From their January 2021 peak, economically-sensitive small-cap stocks are down about 19%. The NASDAQ is -17% from last November, and the average drawdown is 23% so far. The S&P 500 has fallen just over 10%. Canada’s TSX has held up better to date (-3.8% from November high) on its massive overweight in late-cycle favourites–financials (32%) and fossil fuels (13%). This, too, shall pass.

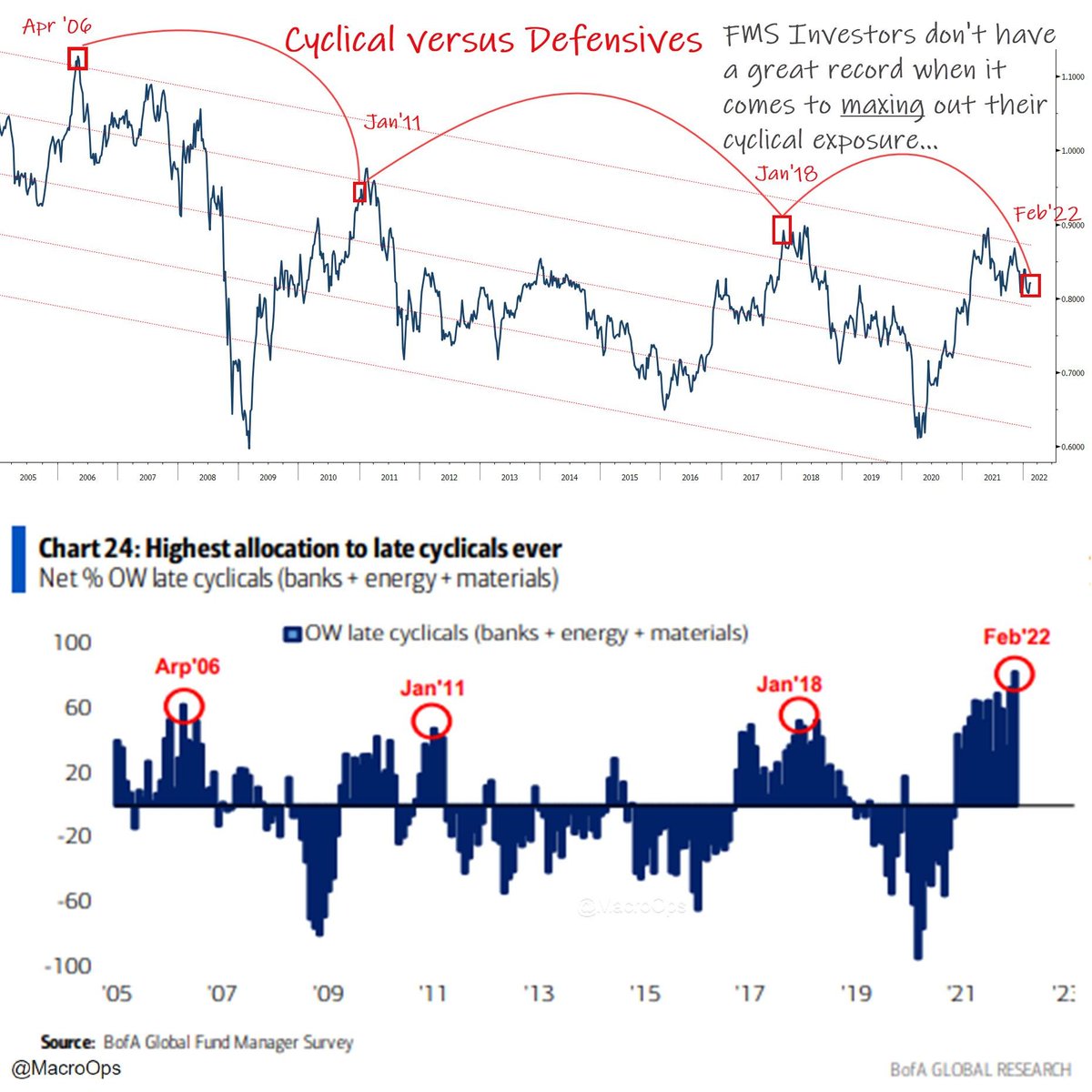

As shown below, courtesy of Macro-ops and Bank of America, these bets were also notoriously misplaced at commodity price peaks in 2006, 2011 and 2018, before prices tumbled and demand and inflation bulls finally capitulated.

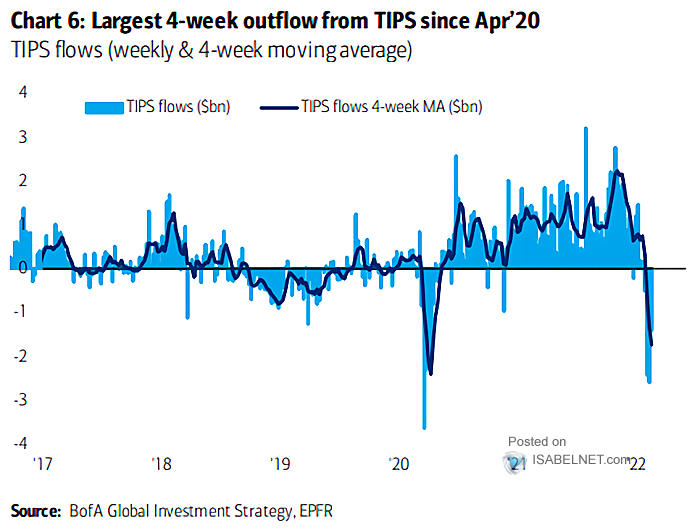

Inflation-protected-treasury bond flows (TIPS) have been retreating hard this month, as shown below courtesy of ISABELNET.com.

Those who think that the rapid stock rebound from March 2020 was typical are in for some tough schooling. As shown below in my partner Cory Venable’s chart of the S&P 500 during the 2000 to 2003 bear market, counter-trend rebounds are par for the course, but buying early dips is a time-worn path to pain and suffering. Patience and cash reap their rewards in due course. Experience and price discipline always matter, in the end.