Sixty-year market veteran and co-founder of Boston-based GMO did a lengthy interview with John Authers for Bloomberg this week. It’s worth a read here. I include some highlights and charts below:

“The last 12 months have been a classic finale to an 11-year bull market,” Grantham said. “Checking all the necessary boxes of a speculative peak, the U.S. market was entitled historically to start unravelling any time after January this year.”

…It’s particularly dangerous now because the bond, stock and real estate markets are all inflated together, Grantham added, noting that even commodity prices are surging.

“That trifecta-and-a-half has never happened before anywhere — the closest before was Japan in 1989,” he said. “The consequences for the economy were dire and neither land nor stocks have yet returned to their 1989 peaks!”

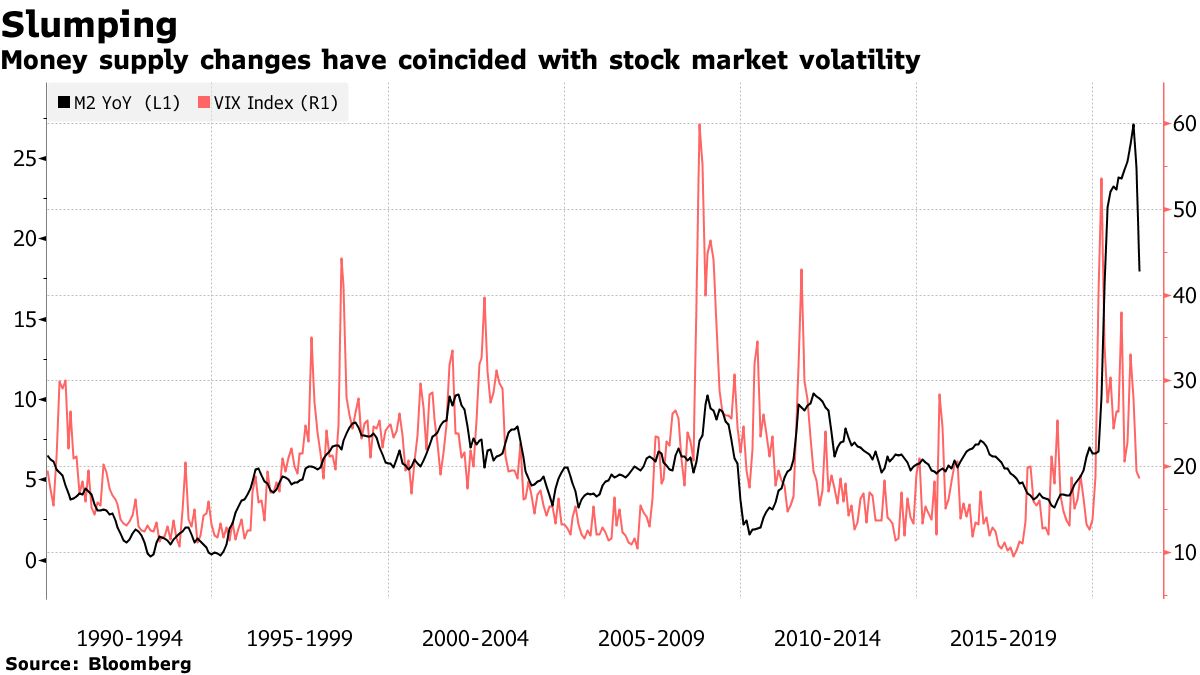

…On the subject of liquidity, which bulls have argued is a reason why there’s more room to rally, Grantham said although the rate of increase in M2 is extremely high, its growth has declined in recent weeks at the fastest rate ever recorded, from about 18% year-over-year to 12% (see chart).

…For the great bubbles by scale and significance, we also noticed that they all accelerated late in the game and had psychological measures that could not be missed by ordinary investors. (Economists are a different matter.) The data, like today, is always clear, just uncommercial and inconvenient for the investment industry and often psychologically impossible to see for many individuals.”

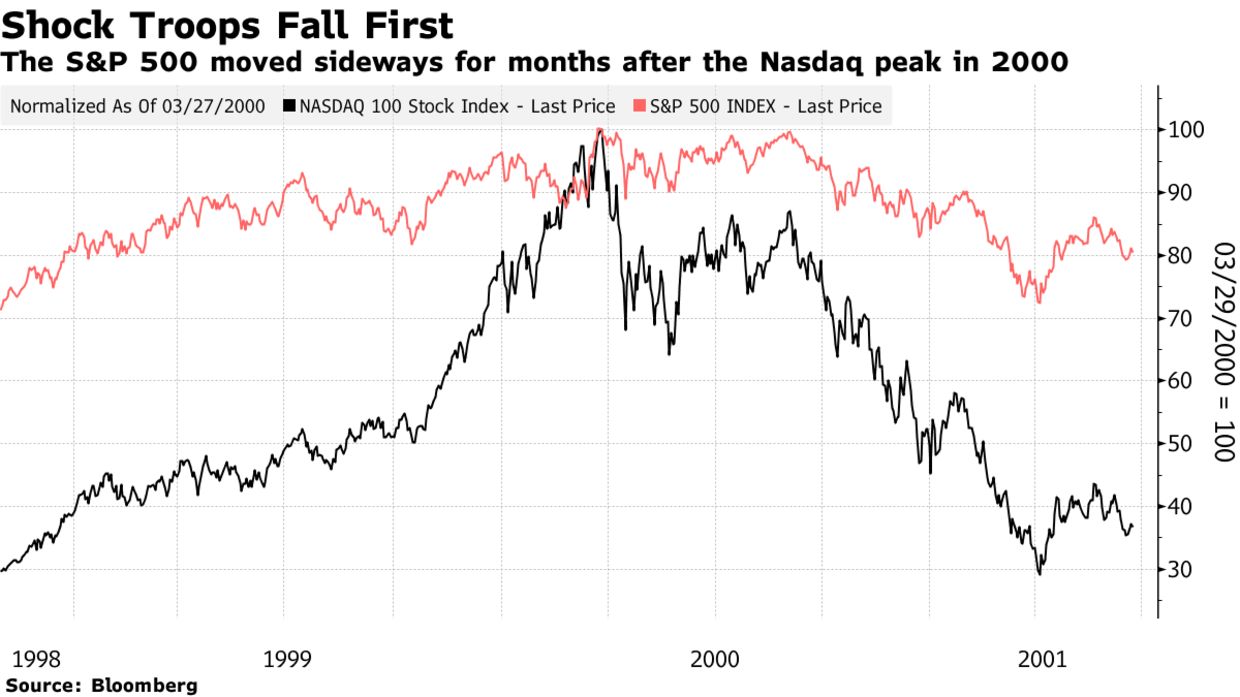

Grantham points out that the tech-centric NASDAQ Index (shown below in black) doubled in 1999 before turning down in March of 2000 while the broader market (in red) held up for another quarter before breaking down.

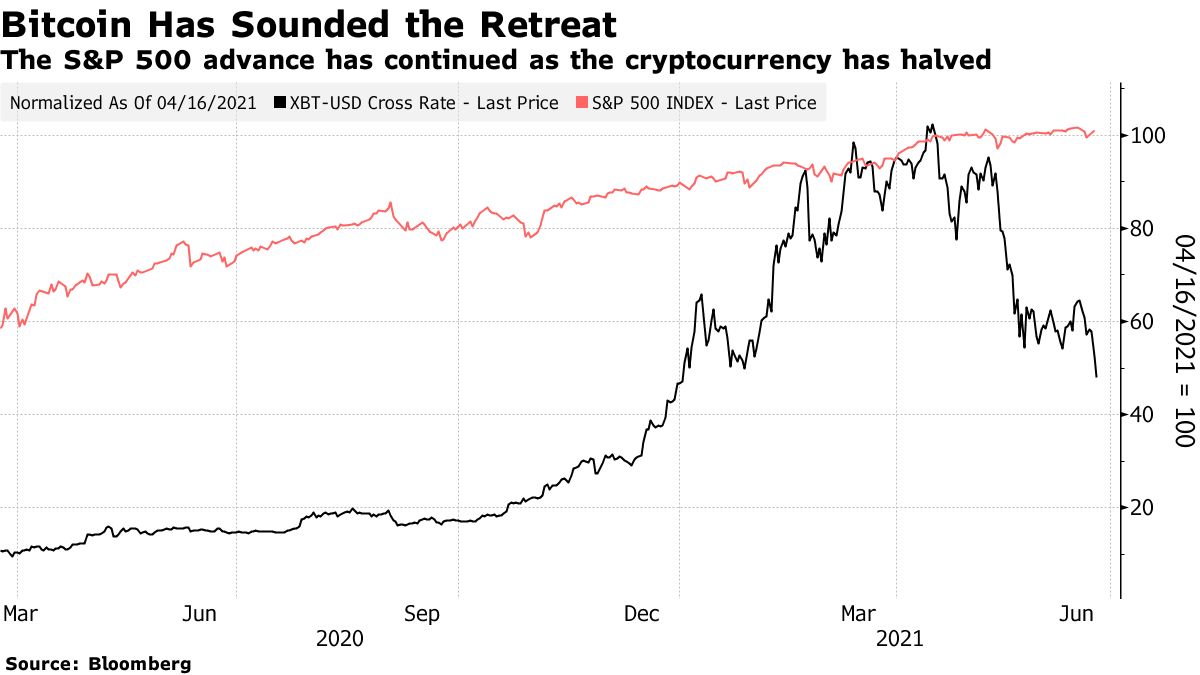

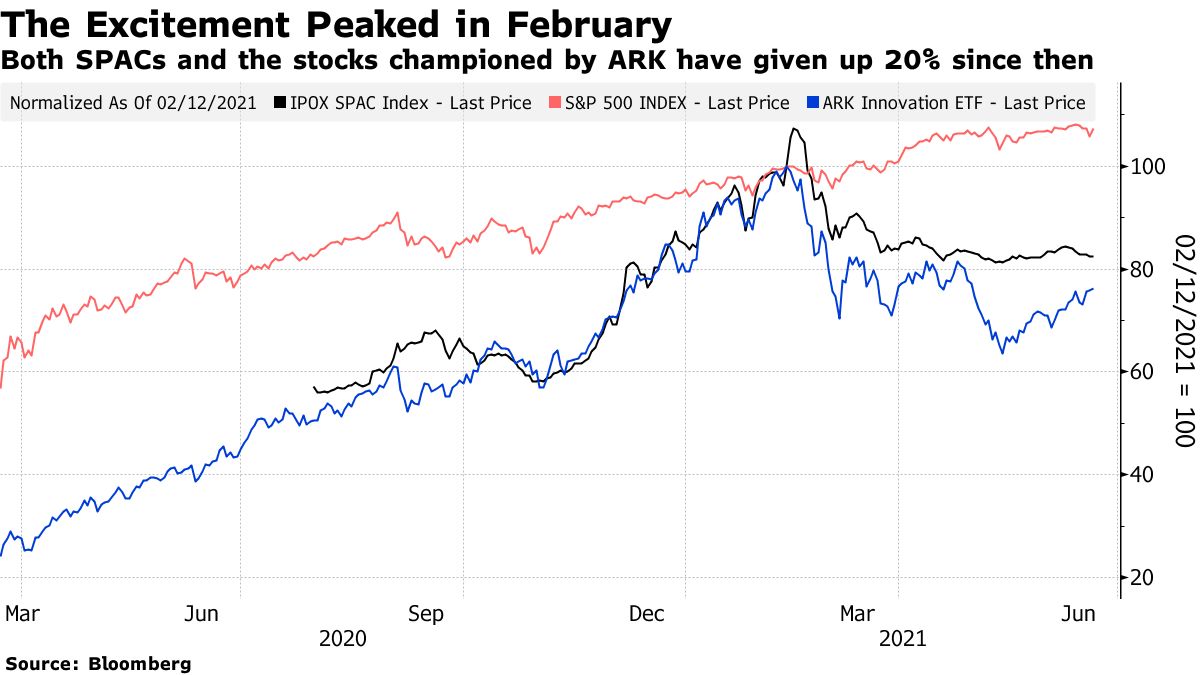

He sees something potentially similar in how SPACs, cryptocurrencies and some other high fliers have dived since March 2021, while broad markets have moved sideways.