Friday, it was news that US consumer confidence fell 13% from July into August to 70.2 (vs 81.3 expected), the lowest since 2011.

Yesterday, it was news that US retail sales for July—purchases at stores, restaurants and online—fell 1.1% compared with June. Today, we learn that US mortgage applications for new homes fell for the second consecutive week (19% lower than a year ago) and that US housing starts fell 7% versus the 2.8% increase the consensus had forecast.

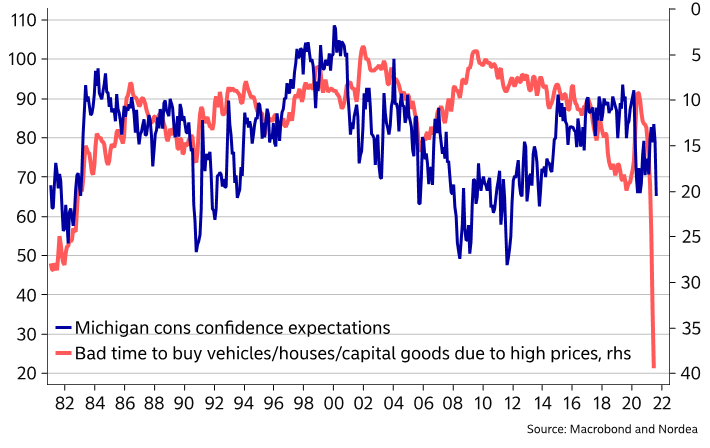

As shown on the left in red since 1980, the problem is the most unaffordable prices for goods and housing (relative to income) in at least 41 years.

As shown on the left in red since 1980, the problem is the most unaffordable prices for goods and housing (relative to income) in at least 41 years.

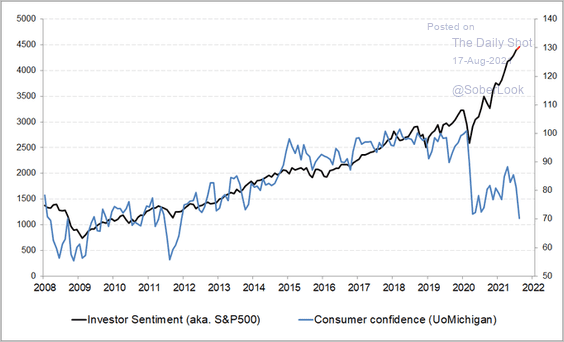

With asset prices among the most egregious in history, capital allocators should suffer similar sticker shock. However, as shown below in black since 2008, ‘investor sentiment’ remains freakishly  untethered from economic prospects and the consumer sentiment (in blue) that drives them.

untethered from economic prospects and the consumer sentiment (in blue) that drives them.

As macro data and expectations have rolled over again in the past 5 months (light blue on the lower left since 2008), asset managers remain overweight equities (dark blue) where they collect the richest underwriting and management fees.

As in 2000, 2009 and 2020, they will hold as asset prices tank until marginal calls and customer redemptions force them to sell near cycle lows once more. Rinse and repeat. At that point, cash will be king and buyers rewarded.