The most critical function of savings is to cover future needs, wants and opportunities.

For this reason, savings should be as protected and uncorrelated as possible with our other income sources. For example, it’s not diversified for tech workers to keep the bulk of their savings in tech shares, nor for property sector workers to keep most of their savings in real estate/construction-related businesses and securities.

During economic downturns, it’s typical for receivables to rise, revenues to fall and incomes and cash flows to dip. Workers and business owners do not want the value of their savings to plummet just as they need it for liquidity and income support. This is especially true for retirees who rely on their savings to live.

Today’s challenge is that asset markets have become one big levered global ‘trade,’ which makes meaningful diversification, i.e., safe places to store savings, the most limited in decades. Enticed into high-risk ‘plays’ by a decade of minuscule yields, most do not appreciate that their present holdings–like realty, commodities, cryptocurrencies, equities and other corporate securities–are highly correlated, and weakness in one is pretty sure to infect the rest.

For meaningful diversification, cash, guaranteed bank deposits and low-yielding government bonds (for guaranteed interest and return of principal) remain the best opportunities on offer. And yet, tragically, most have been convinced that they can’t afford to own ‘safety.’ This has the makings of a financial firestorm that will see panicked liquidation and losses across most asset classes all at once.

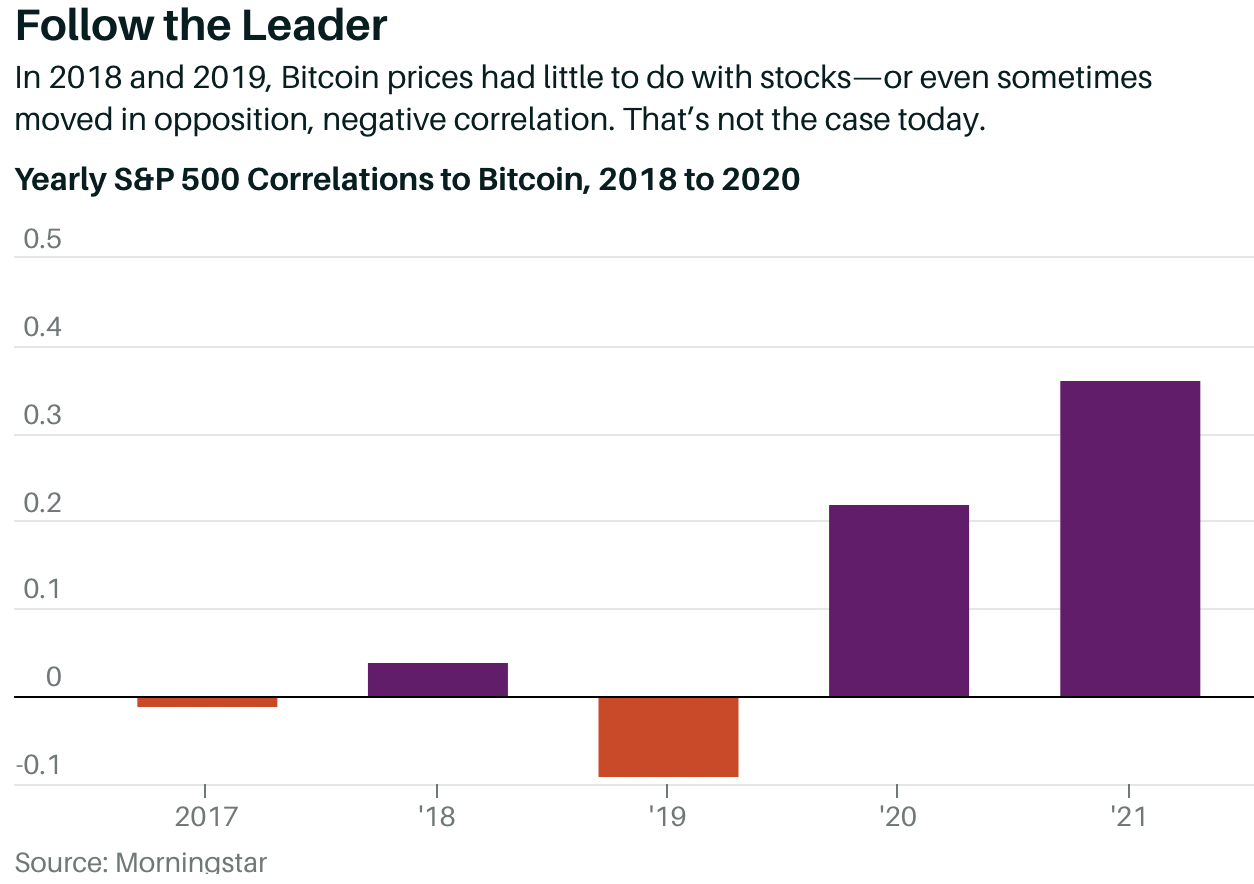

Some individuals and institutions understand the setup and are willing to take proactive steps, but few have the courage or independence to warn others. The International Monetary Fund dipped their toe in the water this week with a warning on the interconnectedness of Crypto and stock market allocations; see, Crypto and stocks look increasingly correlated. That has raised risk fears:

Bitcoin and the broader crypto world aren’t likely to offer protection against downturns in equities. Crypto’s volatility is also spilling into equity markets, and vice versa, implying that “sentiment in one market is transmitted to the other in a nontrivial way.” The IMF views this as a risk to financial stability, particularly in markets where Crypto is taking off.

Bitcoin and the broader crypto world aren’t likely to offer protection against downturns in equities. Crypto’s volatility is also spilling into equity markets, and vice versa, implying that “sentiment in one market is transmitted to the other in a nontrivial way.” The IMF views this as a risk to financial stability, particularly in markets where Crypto is taking off.

The reality is that participants in interconnected asset bubbles and highly levered economies are all in harm’s way, whether we recognize it or not.