As I discussed last week, in Inflation hype past the boil, the pandemic-inspired leap in consumption helped drive bottlenecks, extra precautionary ordering, and general chaos in international supply chains.

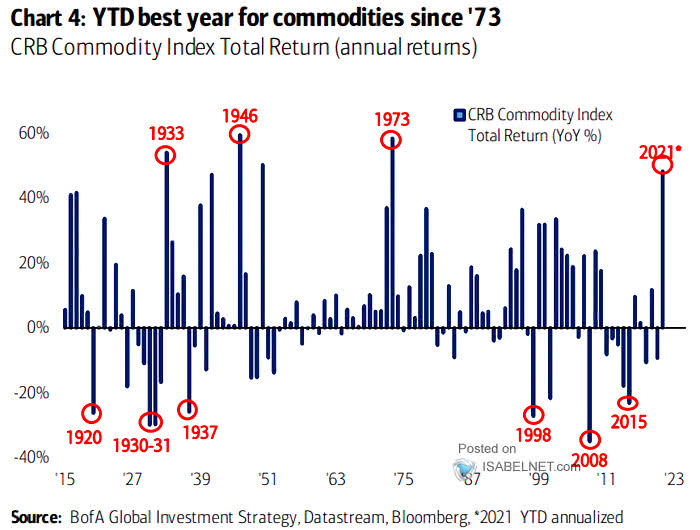

As shown below (courtesy of Isabelle.net.com), the initial squeeze on supply helped to inspire the most dramatic commodity inflation since another infamous market top in 1973 (p.s. from January 1973 to December 1974, the economy then tanked, and global stock markets entered a 694-day 45% plunge).

Today, consensus inflation expectations remain high even though most commodity prices have dropped significantly over the past six months. As Rosenberg Research points out, only milk, cotton, flour and butter are still rising at this point. At the same time, other economically-sensitive staples have sharply reversed course led by a few standouts such as lumber -64%, iron ore -61%, steel -25%, aluminum -20%, and zinc -15%, so far.

Today, consensus inflation expectations remain high even though most commodity prices have dropped significantly over the past six months. As Rosenberg Research points out, only milk, cotton, flour and butter are still rising at this point. At the same time, other economically-sensitive staples have sharply reversed course led by a few standouts such as lumber -64%, iron ore -61%, steel -25%, aluminum -20%, and zinc -15%, so far.

Commodities are infamous for boom-bust cycles because high prices simultaneously encourage supply while curtailing demand. This time is unlikely to be different.

And about that semiconductor shortage…the 12-month change in China’s credit impulse (shown below in blue since 2009 courtesy of Julien Bettel) has led to the year-over-year change in global chip sales (below in grey) with a lag of ll-months. ![]() As usual, production and shipments are ramping while sales and stockpiling appear to have peaked.

As usual, production and shipments are ramping while sales and stockpiling appear to have peaked.