According to economic forecaster Lakshman Achuthan, Wall Street is ignoring a striking consumer spending slowdown that will translate into an underwhelming holiday season. “There’s still this narrative that the rebound is there,” the Economic Cycle Research Institute co-founder told CNBC’s “Trading Nation” on Wednesday. “The hope had been people would shift from goods to services, and that would keep reaccelerating… That hasn’t happened.” Here is a direct video link.

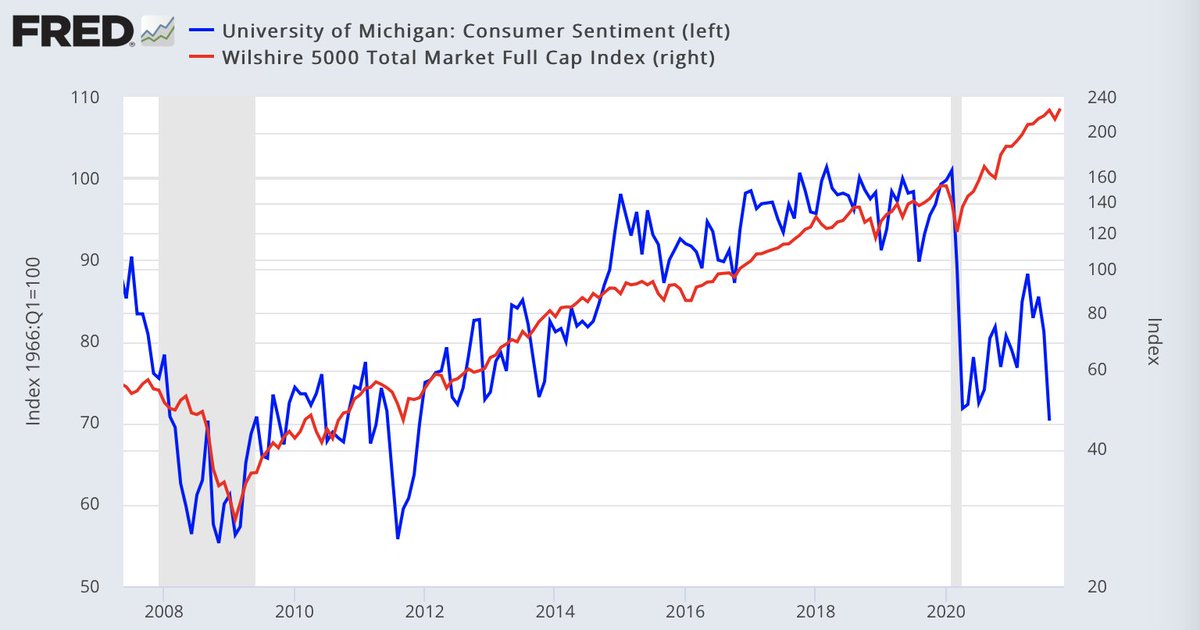

The chart below, courtesy of Mac10, summarizes why consumption is struggling to hold up. While services were closed and stimulus cheques enabled a burst of goods’ spending and financial speculation, retail sales, durable goods, stocks (led by the eight most expensive tech companies), corporate profits and home prices all soared. Real wages have not. A higher cost of living for crucial items like shelter, fuel, food, and transportation is naturally crimping spending ability. Even the few who have the savings and income to keep spending can only use so many cars and fridges and houses. And they are unlikely to need to replace recent purchases for a few years hence.

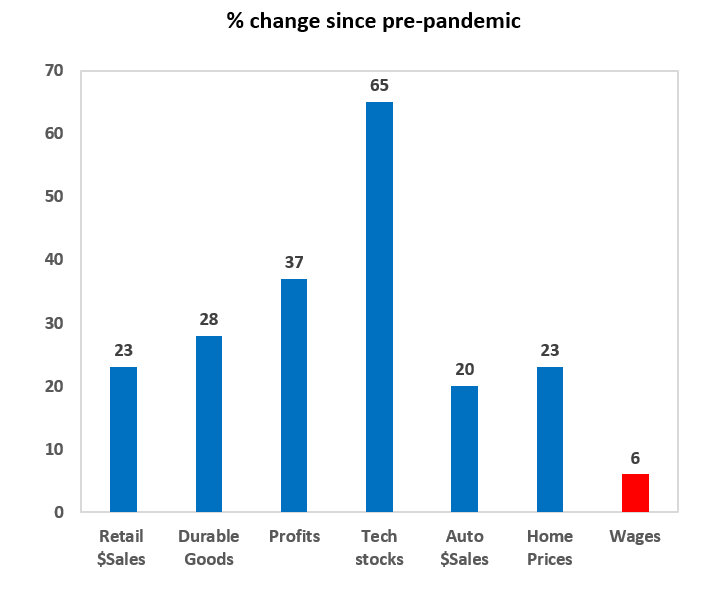

While asset owners are so far still euphoric on surreal price gains since March 2020 (Wilshire 5000 Total Market Cap Index below in red), consumer sentiment (in blue) has abruptly disconnected. Until stock, options and crypto trading somehow takes over as the economy’s primary engine, consumer sentiment is still driving the economic bus here; and it’s not looking bullish.

While asset owners are so far still euphoric on surreal price gains since March 2020 (Wilshire 5000 Total Market Cap Index below in red), consumer sentiment (in blue) has abruptly disconnected. Until stock, options and crypto trading somehow takes over as the economy’s primary engine, consumer sentiment is still driving the economic bus here; and it’s not looking bullish.