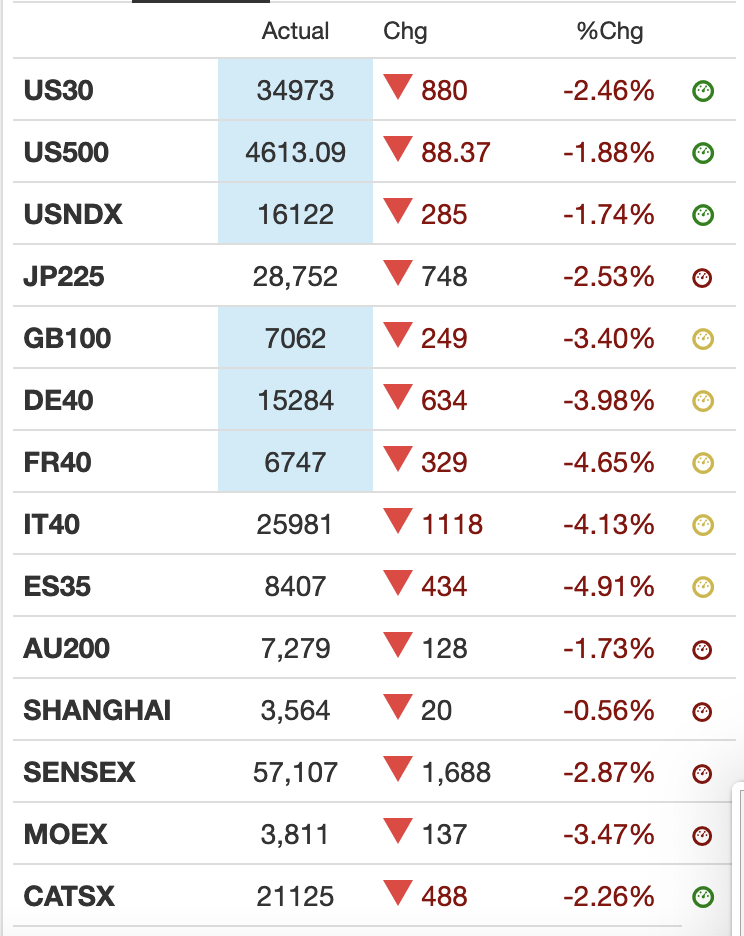

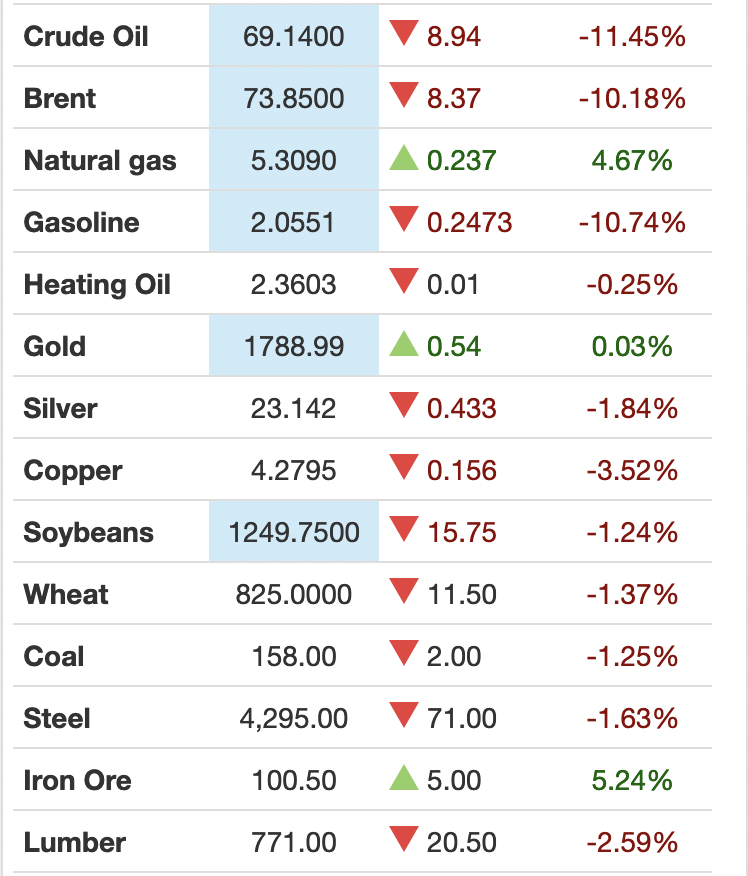

International stocks and commodities are tied at the hip in liquidation selling today, as usual, reminding yet again that different coloured jellybeans in different product wrappers do not offer meaningful risk diversification.

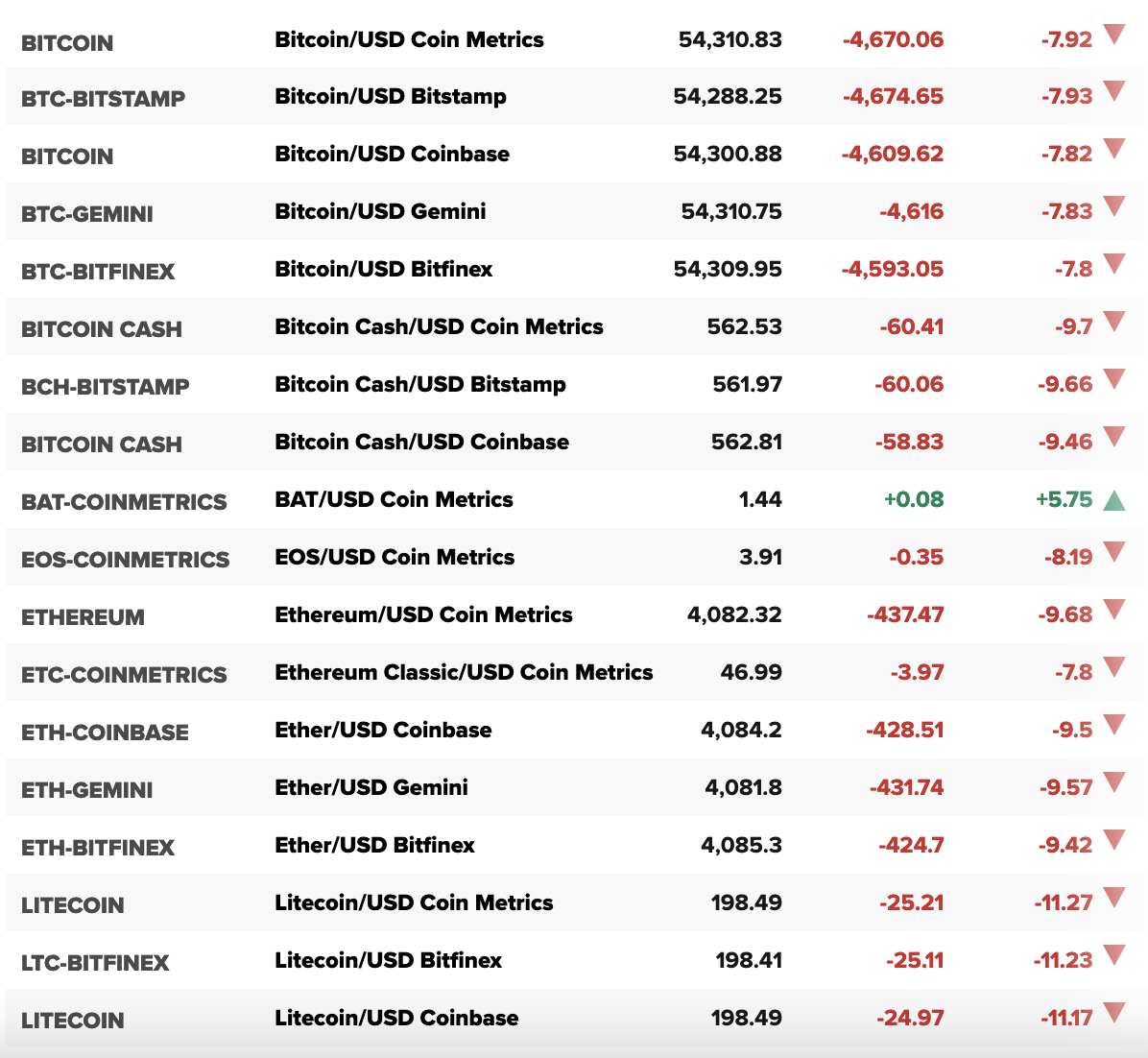

Cryptos, too: no hold of value here, folks.

As expected, risk sellers are heading to government bonds and out of commodity-centric currencies like the loonie and into the US dollar.

As expected, risk sellers are heading to government bonds and out of commodity-centric currencies like the loonie and into the US dollar.

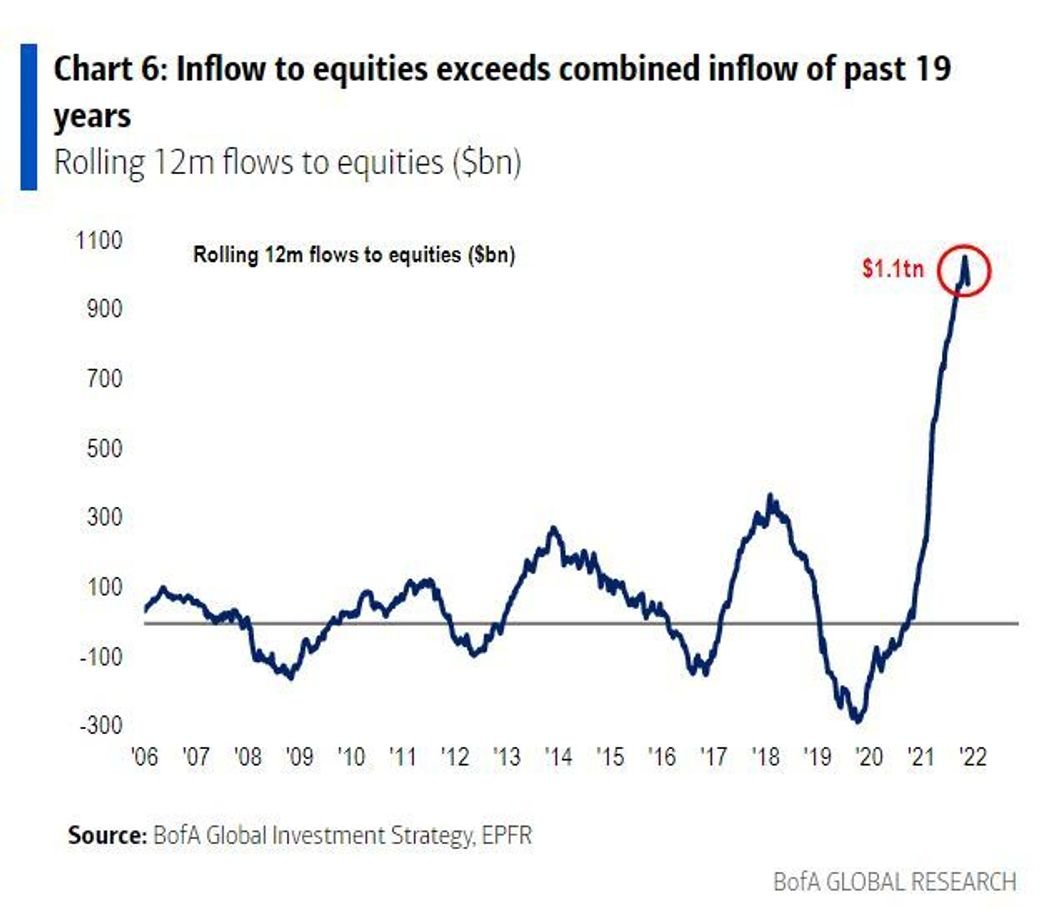

For those who forget, there are no gurus, only cycles. And this extreme cycle has seen participants plough more than $1 trillion (much of it borrowed) into equities alone over the last 12 months–as much as the previous 19 years combined (chart below from Bank of America). Try to digest the scope and scale of recent euphoria. Mindless, to say the least.

It remains to be seen whether we are entering the inevitable next leg of the bear market that was interrupted in March 2020. Meanwhile, tanking markets will go a long way in reversing inflation expectations and central bank tightening plans. It’s never too late to review one’s financial risk and loss exposure.

In the discussion below, Jeremy Grantham offers some valuable historical context for the present cycle.

FEG’s Greg Dowling sits down with renowned investor, philanthropist, activist, and bubble forecaster Jeremy Grantham, co-founder of GMO and Batterymarch Financial Management and founder of the Grantham Foundation for the Protection of the Environment. Jeremy shares his insights on the current market environment, details of his storied history in finance, recommendations for investing in a bubble environment, and his predictions for innovative green technologies that may have the ability to change the world. Here is a direct audio link.