The oil and gas overweight (13%) in Canada’s TSX typically helps buoy the Canadian stock market late in each market cycle. Oil prices leap, explode the highly levered global economy and then plunge with demand once more. Comparatively, just 3% of the S&P 500 is oil and gas.

With West Texas Crude back at an eight-year high today–last seen in 2014, and before that in the commodity cycle peaks of 2008-2011– the TSX is less negative this afternoon than most global markets. With the S&P off nearly 8% from its December high, the TSX is down less than 2 percent since October.

Interestingly, currency traders are not buying the trend, with the loonie at .786USD, down against the greenback on the day, week, month and year to date.

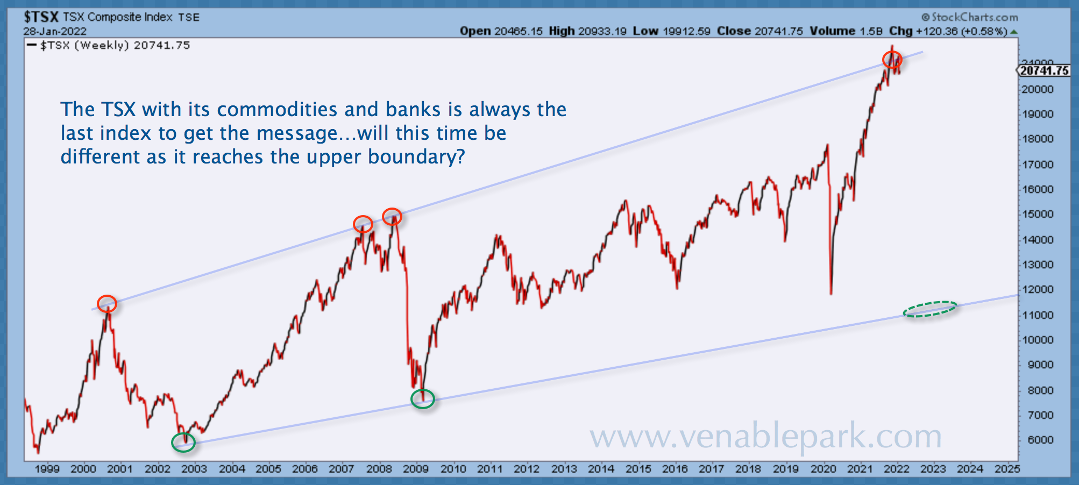

As shown below from my partner Cory Venable since 1998, after going parabolic on retail inflows during 2020 through 2021, Canada’s TSX index (which most Canadian stock funds, ETFs and equity portfolios track) is precariously peaked.  Few present holders appreciate how vulnerable this makes their capital. Or that a relatively modest 30% bear market from here would return the Canadian stock market to the 15,000 area where it topped with oil in June 2008–13 years ago. And with secular support in the 12,000 area (lower line above), a 30% retracement would be a historically modest correction cycle from here.

Few present holders appreciate how vulnerable this makes their capital. Or that a relatively modest 30% bear market from here would return the Canadian stock market to the 15,000 area where it topped with oil in June 2008–13 years ago. And with secular support in the 12,000 area (lower line above), a 30% retracement would be a historically modest correction cycle from here.

Who will have outperformed then? We are going to find out.