are no gurus, only cycles (h/t Michael Gayed). This one is epic for the history books and very much still in motion. With financial leverage at unprecedented extremes, the Pandemic-bail-out-boom is destined to go bust. In the end, as always, it’s not what markets did on the upside, but rather who has retained what in the end. Limiting capital downside is job number one.