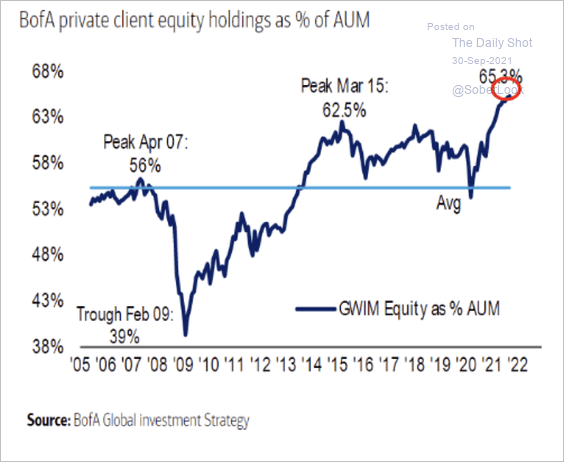

Household wealth is more concentrated in equities today than at any time in the last 50 years, including the 2000 tech bubble top. This is great for firms who make the richest fees issuing, trading and holding equities in client portfolios. As shown below since 2005, from Bank of America, 65.3% of client assets under management are in stock-based products today compared with a peak of 56% at the cycle top in 2007.

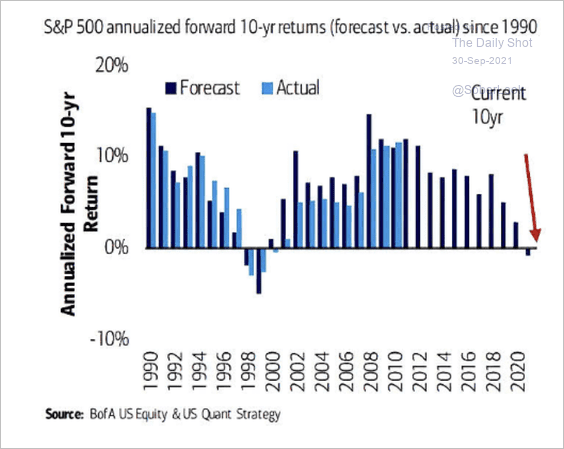

Unfortunately, for the holders/clients, this record exposure to stocks (S&P 500 below) comes at a time when the securities are priced to deliver negative returns over the next decade, as they were, and did, from the cycle peak in 2000.

Unfortunately, for the holders/clients, this record exposure to stocks (S&P 500 below) comes at a time when the securities are priced to deliver negative returns over the next decade, as they were, and did, from the cycle peak in 2000.

This will be super hard on financial plans and prompt many to reduce spending and/or work longer than they presently imagine. Asset bubbles are no free lunch or dinner.

This will be super hard on financial plans and prompt many to reduce spending and/or work longer than they presently imagine. Asset bubbles are no free lunch or dinner.