As central banks have pumped liquidity into financial intermediaries with every market stumble since 2008, the finance sector has become more affluent and bolder than ever. In the process, long-established cornerstones of prudent capital management are considered redundant, dumb, even cowardly.

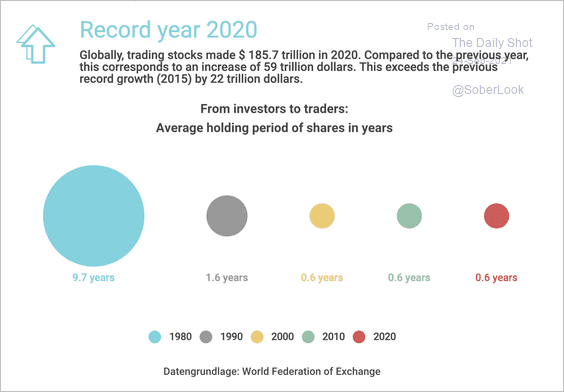

As shown below, hidden and not, fees generated from trading stocks globally amounted to more than $185 trillion in 2020, an 8-fold increase from $22 trillion in 2015. In the process, the average holding period for publically traded shares has fallen from 9.7 years in 1980 to was just over seven months (.6 years). Everyone’s a trader now.

Even though studies have repeatedly confirmed that frequent trading and high investment fees are negative for capital owners over time, these are the facts. But you’ve got to be brave; at least that’s what the marketing memes urge us.

Even though studies have repeatedly confirmed that frequent trading and high investment fees are negative for capital owners over time, these are the facts. But you’ve got to be brave; at least that’s what the marketing memes urge us.

As leaks spread about the predatory business models of social media companies looking to addict their users, some are making the connection with financial-tainment and the pandemic of gambling now sweeping the world. Lives are being messed, as usual. See Traders phone up gambling helplines as game-like broker apps spread:

“The user experience is converging and the line between gambling and investing, which was already pretty fluid, has almost been completely erased,” said Keith Whyte, executive director of the National Council on Problem Gambling, among the groups reporting more calls from stock traders to their help lines.

The US Securities and Exchange Commission (SEC) is said to be investigating the extent to which brokers’ and investment advisers’ “digital engagement practices” — including so-called gamification — assist or undermine small investors.

The outcome should be a no-brainer. But with the companies reaping huge activity fees dominating regulators and legislators, we should not hold our breath here. That is, not until the next big wipe-out devastates retirement accounts, at least. Even then, given the action-lite precedent to date, who knows.

A seductive trading portal ironically named Robinhood that sells its customer ‘flow’ to predators reflects the ethical dark ages in which we now function. The devolution of Canada’s Wealthsimple and other so-called Robo-advisors is another vivid marker.

Robo-advisers started out saying they were all about helping retail customers avoid emotional allocation choices to build their savings with less risk and lower fees. But there’s not enough profit in that, especially when founders and executives are gunning to hit personal liquidity events through initial public offerings. Rapid fee growth is the target, so promoting transactions and the highest-fee products are the natural migration. See Why Wealthsimple went from preaching low-fee, low-risk investing to pushing stock trading and crypto:

To understand what that could mean for Wealthsimple, simply look at the fee schedule. The company’s robo-clients often pay 0.5 per cent annually, while crypto traders pay 1.5 per cent to 2 per cent per transaction (although Wealthsimple must split that fee with other parties).

Stock trading and crypto are also popular with younger users, which has always been Wealthsimple’s target market but proved to be a tough nut to crack.

There’s no doubt this will end badly for most of the users. But intermediaries and dealers in finance have all carefully structured themselves to avoid liability for customer outcomes. That’s the dominant and most profitable business model. Pretending to be shepherds is how wolves attract the most sheep.