Facts exist whether we choose to acknowledge them or not.

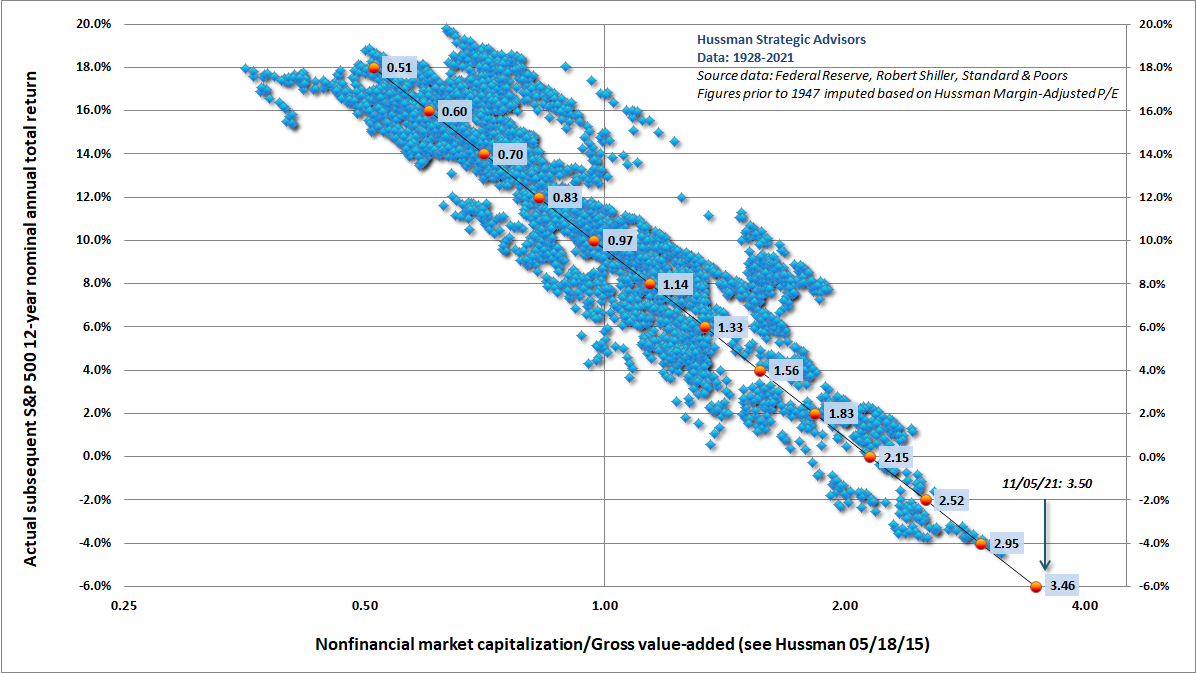

The chart below, courtesy of John Hussman, shows the current S&P 500 price as a ratio of historically reliable valuation measures (bottom x-axis) and actual subsequent S&P 500 12-year total returns (y-axis) since 1928. The present extreme implies a negative total annual return (including the 1.3% dividend yield but before fees) over the next 12 years.

Some more facts that corroborate the extremity of present conditions:

- Market participants are aggressively confident: net speculative long bets that the S&P 500 will rise further are the largest since October 2020, while net speculative short bets that the US 10-year Treasury price will decline are the most since February 2020.

- Trading in the options market is 50% above normal levels, and trading in bullish call options is at levels only seen ahead of the 2000 tech wreck.

- Equity portfolio managers are out of dry powder with cash weights at historic lows of 2%.

- The cryptocurrency market is highly levered and valued at over $3 trillion, up sixfold from $500 billion a year ago. Contagion risks between asset classes are epic.

- $865 billion flowed into global equity funds year to date, 3x the prior annual record and equivalent to all the retail buying activity over the last 20 years.

- Option trading volumes representing massive leverage are about 50% more active in nominal dollar terms than actual stock trading.

It is tough to be hyperbolic about the present capital loss prospects.

Ironically, the consensus calling for run-away inflation and negative implications for treasury prices are simultaneously ignoring the fact that higher inflation has been historically devastating for stock prices, especially when starting from extreme valuations and a cycle high in earnings, like now. Hussman offers some important context:

It is a fiction that stocks, at any price, are better than low-yielding bonds. If you want to make that argument to investors – here I’m speaking directly to analysts on Wall Street and the Fed – at least have the intellectual decency to test your estimates against decades of actual subsequent market returns, and show them side-by-side. By our estimates, the S&P 500 is likely to lag Treasury bonds by about 8% annually over the coming decade – the largest gap in history, and slightly worse than the outcomes after 1929 and 2000. For a discussion of equity risk premium (ERP) models, including the Shiller-Black-Jirav “excess CAPE yield”, see A Good Response to a Bad Situation.

Yes, bond yields are lower than they were in 2000, but equity valuations are also more extreme. The end result for relative returns is likely to be similar to that of previous bubbles. Even an “error” as large as the one we’ve seen in the past 12 years (which would require future valuations to remain at bubble extremes) would leave S&P 500 total returns at or below the lowly returns on Treasury bonds.

…The S&P 500 lagged Treasury bills from 1929-1947, 1966-1985, and 2000-2013. 50 years out of an 84-year period. That’s just what overvalued markets do.

We are here. Just the facts.