In 1933, Irving Fisher, one of America’s most influential economists, noted that economic growth declines in highly indebted economies because debt increases current spending in exchange for a decline in future expenditures unless the debt is self-financing, i.e., helping to generate an income stream that repays the principal and interest. Thus, debt borrowed for personal consumption, including housing, reduces savings for investment and future growth. The accelerated consumer spending over the past year was always to be short-lived as households now spend years paying down the additional debt. For a good update on the latest data, see Disappointing Growth Shows Stimulus Diminishing Returns.

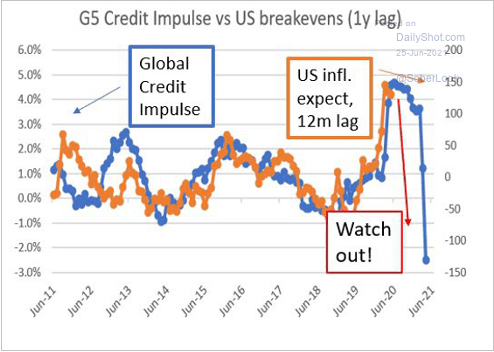

‘Credit impulse’ is a 2008 term coined by Michael Biggs, then an economist at Deutsche Bank, when he noted that the most critical variable in terms of forecasting GDP growth is not the change in the avai lability of credit but rather the change in the flow of credit (loans taken) as a percentage of GDP. As shown on the left in blue, the credit impulse peaked globally last June and has plunged since. Inflation expectations (in orange) are set to follow.

lability of credit but rather the change in the flow of credit (loans taken) as a percentage of GDP. As shown on the left in blue, the credit impulse peaked globally last June and has plunged since. Inflation expectations (in orange) are set to follow.

No one should be surprised that economic growth is quickly cooling and treasury yields slumping once more. Irrationally inflated equity and corporate debt prices are next to get the memo.