Valuable historical context for the Fed’s bubble-blowing antics in this Politico article around former FOMC member and QE dissenter Thomas Hoenig. See The Fed’s Doomsday Prophet has a Dire Warning about Where We are headed. Here’s a taste:

As a bank examiner, Hoenig realized another very important thing. Easy money policies don’t just drive up the price of consumer goods, like bread and cars. The money also drives up price of assets like stocks, bonds and real estate. During the 1970s, low interest rates fueled demand for assets, which eventually inflated asset bubbles across the Midwest, including in heavy farming states, such as Kansas and Nebraska, and in the energy-producing state of Oklahoma. When asset prices like this rise quickly, it creates that dreaded thing called an asset bubble.

The self-reinforcing logic of asset bubbles was painfully evident in farming, and it reflected the dynamics that would later play out in the housing bubble and the over-heated asset markets of 2021.

…“There is no painless solution,” Hoenig said in a recent interview. “It’s going to be difficult. And the longer you wait the more painful it will end up being.”

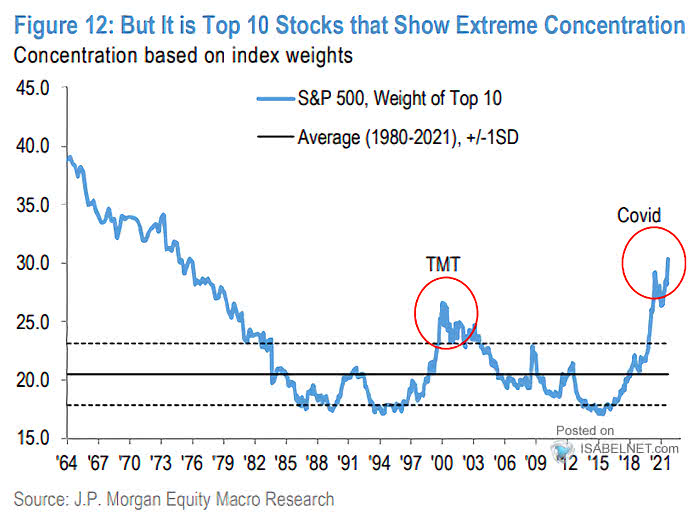

Meanwhile, the S&P 500 has made all-time highs courtesy of its ten most concentrated holdings (chart below courtesy of ISABELNET.com) at the same time that its average component stock is -11% from a 52-week high. Worse breadth than the 2000 tech top.