As the global economy continues to decelerate, the US dollar is rising and key commodities (priced in dollars) are tumbling. Iron ore, silver and lumber are all back to where they were before COVID-19 vaccines spurred reopening euphoria in November 2020.

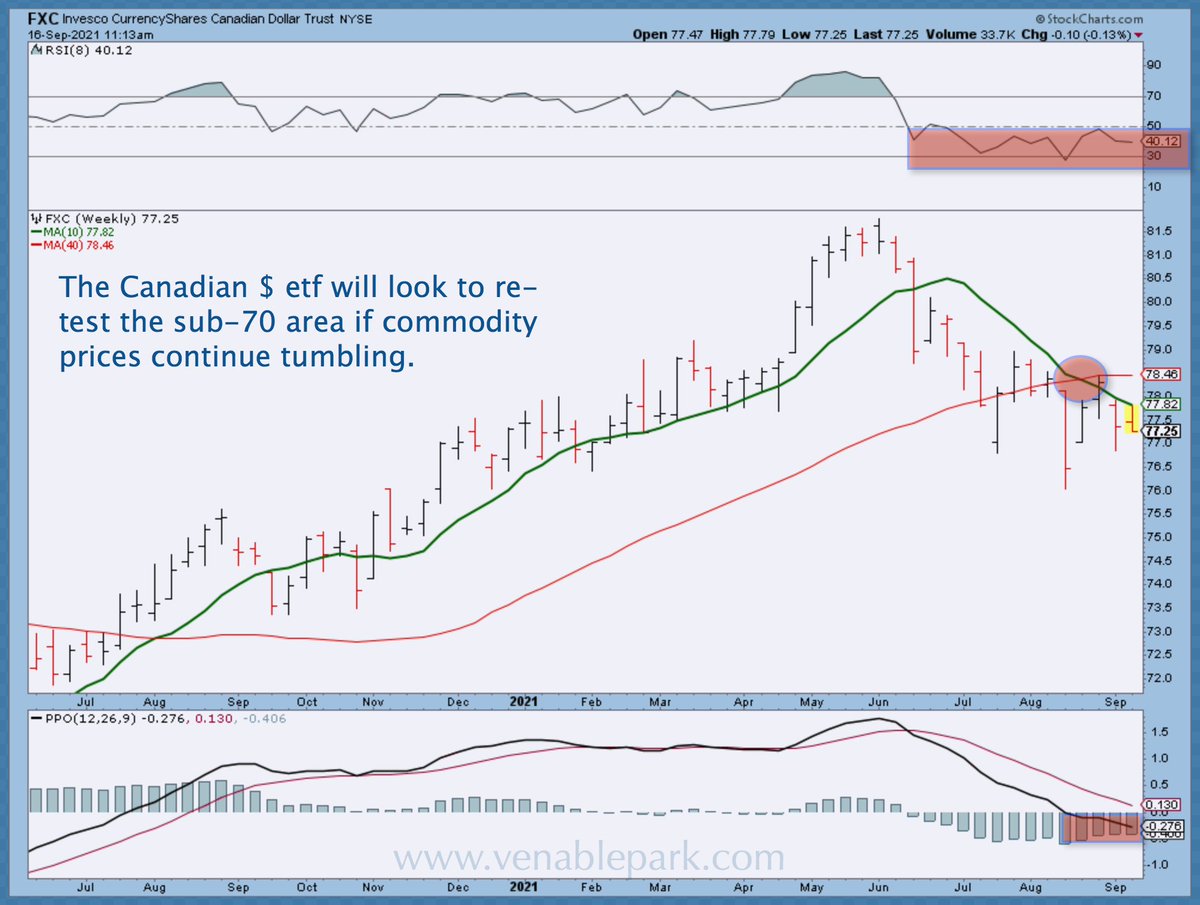

As shown below in my partner Cory Venable’s chart, the commodity-centric Canadian dollar (FXC) is also swooning along for the ride, returning to the $77 area it broke out from in late 2020, with more weakness likely to come.

The following video clip explains the global impacts of a rising US dollar (with a very dramatic soundtrack!).

The US Dollar is the bedrock of the world’s financial system. The availability, cost, and level of the dollar can have an outsized impact on economies and investment opportunities. But, more important, is the rate of change in the level of the dollar. If the level of the dollar moves too quickly and particularly if it rises too fast, then problems start popping up all over the place. And that is why everyone should have a plan for a rapidly rising dollar.Here is a direct video link.