Ongoing revelations that politicians, central bank heads, and federal judges have joined corporate insiders in using advance notice of non-public information to execute self-enriching trades confirms what many of us have known for some time: markets are rigged in favour of those who cheat, break laws and abuse the public trust.

In the process, respect for public institutions and systems is dangerously and deservedly crumbling from the top. See more in Bloomberg Businessweek’s: Most Americans today believe stock markets are rigged, and they’re right. Here is a direct link to an audio reading of the article:

Time and time again, insiders appear to exploit private information for opportunistic gain. Cheating…they discovered, seemed to be everywhere.

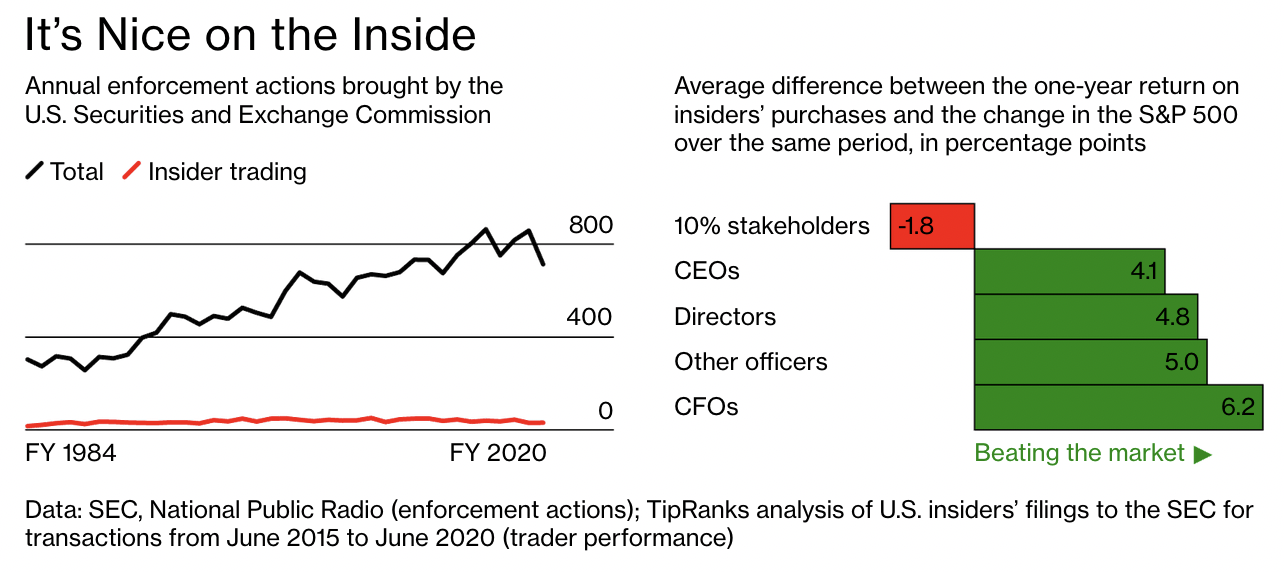

While the evidence is plentiful, as shown above (red line), the prosecution has intentionally lacked, so white-collar offenders have become ubiquitous.

The only meaningful deterrents to this are public embarrassment, enforcement and punishments that include disgorging of ill-gotten gains, stripping of positions of trust and jail time, where deserving.

It’s really basic: those who abuse positions of trust, do not deserve to have positions of trust.