Further to my comments in Inventory build belies shortage hype, those in the business of selling the highest fee investment products also are interested in predicting rising prices to encourage buyers. It is also not surprising that cryptocurrency proponents (like Jack Dorsey and others) espouse run-away inflation since fiat debasement is a big part of their bullish altcoin forecasts.

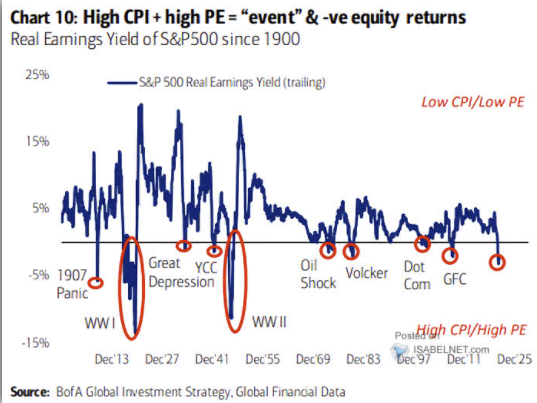

Meanwhile, it’s worth noting that higher inflation reduces real earnings and has historically been negative for stock returns when it coincides, as now, with high equity valuations. The chart below, courtesy of ISABELNET.com, circles the previous high CPI/high PE periods since 1900 that ushered in nasty bear markets. The market plunge in March 2020 wiped out years of stock returns in just 15 trading days. A rapid rebound has saved many from learning the lessons of reckless financial management, but the next multi-quarter bear market will not be so forgiving.

The market plunge in March 2020 wiped out years of stock returns in just 15 trading days. A rapid rebound has saved many from learning the lessons of reckless financial management, but the next multi-quarter bear market will not be so forgiving.

The set-up now is especially ugly given the distended financial leverage that has risen with asset prices. Margin debt borrowed against securities portfolios (below in red) is just one of many types of investment leverage popular this cycle. As shown below, since 1995, retracement from a 50% year over year jump in margin debt (as we have seen year to date) preceded both the 2000 and 2008 bear markets. When stock prices next mean revert from the highest valuations in history, forced liquidation will accelerate the decline.

That’s not including the forced selling that will emanate from the present crypto-bubble, where the notional market cap has ballooned to $2.3 trillion from $16bn in 2017. In 2021 alone, mainly unregulated crypto assets have grown 200% from just under $800 billion in 2020. Data shows that 95% of them, including bitcoin, are not backed by any asset or fiat currency. Vapid collateral has not stopped an explosion in borrowing against crypto holdings to buy homes, cars and more crypto. See: Borrowing against Crypto is growing. Is it safe?

That’s not including the forced selling that will emanate from the present crypto-bubble, where the notional market cap has ballooned to $2.3 trillion from $16bn in 2017. In 2021 alone, mainly unregulated crypto assets have grown 200% from just under $800 billion in 2020. Data shows that 95% of them, including bitcoin, are not backed by any asset or fiat currency. Vapid collateral has not stopped an explosion in borrowing against crypto holdings to buy homes, cars and more crypto. See: Borrowing against Crypto is growing. Is it safe?

Just one group of crypto lenders has $25 billion in outstanding loans to individuals and institutional clients, up from $1.4 billion a year ago, according to the crypto research firm Messari. What could go wrong, right?

The deputy governor of financial stability at the Bank of England compared the destabilizing power of cryptocurrency to the subprime collapse of 2008 this month, saying,” In that case, the knock-on effects of a price collapse in a relatively small market was amplified and reverberated through an un-resilient financial system causing huge and persistent economic damage.”

The next market rout will have broad contagion effects for highly levered asset markets and the economy, and it won’t be inflationary.